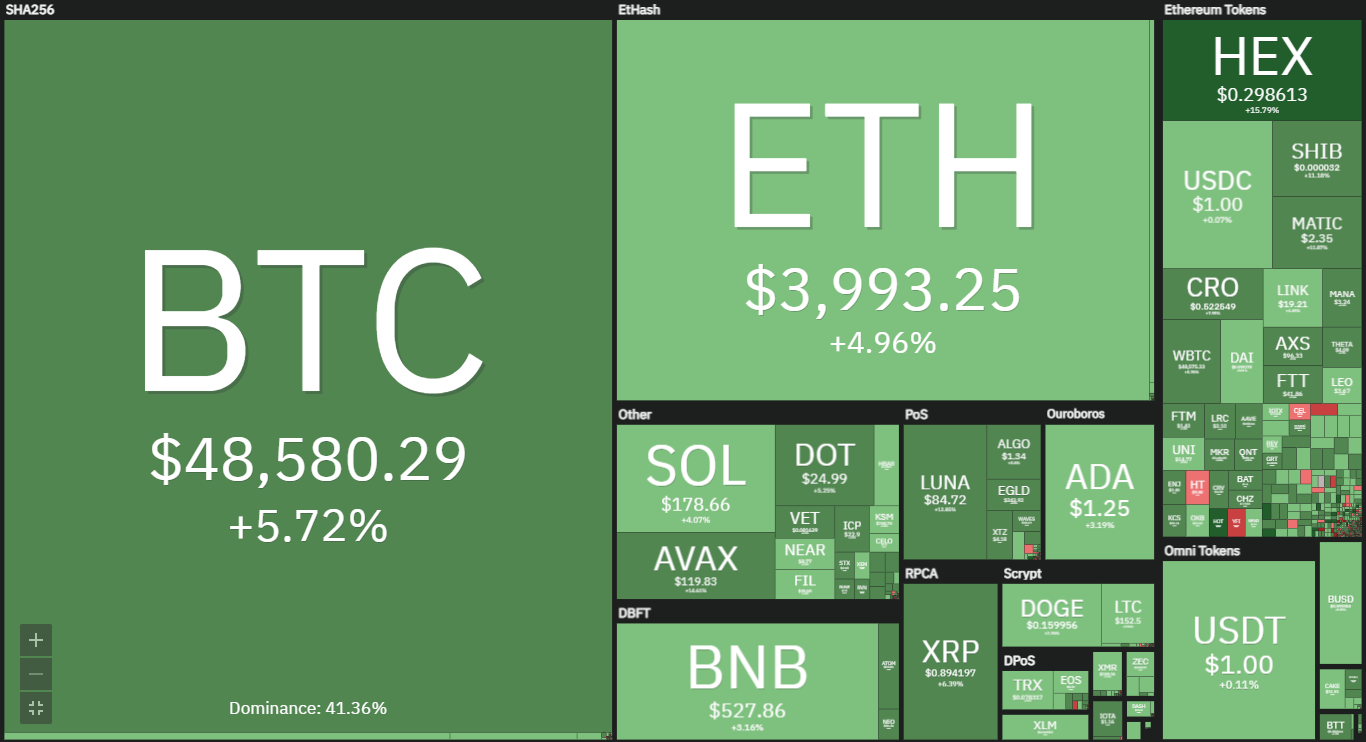

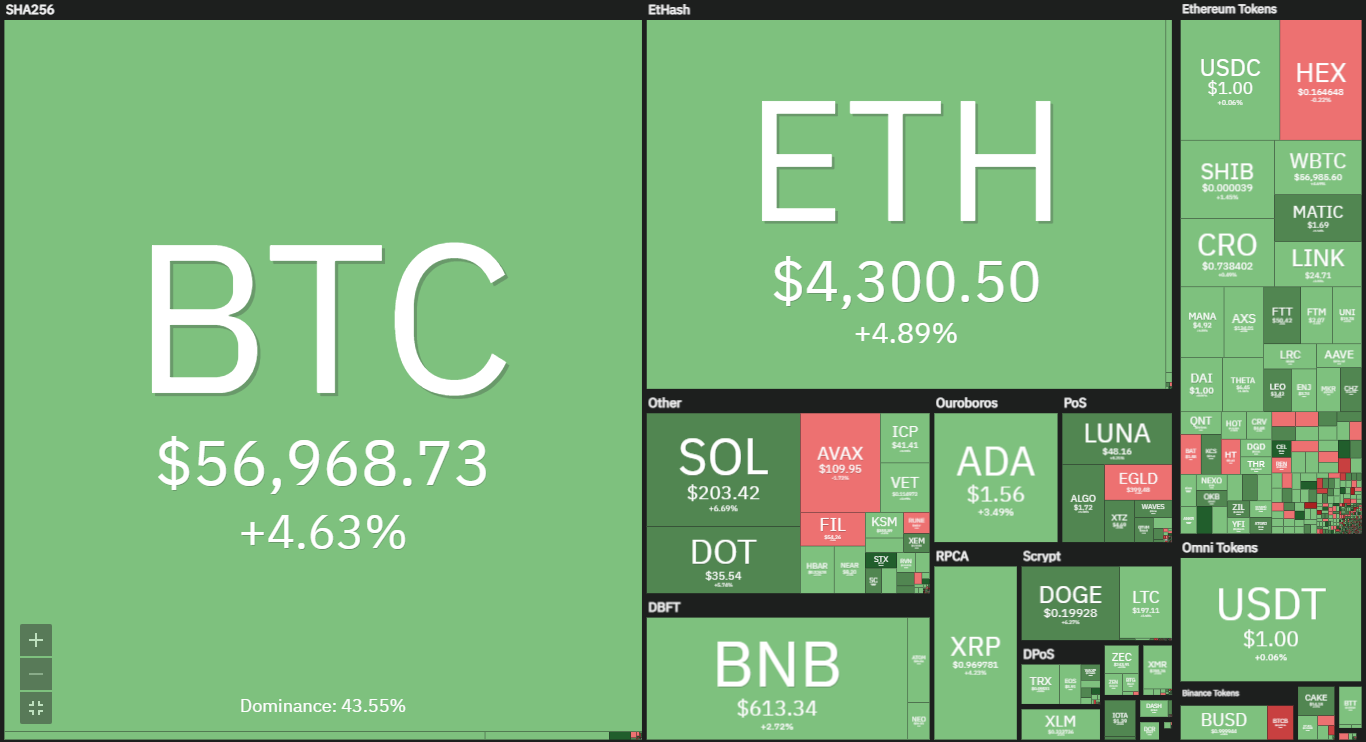

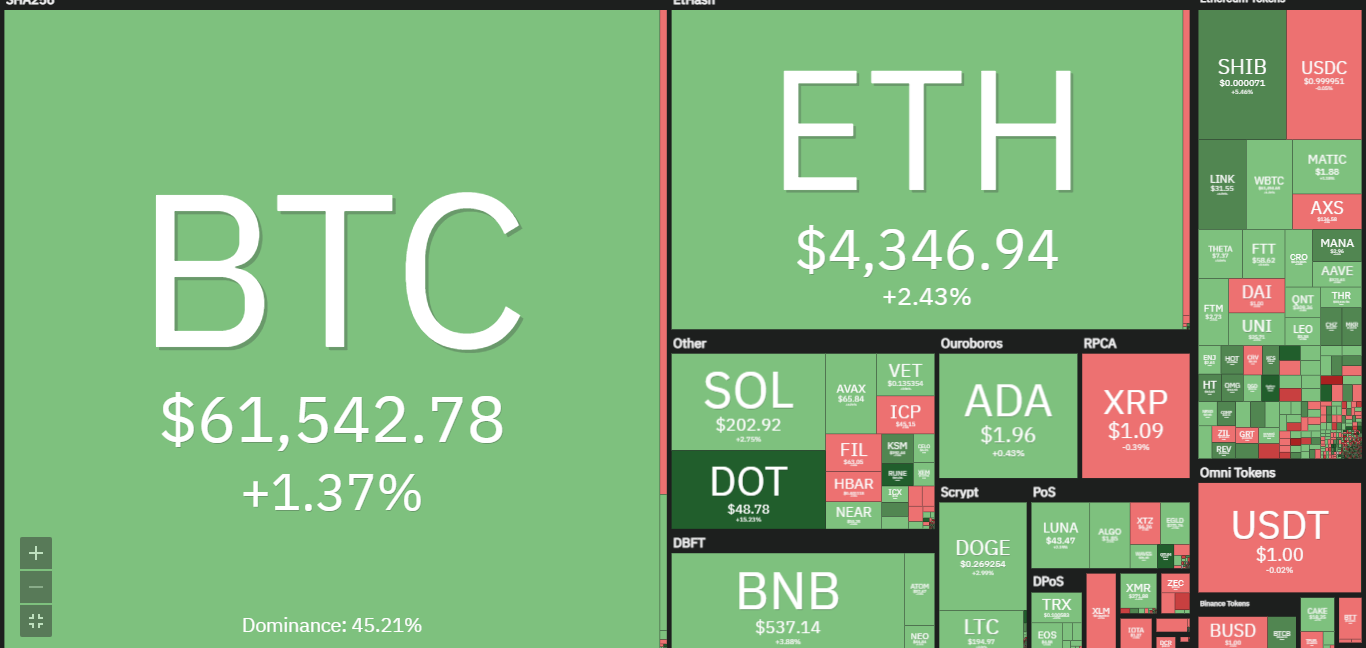

Following a bullish start to the month, long traders are confident of further uptrend. The crypto market ended January at $1.75 trillion but is currently worth more than $2 trillion. Most cryptocurrencies experience hikes that have been absent in the past two months.

