Most cryptocurrencies failed to impress last week as we observed the recurring downtrend that affected them. The inability of these assets to record significant gains has resulted in the reduced value of the global crypto market.

It opened at $2.16 trillion and reached a peak of $2.17T. The high suggests that the sector did not experience any notable increases during this time. It dipped as low as $1.8 trillion but quickly recovered and closed the intraweek session at $2T.

Amidst the corrections, tokens like KNC gained more 30%, making it the top gainer. MINA is the second highest gainer as it recorded a more than 16% increase. Waves is the top loser over the last six days as it is down by 47% with AAVE is closing behind with a more than 26% decrease during this period.

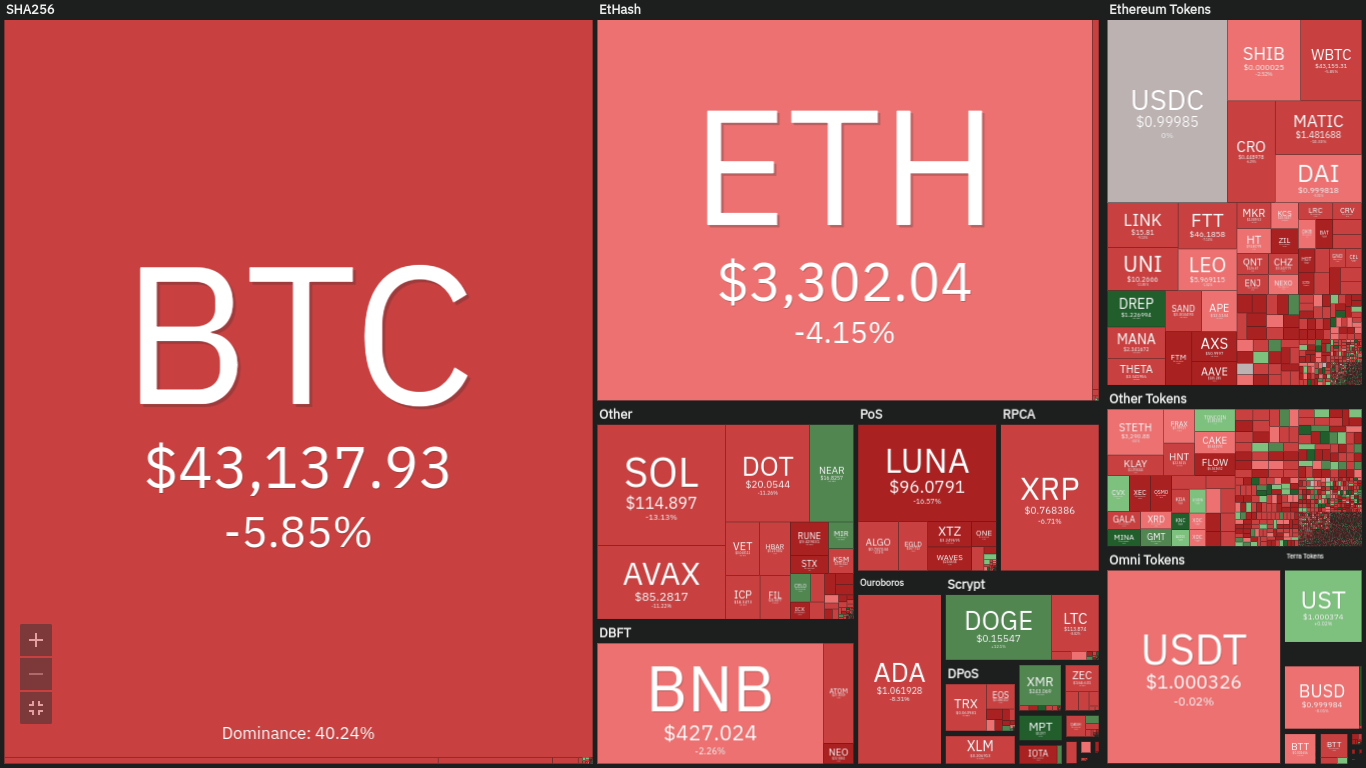

The image below further shows the performance of some assets in the market. We observed that BTC is experiencing a drop in its market dominance as a result recurring decrease in its market cap.

