The crypto market has been on a downtrend over the last three weeks as most cryptocurrencies have failed to excite. Last was no exception as it closed at $1.84 trillion after opening a little higher. The sector valuation hit a high of $1.9 trillion but could not maintain above the mark as market sentiments changed.

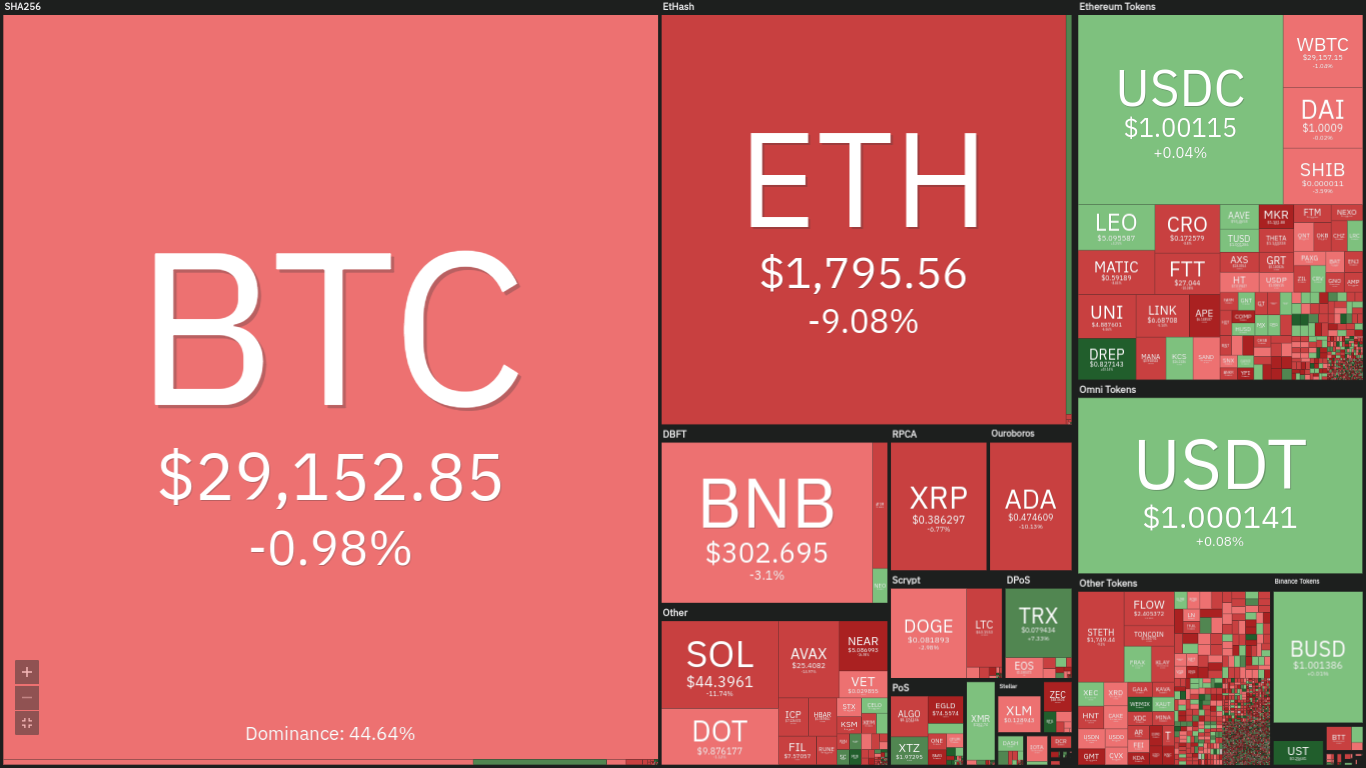

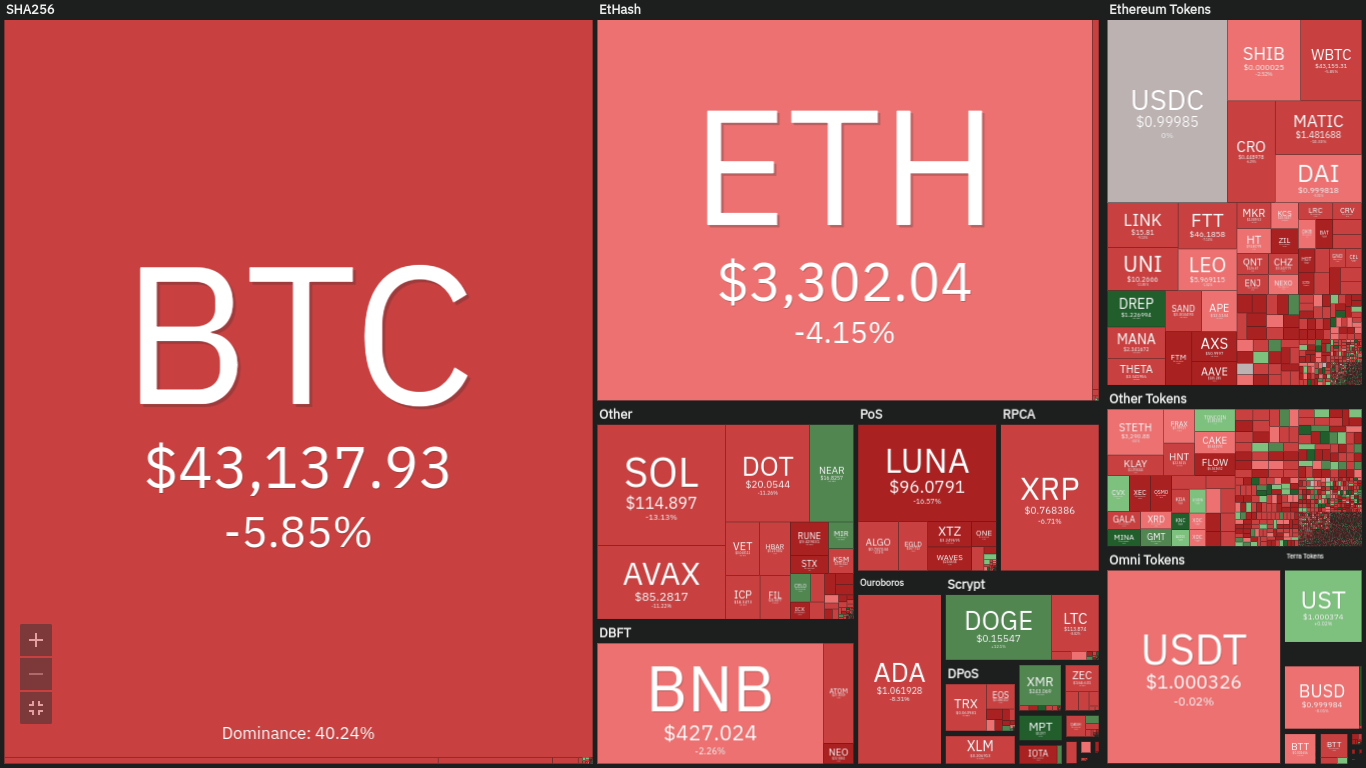

The bearish dominance of most crypto assets continues to slow or halt the increase in the worth of industry. The image below further expresses what transpires with the sector over the last seven days.

Source: Coin360

The illustration shows that most projects are down by a few percent. We may conclude that this is as a result of market sentiment during this period. The Fear and Greed index showed very little upward momentum as it failed to exceed 30.