These digital assets no doubt saw a lot of hikes with minute retracements. Many believe the bearish dominance has ended based on the current run of the industry. This claim is backed by the fact that most projects are significantly up. The top gainer from the past intraweek session was MANA, as it gained more than 30% at the time.

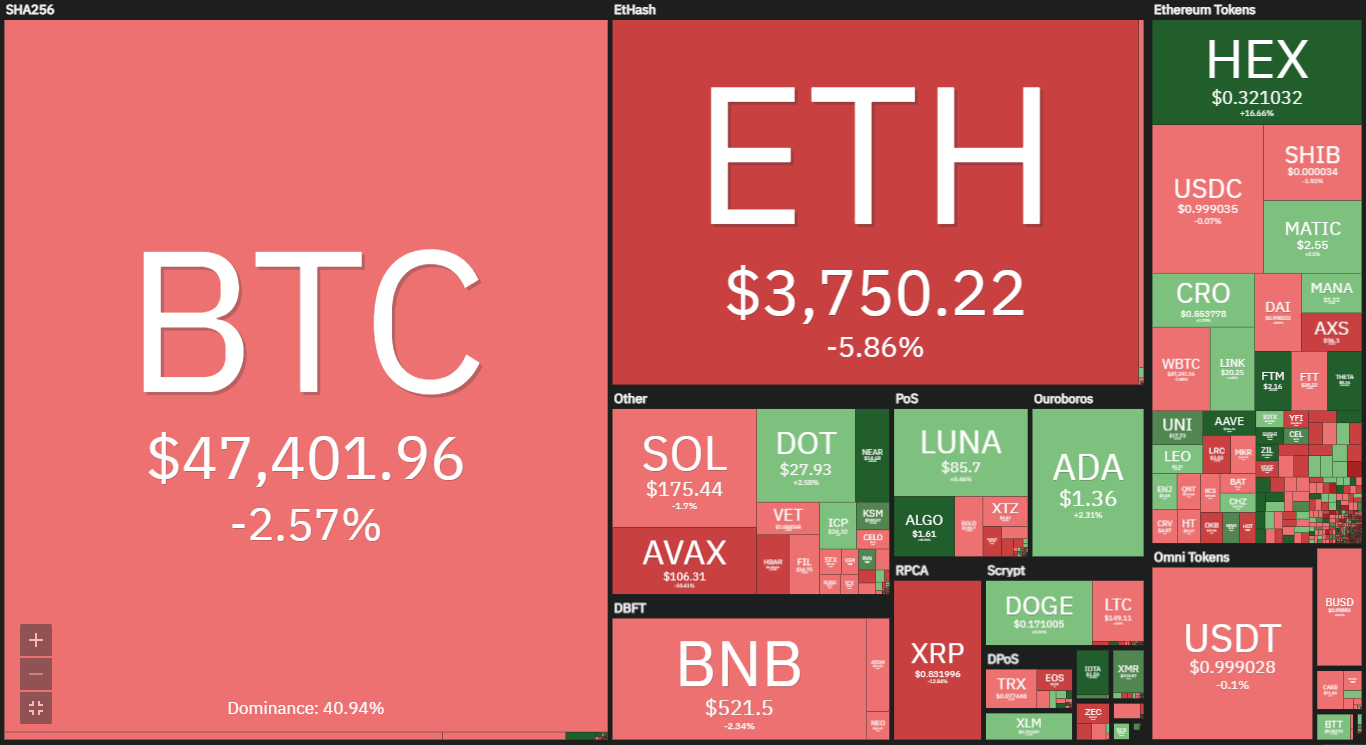

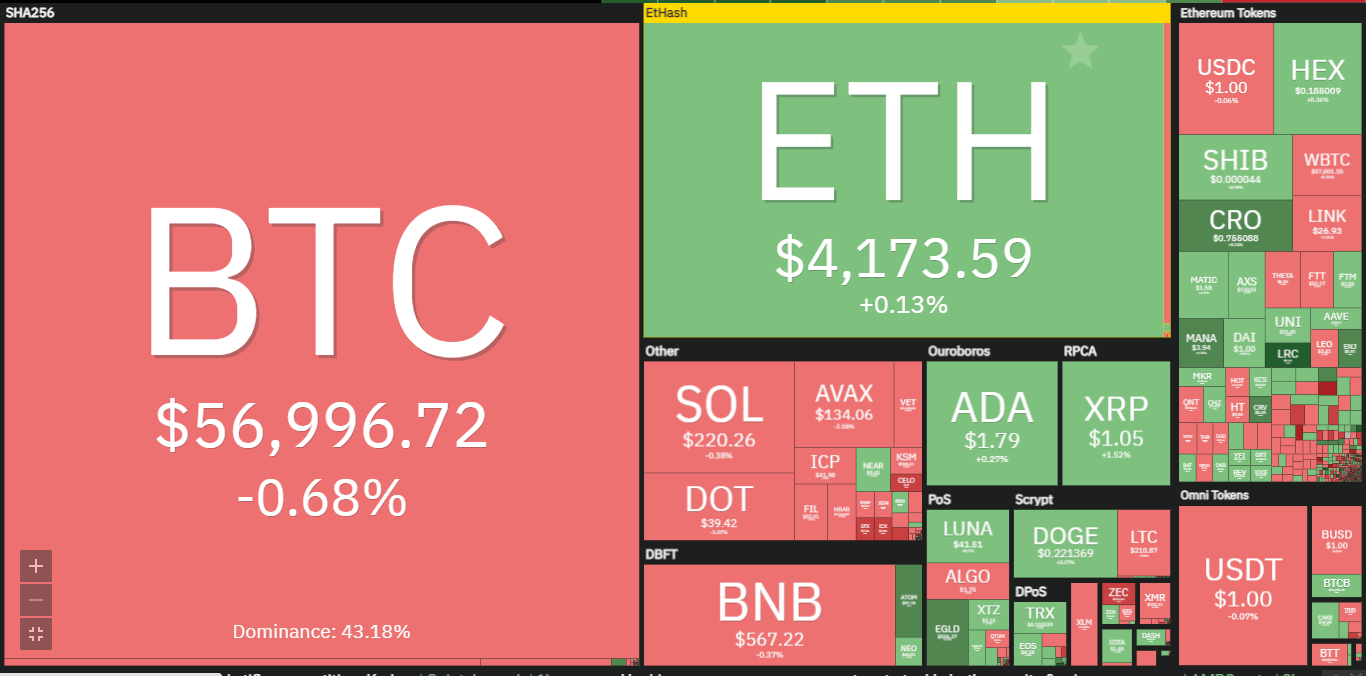