Market fundamentals, on the other hand, were bullish as there were several positive stories. One such is the announcement by Próspera, a special economic zone located in Roatan, Honduras, has declared Bitcoin and other cryptocurrencies as legal tenders within its jurisdiction.

Crypto Market Down by 6.5%

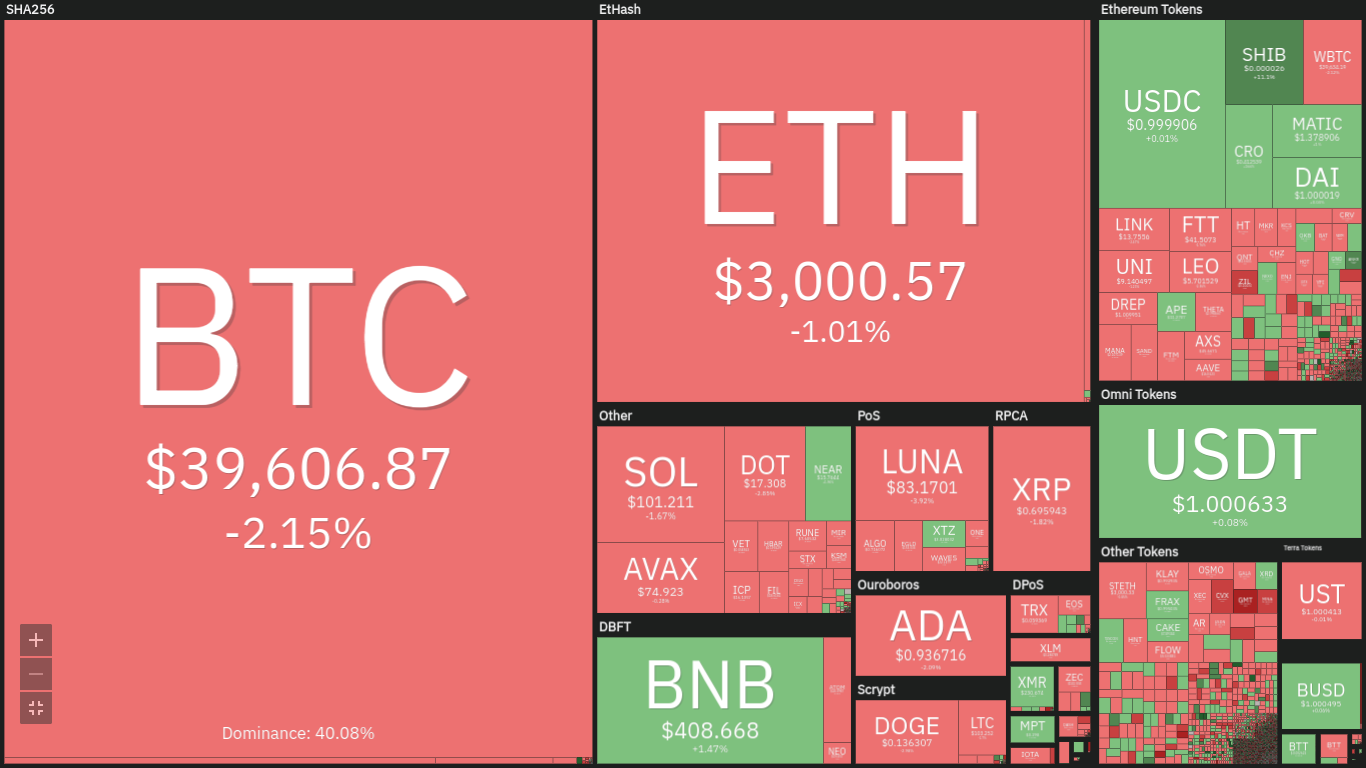

Closing the past week at $2 trillion, traders expect more improvements during the current intraweek session but are yet to see any such positive price changes. Unfortunately, the industry was met by a further downtrend that saw it lose more than 6% of its value.