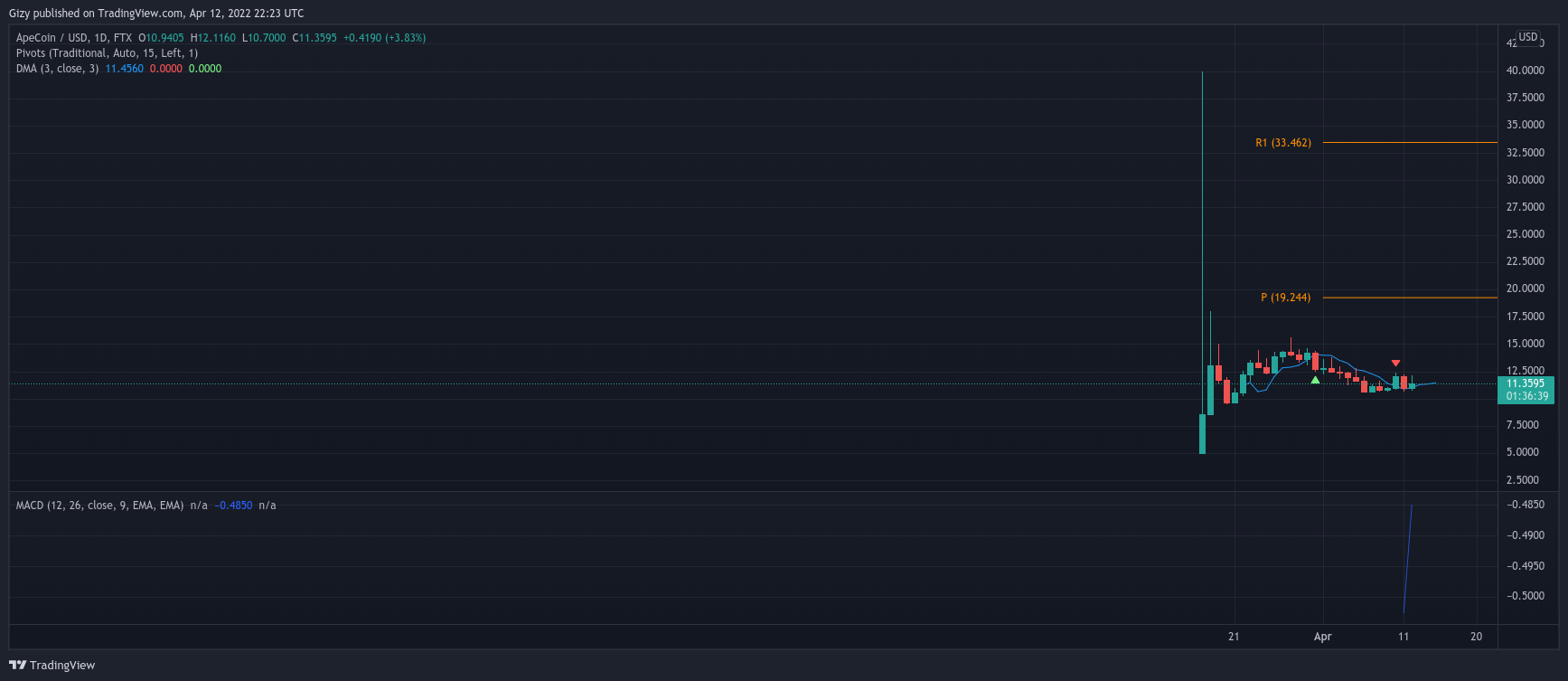

HNT lost 15% over the last seven days, making it the top loser. Waves trail behind with an almost equal value. Apecoin is making a comeback after failing to excite last week. It is currently up by more than 35%.