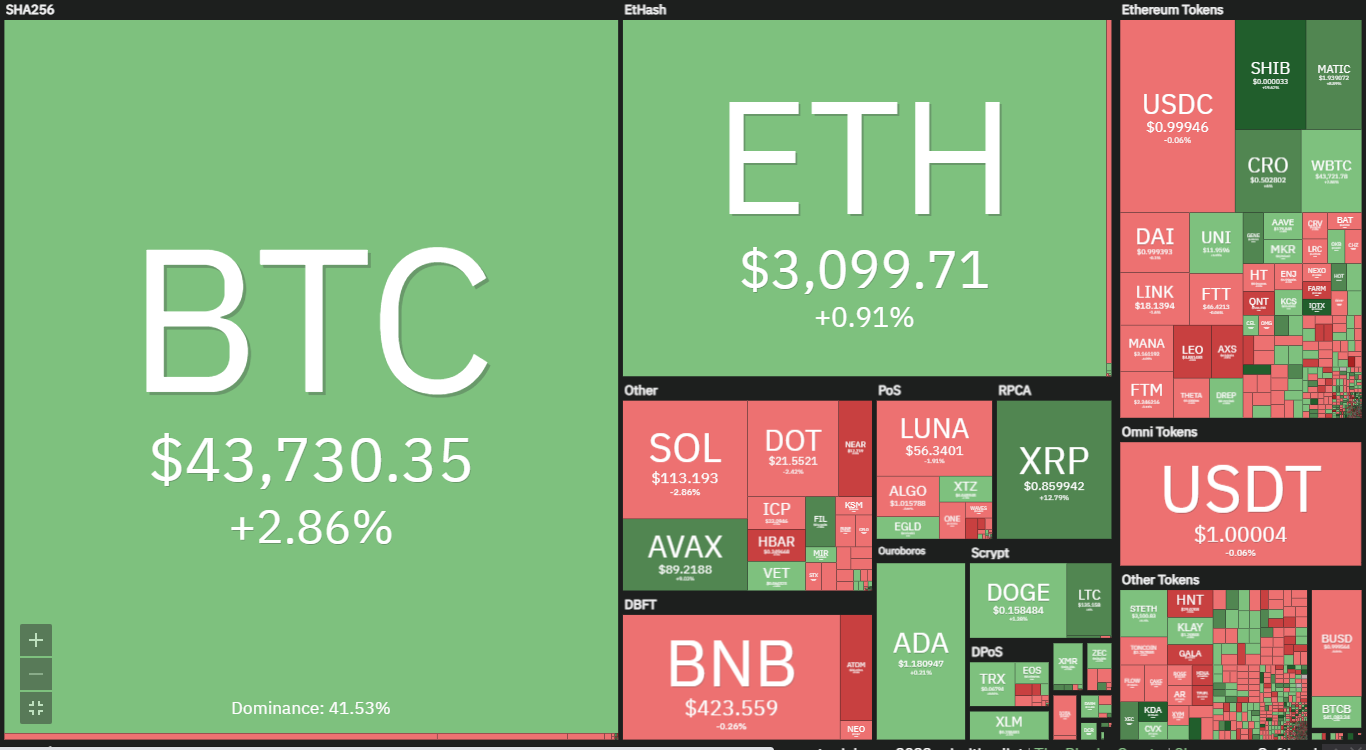

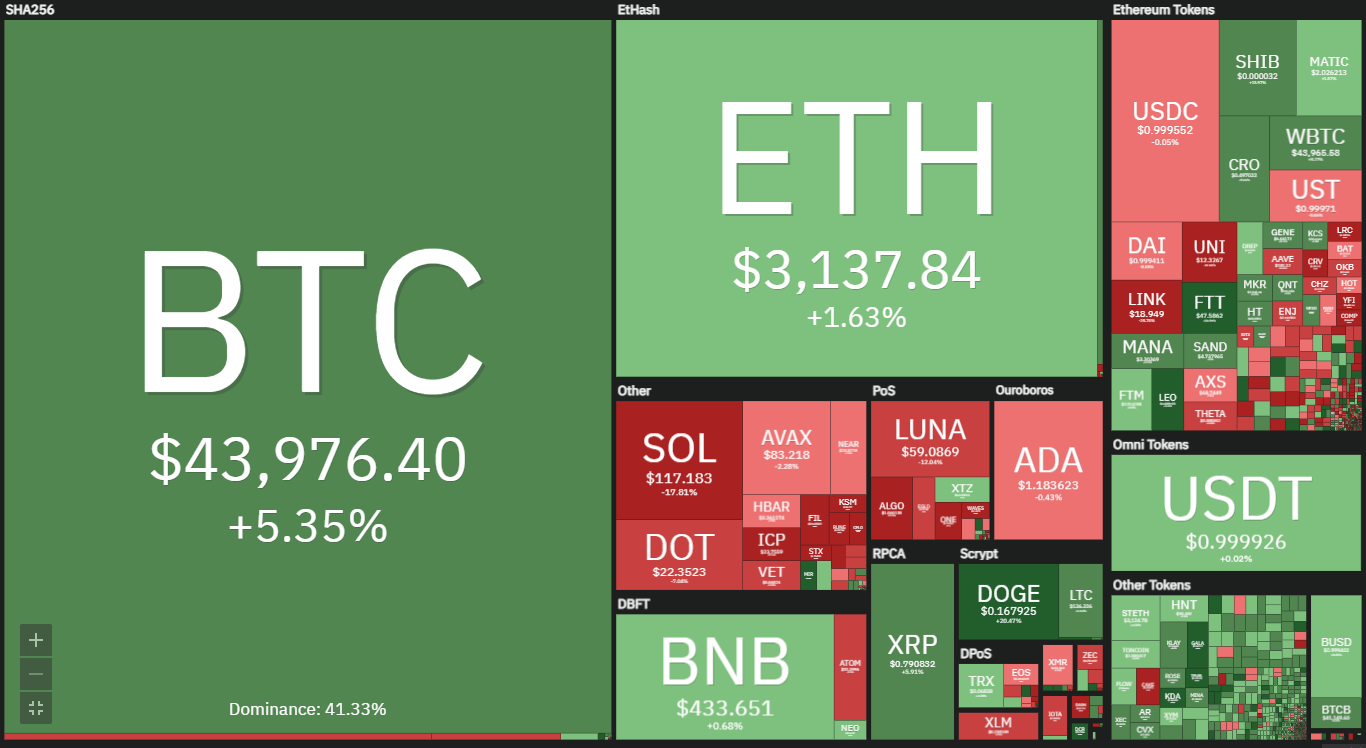

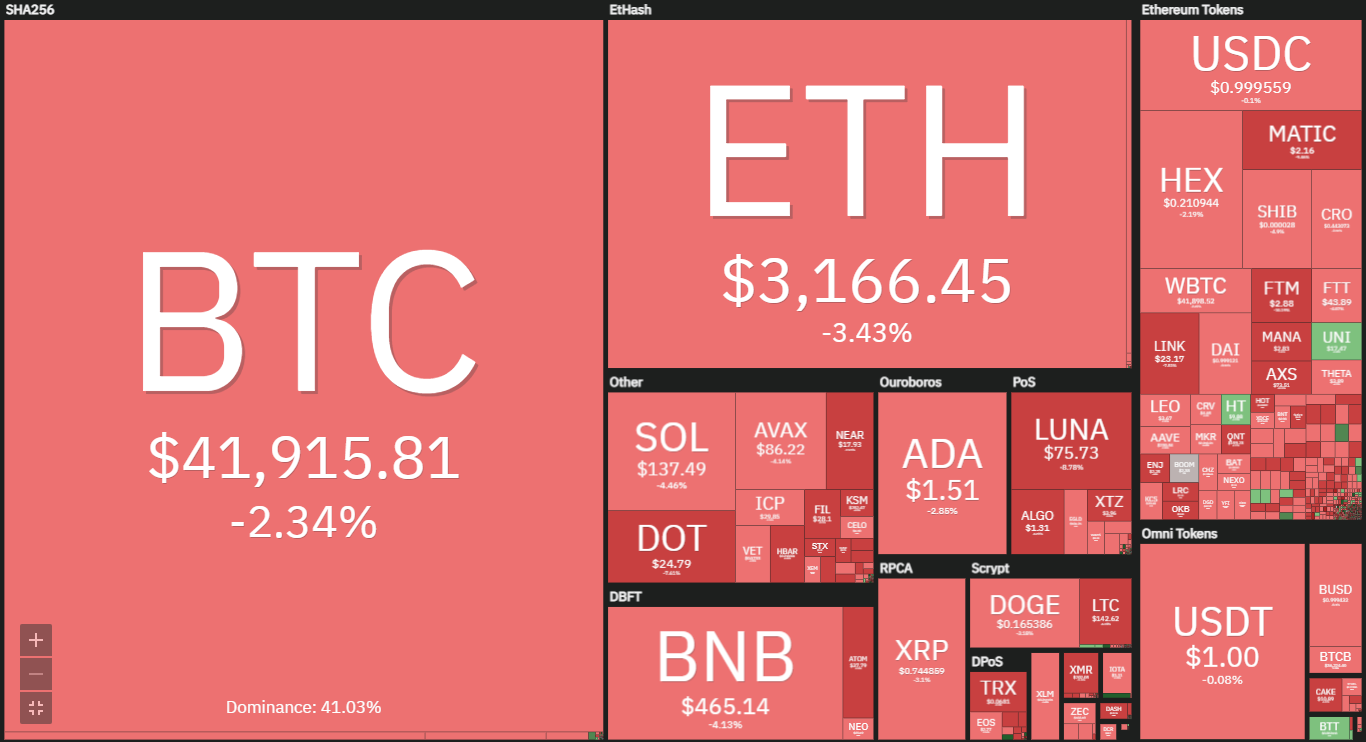

The crypto market seems to be maintaining that previous momentum as some coins are still enjoying relative hikes in price. The chart below suggests that although the bullish momentum that was seen during the past 24 hours is dwindling, most projects are still holding on to some critical levels.