The global cryptocurrency market cap is currently valued at $1.87 trillion. and is showing no signs of an impending uptrend. The image below further expresses the state of the sector. Although most cryptocurrencies are down by a few percent, a few are seeing notable price increases.

For example, BNB is enjoying a little uptrend. The top gainer over the last 24 hours is Monero, as it is up by more than 8%. APE, SHIB, COMP, and a few other assets are up by more than 5%. With a brief overview of the market, here are the top five projects to watch this week.

Top Three Cryptocurrencies to Watch

1. Bitcoin (BTC)

Last week, bitcoin opened at $46,414 and hit a high of $47,201 on the first intraday session but failed to record any notable gains as the candle representing that period is a green doji. An almost good start to the session was expected to mark the start of a new uptrend. However, the opposite happened.

The next two days were marked by downtrends as the asset lost almost 8% of it value during the timeframe. It dipped as low as$43,086 which was the lowest over the last twelve days. Thursday offered more in terms of buying pressure.

An increase in demand concentration resulted in the coin closing the session with positive changes worth a few percent. The rest of the week was mostly bearish, with few price increases.

At the end, BTC ended the previous seven-day period, losing more than 9%. The Moving Average Convergence Divergence (MACD) suggests that the top asset has had a bearish divergence over the last seven days.

It was also observed that the top coin lost its pivot point during the previous session and also dipped below its Displace Moving Average (DMA). Unfortunately, market conditions are yet to improve as bitcoin is currently trading at its open.

With most indicators painting a more bearish picture. The only foreseeable factor that could change the current state of the project are strong fundamentals. We may see BTC retest $38k if market conditions remain the same. However, a change in sentiment could help the largest cryptocurrency steady above $40k.

2. Monero (XMR)

Monero showed a lot of volatility last week. Enjoying a good start to the session, XMR saw notable price change as it closed, exchanging a few percent above its opening price. The next day saw almost an equal amount of trading volume but failed to close, holding on to the gains.

The candle representing that timeframe was a doji and hinted at an impending price decrease. The drop in price happened the next day as monero dipped as low as $211, losing more than 4% in the process.

The bulls launched a repraisal attack on Thursday as the token gained more than 6%, erasing the previous day’s losses. The main highlight of the week happened on Saturday as XMR surged by more than 10%.

It hit a high of $246 – the highest since January. More good news for the token as it retested its first pivot resistance. Unfortunately, it failed to gain stability above the mark but closed the previous intraweek session above that level.

Although it experienced a bearish divergence last week, the bulls successfully ignored the indicator and pushed the asset a more than 8% increase over the last seven days. The new week is expected to be a continuation of that sentiment.

XMR kicked off the current seven-day period experiencing increased bearish dominance. However, the token has recovered the losses and may continue the uptrend. We may see a monero gain stability above its pivot resistance.