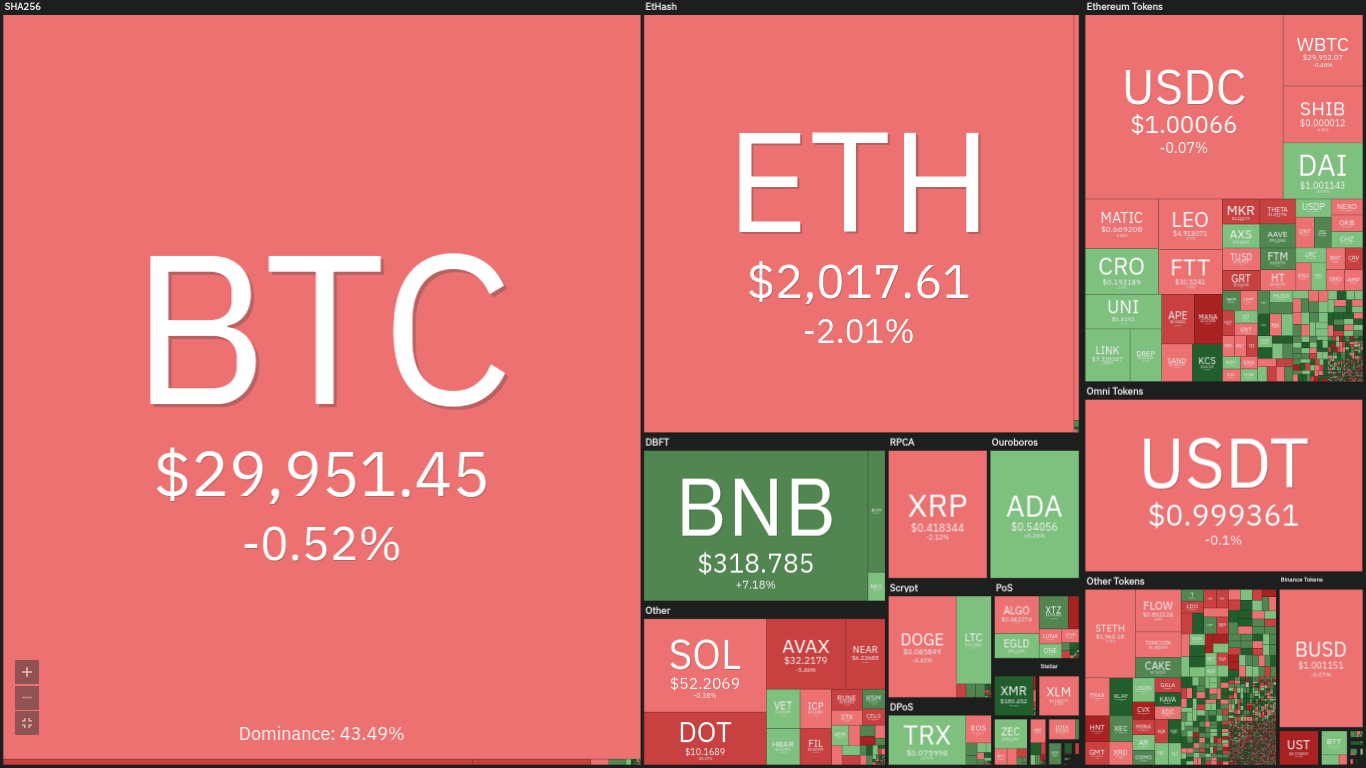

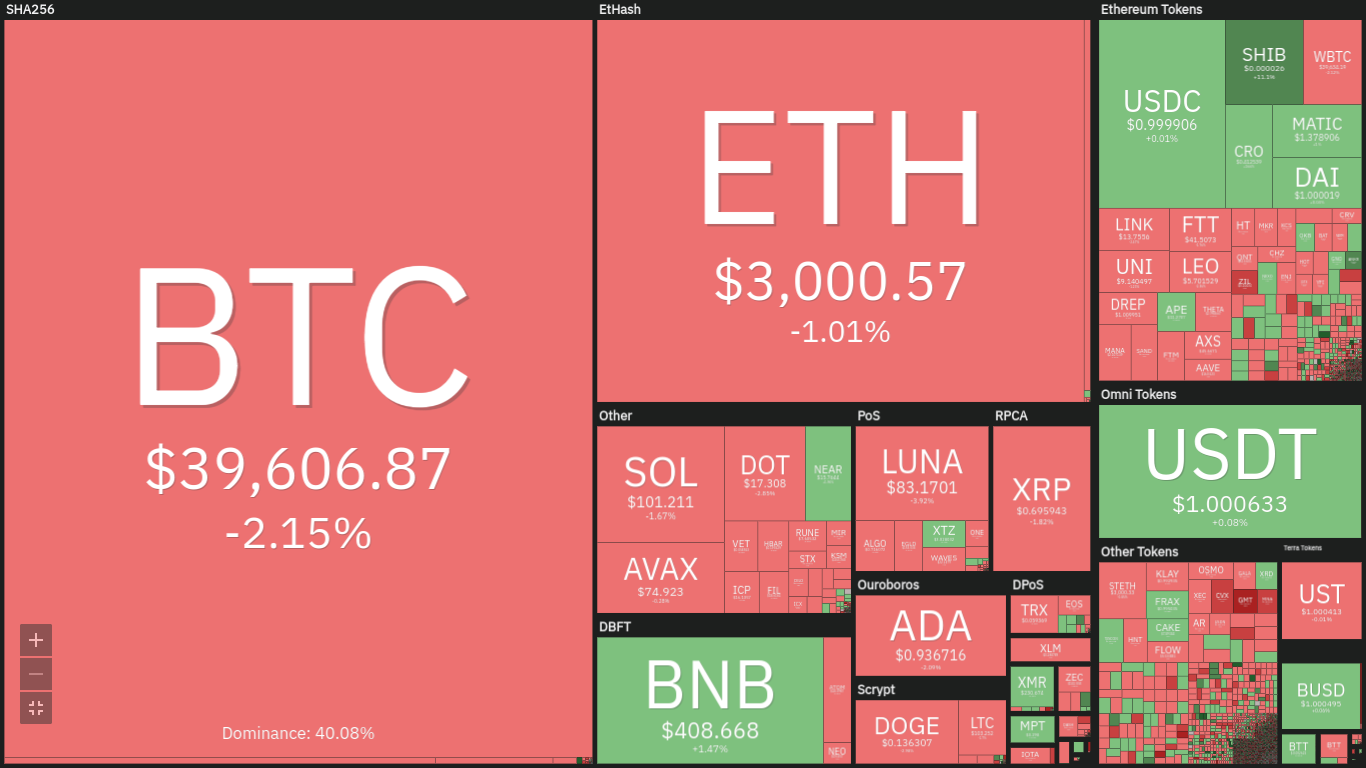

Most Cryptocurrencies are Still Down

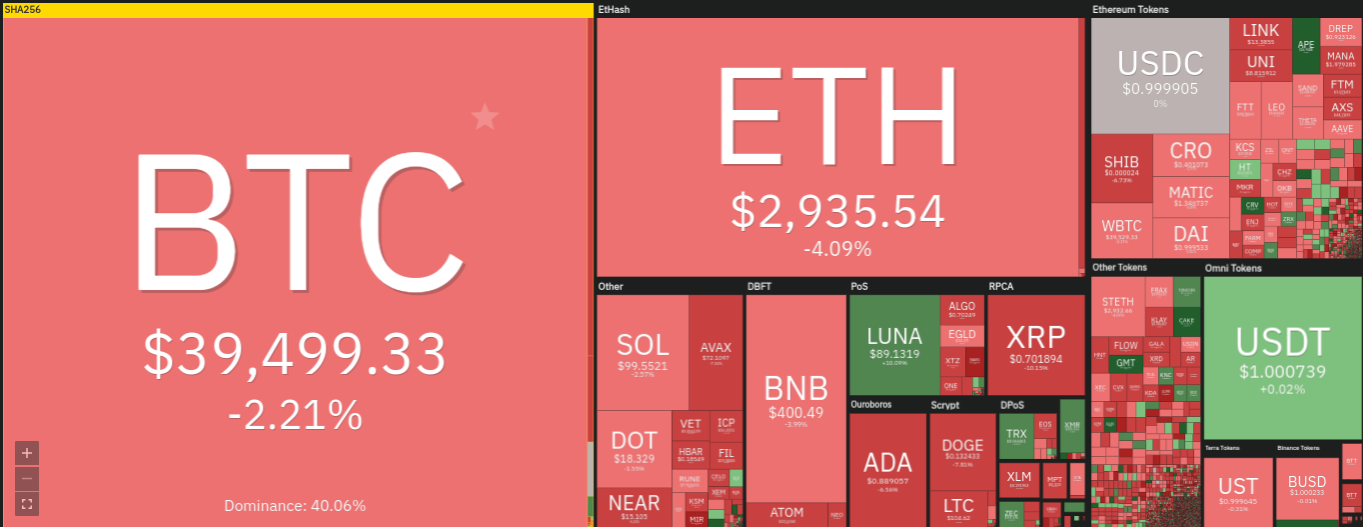

The image above is almost a replica of the past seven days. This is a clear indication that the crypto market is yet to recover from the bearish grip. Most projects in the top 10 are still down by a few percent.

However, the fear and greed index is showing signs of improvement as it is 27. Evidently, there has been a notable increase in the metric as it was at 23 as at yesterday. This positive change can be attributed to the presence of bullish news.

A recent survey reported today by the Bitcoin Mining Council (BMC), a voluntary global group of bitcoin miners who are committed to the network and its core principles, has revealed that Bitcoin mining is becoming more energy-efficient.

Kraken has also secured a Financial Services Permission (FSP) license from Abu Dhabi Global Market (ADGM) to operate as a regulated virtual asset exchange. Will there be further improvements in the market? Here are the top five cryptocurrecies to watch.

Cryptocurrencies to Watch This Week

The past week ended with BTC failing to record any significant increase or decrease. We may conclude that both the bulls and bears had a fair share of dominance. However, a closer look at the chart reveals that the top asset was mostly bearish.

