Top Five Cryptocurrencies to Watch in February 2022

January is a month many would love to forget as the first 31 days of 2022 were marked by a market-wide correction. A market that kicked off with a $2.2 trillion market cap ended in January with $1.75 trillion, making a 20% decline during that period.

The depreciation of the market is felt across almost every project as is with the top loser as per data from Cryptocurrenciestowatch.

Interestingly, the bulls seem to have staged a fightback since the start of February and investors are once again optimistic.

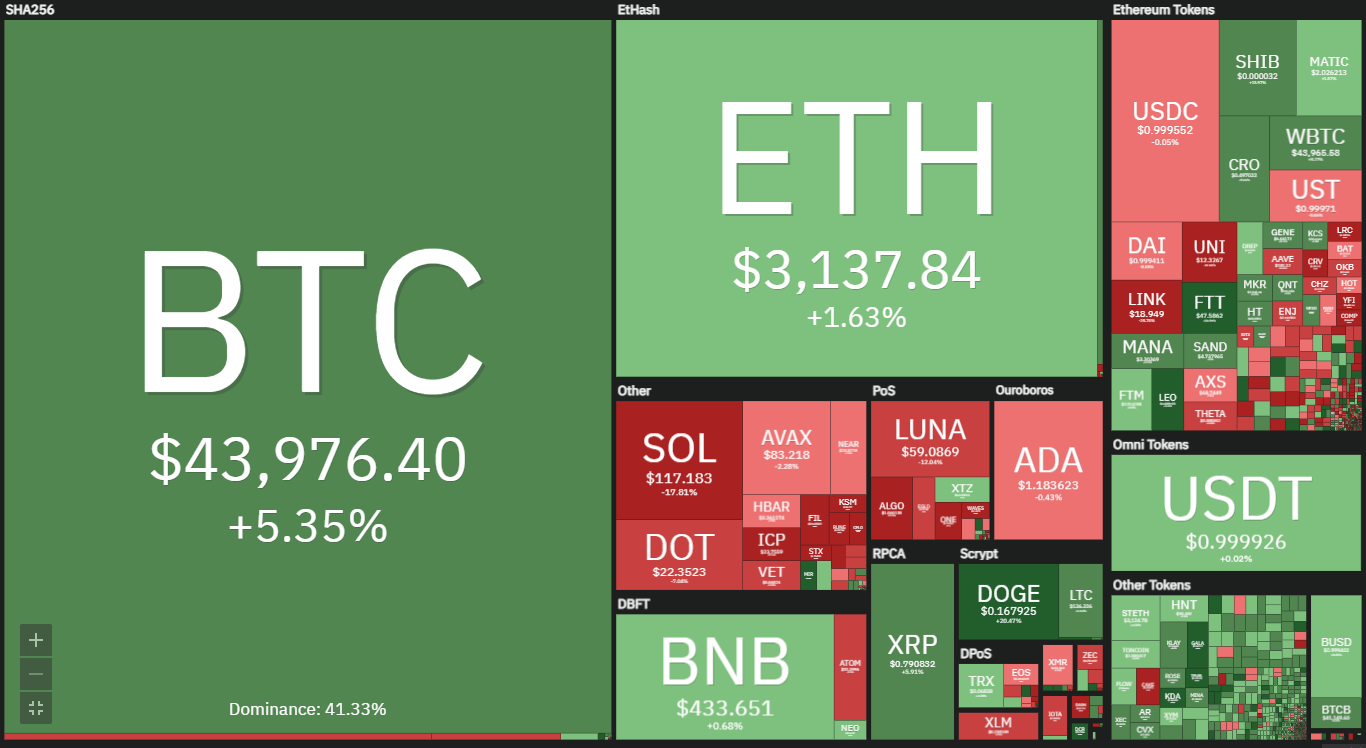

(Source: Coin360)

Indeed, the market situation at the time of writing has improved. The crypto industry is worth more than 8% higher than it started in February. It opened at $1.75 trillion and is currently worth more than $2 trillion.

The Fear and Greed index has also seen a considerable increase, moving back above 50 for the first time in a long time to suggest neutral market sentiment.

With a brief overview of the market now behind us, we take a look at the top five cryptocurrencies to watch this month.

Table of Contents

Top Five Cryptocurrencies to Watch in February 2022

1. Bitcoin (BTC)

The past 31 days have seen the apex token lose more than 16% of its worth. Bitcoin dipped to a low of $32,950 during the period and a high of $47,989. More than $2 trillion was liquidated from both long and short positions.

However, we noticed that BTC gained a lot of attention in January as more institutions as well as nations are adopting the asset or have indicated interest in doing so. With the first month over, many are looking to the next with a lot of optimism.

Will February be productive for the largest cryptocurrency?