3. Apecoin (APE)

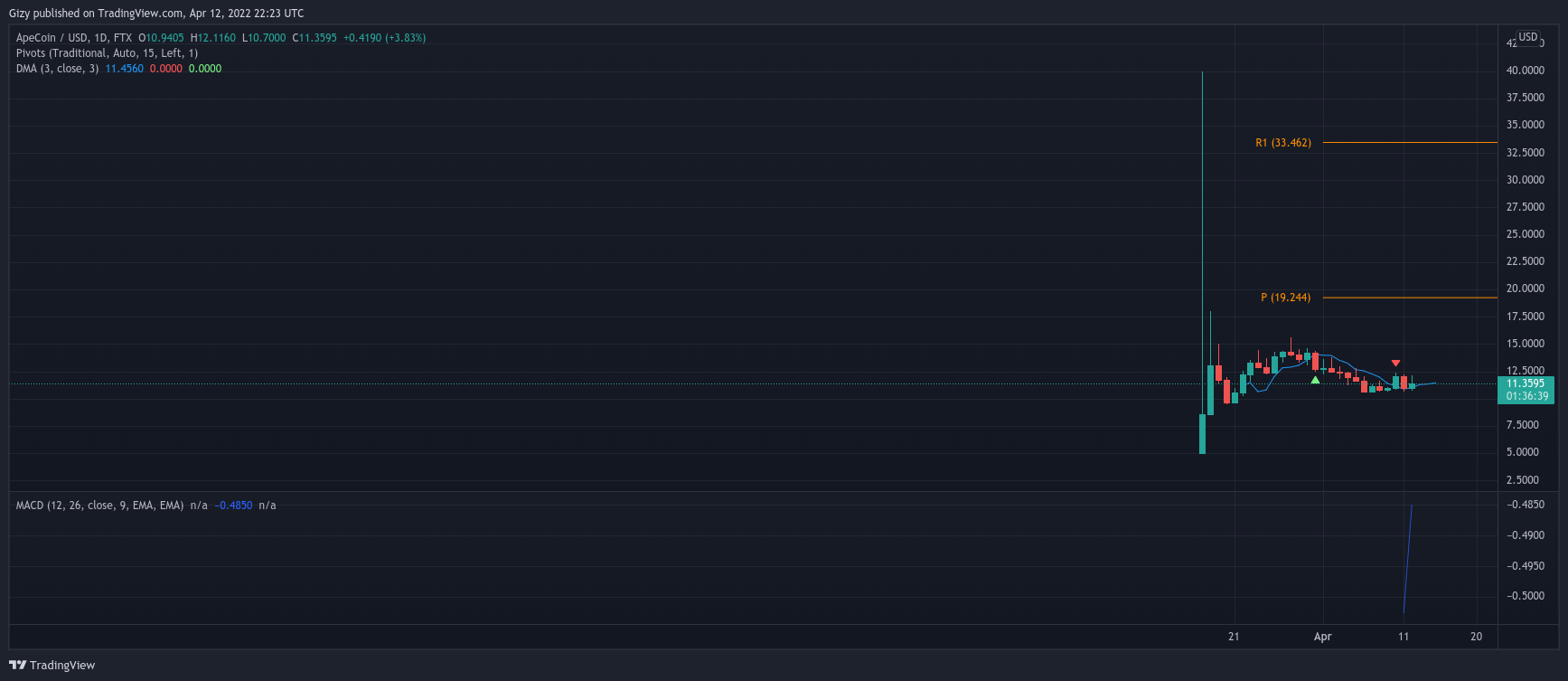

The first two days of the week were marked by various dips as the token failed to surge. It lost more than 5% during this period and dipped as low as $11.1. The biggest correction happened on Wednesday as the asset lost a little above 8%.

The next three days were mostly bullish as APE gained a few percent. It saw its biggest hike on Sunday, as it gained almost 10%. It also hit a high of $12.3. It closed the previous intraweek session losing a few percent.

Been fairly a new token, most indicators are not on display. However, the asset is currently trading below its pivot point. We also observed that the $10.5 support held out through all the corrections.

We may expect the same this week as the bears will attempt to push APE as low as $10. Additionally, we may see a retest of the $12.5 resistance, provided the asset picks momentum and its sustained by the bulls.

Conclusion

This article highlighted five cryptocurrencies to watch this week. The above predictions coming true largely depend on market conditions remaining relatively stable for most parts of the next seven days, which of course is not guaranteed. The volatile nature of the crypto space means investors and traders must do their own research and always keep an eye on the charts