Bitcoin saw a lot of volatility on Monday as it dipped below $39k. The retracement continued and was halted at $38,500. The bulls seized control of the market after the rebound and pushed BTC as high as $41,100 but closed the intraday session at $40,800.

The next day was a continuation of the uptrend as BTC made an attempt at $42k but was stopped in its tracks as it faced strong resistance at $41,700. It ended the 24 hour period no significant gains but maintained at $41,493.

Wednesday was also filled with a lot of movement. The apex coin flipped the $42k resistance and hit a high of $42,199. It also saw a low of $40,820 and failed to record any notable increases.

BTC surged to its high for the week as it made an attempt at the $43,000 resistance but halted at $42,976. It saw a low of $39,751 and closed above $40k. The downtrend lasted over the next two days till the end of the week.

The coin closed the week above its first pivot point support. Additionally, the Relative Strength Index (RSI) suggested that the retracement may extend as it was at 39.4.

The Moving Average Convergence Divergence (MACD) also had most traders on edge as both Moving Averages hint at BTC experiencing a bullish convergence. Unfortunately, both MAs have been close since on Wednesday and is yet to seal the bullish signal.

Market conditions are yet to improve, as bitcoin is currently down by more than 5%. The $38,000 support is under threat from the bears and may flip if the most recent market trajectory is not changed.

Failure to halt the dip may result in a retest of the $37,000 support. However, a bullish takeover may guarantee a return to $40,000.

LUNA is one of the few coins that has seen more uptrends over the last seven days. While most digital assets suffer from various corrections, the cryptocurrency surge by more than 18% on the first day and flipped the $90 resistance.

Tuesday was another day filled with upward movements. It hit a high of $96 and a low of $88. The asset closed the day gaining almost 10%. However, the following intraday session was as bullish as the previous one.

Wednesday was also filled with very little movement. The eighth coin by market retested $96 but failed to gain stability above the mark. It was met by seller’s congestion at the highlighted mark and saw a low of $93. It also failed to record any notable increases.

Terra surged to its high for the week as it made an attempt at the $100 resistance but halted at $99. It saw a low of $89 and closed above $90. Almost all of the lost values were regained the next day.

A little downtrend on Friday and the weekend was bullish. The coin closed the week above its first pivot point support. Additionally, the Relative Strength Index (RSI) suggested that the trading volume over the week as it remained around 50.

Terra had a bullish divergence last week Thursday. However, there are signs of a bearish divergence soon. If this happens, LUNA may retest the $80 support, Nonetheless, based on price movement, we deduced that the asset under consideration may surge above $100.