Based on previous records, we note that the second month of the year is the most profitable in the first quarter. The highest the apex coin gained during this period under consideration is 87.6% while lost 26.8% – the highest loss.

We also observed that of the eleven Februarys, nine came out positive as bitcoin recorded significant gains. On average, the largest coin by market cap increases by more than 15.2% every second month of the year.

BTC had its biggest hike since February 2021 during the previous intraday session, as it gained more than 11%. The coin is currently trading above $41,000 – hence the improvement in the fear and greed index.

Will the uptrend continue?

Based on the average gains per month, the firstborn cryptocurrency may experience a 10%-15% hike over the next 24 days. In the coming days, we may see BTC test $46,600. However, the top coin may face intense selling pressure at $44k. Being unable to surge past this mark since January 7, intense buying pressure may be needed to break the $44k resistance.

As the largest digital asset picks up momentum, we expect a bullish convergence on the Moving Average Convergence Divergence (MACD) that may seal the start of a new bullish trend.

2. Ethereum (ETH)

Ethereum kicked off the past month trading at $3,657 but closed at $2,689. The closing price reflects a more than 26% loss at the time. The cryptocurrency surged to a high of $3,894 and saw a low of $2,195.

Ether (ETH) suffered from negative sentiment as outflows during that period exceeded $100 million. The coin was about testing the $2,100 support but was stopped thanks to whales. The number of unique wallets is at an all-time high as the large bag HODLers purchased more of the token. Coupled with that, a new all-time high of 26.22 Million $ETH held by top non-exchange whale addresses.

The two-month-long downtrend seems to be coming to an end, as the Ether is currently up by 13% since the start of February. The second largest coin by market cap currently holds the $3,000 support and may continue to stay above the level provided market conditions remain the same.

Indicators in major timeframes are silent as to how the largest alt will perform this month. However, previous records show that February is one of the most profitable months for ETH. With this in mind, we may expect Ether to retest $3,600.

3. Solana (SOL)

As with most cryptocurrencies to watch this month, Solana has also suffered massive retracement in the past 31 days. The coin kicked off the period under consideration at $169 and closed at $99 – a more than 40% loss. The asset saw a low of $80 and a high $179.

SOL experienced a cushioning effect from its price retrace on the last week of January, as it lost 7% as opposed to 10% average over the past two months. Unfortunately the slight improvement was not enough to pull the asset out of the bearish dominance.

This has resulted in a convergence of the Moving Average Convergence Divergence (MACD), which hints that SOL may experience another bullish convergence. Amidst the market stability, the $84 support still holds and may be tough to break.

Following a bullish divergence on February 1, the digital asset started an uptrend that saw it up by 13% as at the time of writing. With indicators remaining silent on the daily timeframe, we look to the weekly where we noticed the buying pressure that may aid an ascent to $150.

4. Polkadot (DOT)

Losing 27% during the past 31 days, the cryptocurrency will look to enjoy more surge this month. Polkadot opened January at $26 and closed $19. It also saw a low of $15 and surged to a high of $30. As ether suffered an outflow of capital, so did other cryptocurrencies hosted in its chain.

DOT suffered an eight-week long outflow that saw it dip to its lowest since August 2021. However, the token is one of the few that failed to record significant losses or gains last week. Price action during that could spark hopes of an inbound uptrend.

Currently, up by more than 9% since the start of the new month, the cryptocurrency may experience more hikes as the days progress. The Relative Strength Index (RSI) is one indicator that shows a lot of buying actions.

With the coin experiencing a bullish divergence lately, we may expect more uptrends in the coming days. The bulls will be looking to send the token as high as $30. However, DOT may face fierce resistance at $25.

5. Decentraland (MANA)

Decentraland kicked off the past month trading at $3.2 but closed at $2.8. The closing price reflects a more than 13% loss at the time. The cryptocurrency surged to a high of $3.4 and saw a low of $1.7.

The coin was about testing the $1.5 support but was stopped thanks to whales. As market conditions improved on major cryptocurrencies like Bitcoin and Ether, MANA also benefitted from the exposure as its HODLers bought the dip.

The two-month-long downtrend seems to be coming to an end, as the metaverse token is currently up by 8% since the start of February. The MANA/USD pair currently holds the $3 support and may continue to stay above that level if market conditions remain the same.

Indicators in major timeframes are silent as to how the largest alt will perform this month. However, Decentraland may continue to enjoy relative sentiment across the market. The MANA/USD pair may not enjoy the same volume of price increases recorded in the past 30 days. Nonetheless, market fundamentals point to a price increase if the pair recovers from its current retracement.

Conclusion

Although the start to January is not what many expected, we will see a gradual reverse of the current market conditions. Nonetheless, whether that prediction comes through would depend on the market remaining relatively stable for a larger part period within the month. This article mentions the top cryptocurrencies to watch in February, especially Bitcoin as its performance will once again prove pivotal.