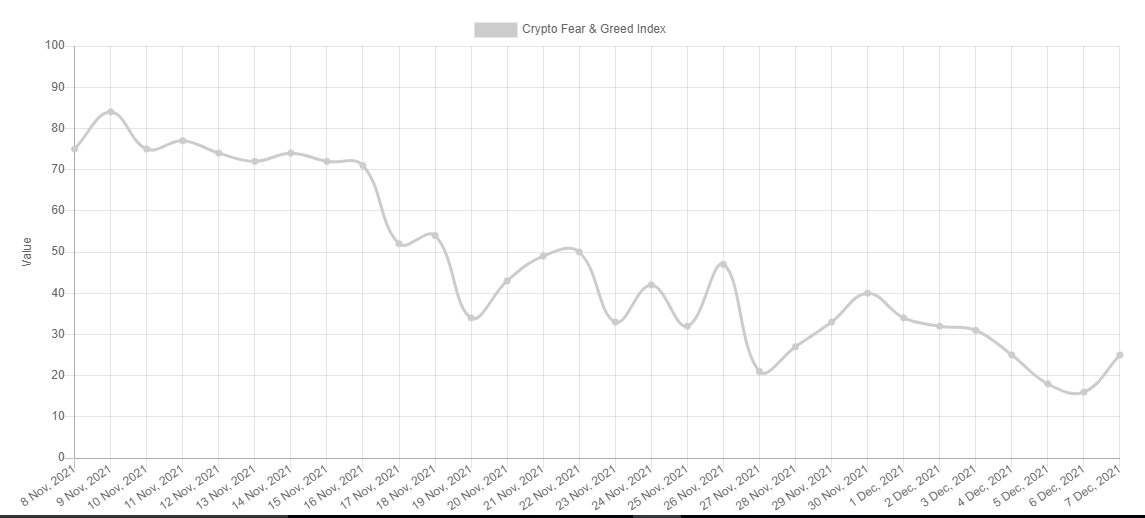

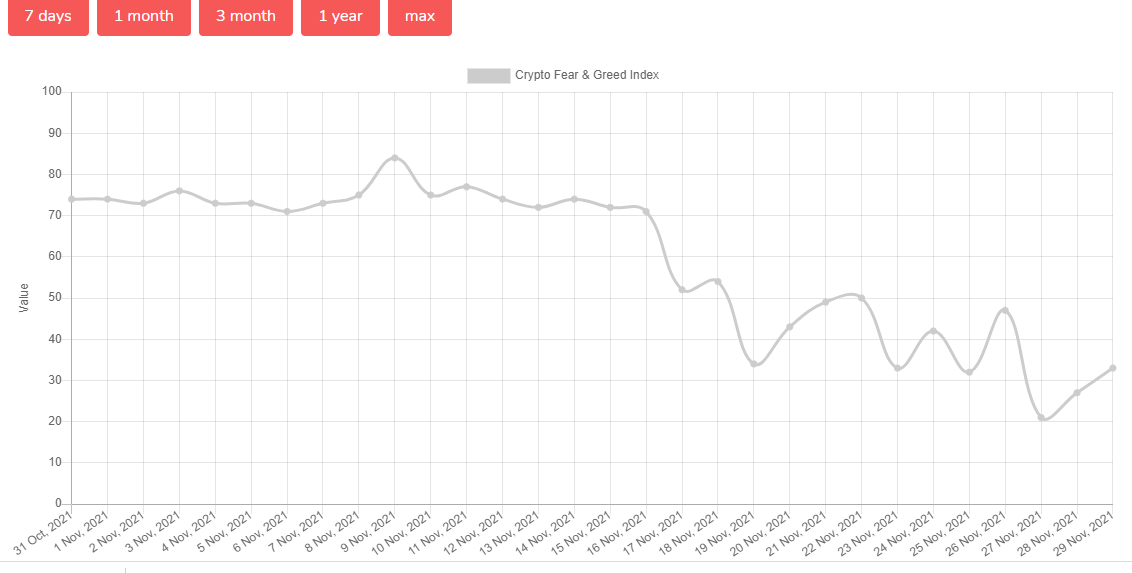

During the previous week, the Fear and Greed Index gradually surged from extreme fear to just fear and is now neutral as its current reading is at 48. Following an improvement in market sentiment, we may expect to see more uptrends over the next six days.

Is the bearish dominance over? Price action over the next few days will be the determining factor. However, we observe that the market is off to a good start following a surge across various coins during the previous intraday session.

Top Five Cryptocurrencies to Watch This Week

1. Bitcoin (BTC)

Last week started a bit slow for Bitcoin as we observe that the difference between the high and low was not up to 5%. The cryptocurrency retraced to $36,631 but surged to $38,776 and closed the intraday activity around $38,400.

The apex token saw its biggest surge on Friday, as it gained 11% at the time. The last two days of the week saw BTC experience minimal price movements as it ended the period under consideration, holding on to that lead.

The coin no doubt benefitted from several bullish stories that flooded the crypto space. One of the most thrilling is the news of Microstrategy splashing another $25 million on the digital asset. Indian traders can now trade BTC as well as other crypto assets thanks to the new tax law.

The largest coin by market cap closed the preceding intraday session with an almost 4% increase. However, the same cannot be said of the current session as the cryptocurrency is experiencing more selling pressure.

Nonetheless, the past seven-day period ended with bitcoin gradually rising above its bearish dominance. With several indicators suggesting further uptrends, buyers will look to make that happen over the next six days.

One such is the Pivot Point Standard (PPS). The apex coin is still trading above its Pivot Point as a result of the latest surge it experienced. Still holding onto it PP, we may expect more price increases as the said metric suggests that the project is on a path to another rally.

The Moving Average Convergence Divergence (MACD) is silent as bitcoin had a bullish divergence last week and the gap between the two lines is wider. This situation indicates that an impending bearish divergence may take place. However, it may be at the end of the current seven-day period.