Pancakeswap has been one of the most bullish tokens over the last seven days. The first intraday session was filled with volatility as it dipped to its lowest for the week. It dropped to a low of $7.8.

The next day was a continuation of the uptrend as CAKE made an attempt at $9 but was stopped in its tracks as it faced strong resistance at $8.6. It ended the 24 hour period with no significant gains but maintained above $8.

Wednesday was also filled with a lot of movement. The token had the biggest mover of the week on Wednesday as it flipped $9. It closed the intraday session gaining more than 6%.

Cake surged to its high for the week as it made an attempt at the $10 resistance but halted at $9.7. It saw a low of $8.9 and closed above $9. It resumed its uptrend on Friday, gaining almost 3%. Very minimal trading volume was seen over the weekend with very little impact on prices.

The token closed above its pivot point and was considered a bullish asset. However, a change in market sentiment has resulted in the asset flipping its pivot point.

CAKE had a bullish divergence last week Thursday. However, there are signs of a bearish divergence soon. If this happens, Pancakeswap may retest the $8 support, Nonetheless, based on price movement, we deduced that the asset under consideration may surge above $10.

Like the previously highlighted coins, Stephen also showed a lot of resistance to the bearish dominance that ravaged the market. While most cryptocurrencies were dipping, the asset saw massive uptrends.

The surge was so much that GMT became the top gainer during the session. It gained more than 30% as cruised past $2.7 resistance and hit a high of $3.3. Tuesday was a continuation of the uptrend as the token made an attempt at $4 but was stopped in its tracks as it faced strong resistance at $3.8.

The second intraday activity closed with a more than 16% increase and regained stability above $3.7. Wednesday was the start of a two-day-long downtrend. The cryptocurrency lost almost 10% and flipped the $3.5 support.

Seeing a low of $3.30, GMT attempted recovery but failed as it closed at $3.36. The decrease continued to the next day as the asset under consideration lost the $3 support, losing 7% of it worth per unit in the process.

Sunday brought relief as Stepn gained over 7% and regained stability above $3.3. The token closed the week close its first pivot point resistance. Additionally, the Relative Strength Index (RSI) suggested that GMT was seeing the needed buying pressure.

However, MACD had a bearish convergence at the end of the intraweek session. A divergence soon followed yesterday, which hints at further downtrends. Nonetheless, the asset is considered bullish based on the PPS which may mean a quick recovery and an attempt at $4.

Kava could be considered the most bullish token over the last seven days. Massive uptrends were seen during the first intraday session as the cryptocurrency surged above $4.4. The triumph over the resistance was short lived as the token was met by immediate sellers’ congestion.

Regardless of the bearish grip, KAVA closed the day with a more than 7% increase. Tuesday saw minimal trading volume. Wednesday was filled with a lot of movement but kava failed to excite. We observed a successful attack on the $5 resistance as the token peaked a little above the mark on Thursday. it also dipped to a low of $4.3 but closed at $4.5.

The next day was a continuation of the uptrend as the digital asset again made an attempt at $5 but was stopped in its tracks as it faced strong resistance at $4.8. It ended the 24 hour period with a 4% increase and maintained above $4.7.

On Sunday, KAVA surged to its high for the week as it made an attempt at the $5.5 resistance but halted at $5.2. It saw a low of $4.7 and closed above $5.1. it close the session with a more than 6% increase.

The token closed the week close its first pivot point resistance. Additionally, the Relative Strength Index (RSI) suggested that kava was seeing the needed buying pressure.

CAKE had a bullish divergence last week Thursday. However, there are signs of a bearish divergence soon. If this happens, the token may retest the $4.8 support. Nonetheless, based on price movement, we deduced that the asset under consideration may test $6 before the week runs out.

Conclusion

This article highlighted five cryptocurrencies to watch this week. The above predictions coming true largely depend on market conditions remaining relatively stable for most parts of the next seven days, which of course is not guaranteed. The volatile nature of the crypto space means investors and traders must do their own research and always keep an eye on the charts