We also observed that MACD is closing in on 0 to and may surge above the mark this week – heralding the start of a bullish trend. It is important for right-wing traders to maintain the previously intraday momentum as the uncertainty in the metric under consideration may play to the advantage of the sellers.

2. Terra (LUNA)

LUNA opened the previous seven-day period at $48 and closed at $56 – signifying a 21% increase. The coin saw a high of $58 and low of $43 at the time. Additionally, it flipped the $50 resistance and has held the mark as support since ascension. The highlighted mark may not be tested any time soon as Terra experienced a bullish divergence less at the time.

Currently positive, Terra is on its second consecutive week of gains following a two-week long downtrend. While it has had a bullish divergence during the past intraweek session, buyers are looking forward to more price increases.

The ninth largest cryptocurrency by market cap was unable to maintain the same momentum at which it started the week as it gained 5.87% during the previous intraday session but is currently down by the percent.

Why is Terra one of the many cryptocurrencies to watch this week?

We note that the LUNA/USD pair edged closer to testing its pivot point but failed based on the most recent retracement. The asset under consideration is currently trading at $55 per unit which indicates that the $50 support may break as the Relative Strength Index (RSI) suggests more selling congestion.

We also observed that the ninth largest coin by market cap was mostly bullish throughout the last seven days as it kicked the week strong but was slowed down in the following two days. The same script has played out before and the effect is seen in the chart above. We may conclude that the cryptocurrency may pick up momentum over the next six days.

3. Near Protocol (NEAR)

Near Protocol ended the past week in profit and is one of the top gainers in the top 100s. The project opened the period under consideration at $10 and closed at $13, adding up to 30% increase. The token was seen consolidating and enjoying a massive surge that resulted in a record profit.

The cryptocurrency tested and flipped its pivot point on the last day of the previous seven-day period. Unfortunately, NEAR failed to stabilize above the mark as it was met by fierce sellers’ congestion that saw it dip below the PP.

As with other assets, Near protocol had its bullish divergence during the previous intraweek session. However, the candle representing the previous intraday session is a doji as the coin failed to hold on to any losses or gains towards the end of the timeframe.

Currently down by more than 8% , the project is off to a bad start. The asset under consideration is one of the many cryptocurrencies to watch this week as the most recent price movement suggests more hikes ahead and hints at the coin hitting $14 this week.

Nonetheless, the most recent dip resulted in an impending bearish convergence. NEAR, experiencing any uptrends this week largely depends on general market sentiment. An improvement in the coin trajectory may see the coin hold the $12 support as further retracement flip the level.

4. Hedera (HBAR)

Hedera opened the previous intraweek session at $0.21 and closed at $0.25 adding up to a 18% increase at the end. The coin saw a low of $0.20 and a high of $0.26 as quick to recover from the more than 5% drop it suffered eight days ago and experienced a number of hikes throughout the week.

The buyers rallied the market and retested the pivot point at $0.25 and have sustained prices above the mark until the end of the intraweek session. Instinctively, many would expect HBAR to test its first pivot support after flipping the above mentioned mark. However, this is not the case as crypto is off to a bad start.

The coin is trading below its pivot point as a result of the most recent retracement. Additionally, HBAR is currently down by more than 6% since the start of the present seven-day period. Why is hedera one of the many cryptocurrencies to watch this week? Based on its volatility, the token, experiencing any uptrends this week, largely depends on general market sentiment.

5. Gala (GALA)

Gala is the top gainer from the past seven days as it opened the session at $18 and closed at $0.32 amounting to a 68% increase at the end. The coin saw a low of $0.17 and a high of $0.35 as it shook off the slow start to the period and experienced a number of hikes till the end.

The GALA/USD pair no doubt saw a lot of volatility as it enjoyed an increase in trading volume. The buyers rallied the pair to test its pivot point at $0.27 and have sustained prices above the mark after ascension. As with the preceding assets, GALA/USD was expected to test its pivot resistance after flipping its PP.

Price movement suggests that the token was close to testing the said mark but failed as it was hit by several short term sellers’ congestion. We also observed that the coin was off to a good start as it gained more 5% during the previous intraday session.

Unfortunately, it has fallen to the prevalent sentiment that is being plagued by retracements. Why is GALA on the list of coins to watch this week? Following the past week’s performance, it is easy to conclude that the bulls will start a rally that may see the asset flip the first pivot resistance, provided the coin trajectory changes.

Conclusion

This article highlighted five cryptocurrencies to watch this week. The above predictions coming true largely depend on market conditions remaining relatively stable for most parts of the next seven days, which of course is not guaranteed. The volatile nature of the crypto space means investors and traders must do their own research and always keep an eye on the charts

Source:

Source: