Most cryptocurrencies have resumed their consistent downtrend but are showing signs of a reverse. Nonetheless, opening the past week at $1.29 trillion, it failed to surge and recorded no further increases as it was hit by immediate downtrend.

The sector under consideration closed at $1.22T which indicates a more than 7% decrease. The previous intraweek session saw the industry’s value dip below $1.2 trillion and a hit a low of $1.17T.

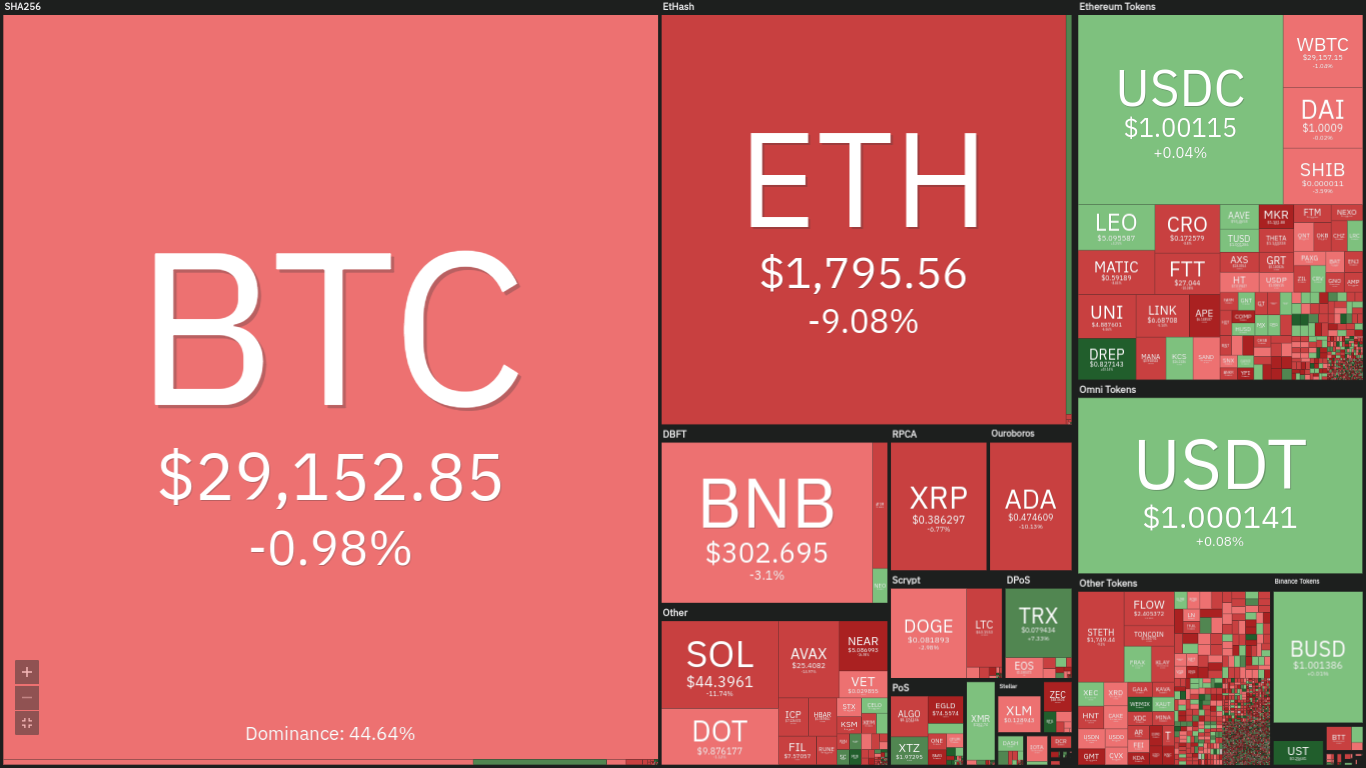

The low was as a result of the state of most projects as they lost a significant fraction of their value. The image below further explains the situation of the market at the end of the period under consideration.

Source: Coin360

One of the few good news from the chart above is the growing dominance that Bitcoin is experiencing. Aside from that, there is little to talk about on the positive aspect. Nonetheless, BTG stands as the top gainer as it gained more than 18%.

There are also a few cryptocurrencies that saw notable increase over the last seven days. However, the top loser over the period under consideration is Waves as it lost more than 25%. Strong bearish fundamentals also caused the prices of Stepn to retrace with similar intensity.

The mobile app was made unavailable to Chinese users which resulted in fears among investors. The Fear and Greed Index did not see any improvement as we observed it does not leave the extreme fear region.

Market conditions have improved as at the time of writing. One of the glaring evidence attesting to the positive change is the global cryptocurrency market cap. We observed that the sector’s valuation has exceeded $1.3 trillion due to the improvement of most digital assets.

As a result of the bullish sentiment spread across the industry, WAVES has made a comeback and is currently up by more than 69% – making it the top gainer. AXS trial behind with a more than 25% increase.

The new week is looking promising. Here are the top five cryptocurrencies to watch this week

Top Four Cryptocurrencies to Watch

1. Bitcoin (BTC)

The largest cryptocurrency by market cap experienced a lot of volatility last week. It opened the previous seven-day session on a bearish note as the first intraday session was marked by an almost 4% decrease.

The next day saw BTC see more upward push as it peaked at $29,802 but failed to record any significant gains. Wednesday was different as a doji marked that trading cycle. However, the top coin peaked at $30,192.

The next two day were marked by little retracement and Bitcoin failed to record any significant boost. The weekend came with more bullish sentiment as we observed the green marking of the chart.

The largest cryptocurrency gained more than 3% during this session. On the part of the indicators, the Relative Strength Index ended the week at 39 but retraced to a low of 36 on Friday.

The Moving Average Convergence Divergence is also seeing more improvement as we observe its upward trajectory that was maintained throughout the past intraweek session. We may expect the uptrend to continue as the asset may leave the bearish region.

If the current state of the market is sustained, we may expect the apex coin to retest the $32k resistance within the next six days. On the other hand, the bulls must defend the $30k support as failure to do so may result in more struggles at $29.

2. Ethereum (ETH)

Like most cryptocurrencies, Ethereum had a bearish start to the previous seven-day period. The largest alt on the first day, lost the $2,000 support as it retraced to a low of $1,954. It closed at $1,971 after an open at $2,040 – a more than 3% loss.

The downtrend extended to the next day as ether retested the $1,900 support but rebounded. It returned to its opening price but failed to surge further. The bearish grip on the market resumed on Wednesday but the losses were insignificant.

Thursday came with the largest correction of the week as we observed that the asset under consideration dipped to a low $1,734. It recovered but could not erase the incurred losses, leading to a close with almost 8% deficit.

The next day saw a spillover of the previous sentiment and ETH lost 3.68%. The weekend came with relief as the largest altcoin recorded gains of more than 5%. Price action on the fourth day of the week negatively impacted the the trajectory of RSI.

We noticed that the dip caused the asset to be briefly oversold as it plunged below 30. It regained composure and ended the intraweek session at 34. The Moving Average Convergence Divergence was also impacted.

The 12 -day EMA saw a slight change in direction due to the bearish dominance. This raised fears of a bullish divergence and more selloffs. But that never happened as the bulls rallied the market.

Yesterday, a massive upward push was seen as the asset under consideration surged by 10%. Ether seems to be going through a cool down as it is currently down by 2.85%. If the downtrend continues, we may expect a retest of the $1,800 support. A rally could send ETH as high as $2,100.

3. Cardano (ADA)

Like the preceding cryptocurrencies, Cardano struggled with bearish dominance during the first intraday session of the previous week. The coin retraced from $0.54 to a low of $0.50 but saw a small recovery that saw it close at $0.51, losing more than 5%.

The first half of the next 24-hours trading cycle saw the bears seize total control of the market. The asset lost the $0.50 support as it dipped to a low of $0.49. The second half saw the bulls erase the incurred losses and rallied the market to a close above its opening price.

Wednesday saw the ADA record low trading volumes, which resulted in low volatility. It failed to end the session with any significant price changes. The bearish dominance intensified on Thursday as the asset under consideration saw its biggest correction.

The coin retraced from $0.52 to a low of $0.46. Seeing a slight recovery, the session ended at $0.47 – an almost 7% decrease. The grip grip on the market softened the next day as cardano lost the $0.45 support.

The mark was regained, but the asset lost more than 4%. The last two days of the week were marked by green candles indicating the cryptocurrency saw more bullish sentiments. It gained more than 5% during that period.

The asset was almost oversold as its RSI dipped as low as 32. it ended the intraweek session at 36. MACD, on the other hand, also gave a scare of an impending selloff as we observed a bearish convergence.

The cross was averted as and the 12-day EMA continued its uptrend. Both of the highlighted indicators reached their peaks during the previous intraday session as it gained more than 18%. If the uptrend is sustained, we may expect an attempt at the $0.80 resistance before the end of the week.

4. Near Protocol (NEAR)

Of all the highlighted cryptocurrencies, Near protocol has been the most impacted by the bearish dominance last week. The coin hit a peak at $6.52 on Monday but was soon met by correction as it dipped to a low of $5.73.

It closed at $5.83 which indicates a more than 6% decrease. The downtrend continued the next day as the asset retraced to a low of $5.51 but ended the session at a little above its opening price, gaining 2.25%.

However, the bears seized complete control of the market over the next three days. Wednesday saw the coin lose more than 3%. Thursday saw NEAR retraced from a high of $5.82 to $5. A slight recovery saw the cryptocurrency close at $5.2, dipping by more than 9%.

The next day was continuation of the retracement as the $5 support broke as a result of the massive sellers’ congestion the asset experienced. The session ended at $4.8 indicating a 8.22% deficit.

The bulls regained control of the market over the weekend. On Saturday, NEAR surged by 4% and almost the same amount of positive change was seen on the last day of the week. Going over the price action of the last seven days, it is no surprise the asset under consideration was oversold.

The two-day surge that was recorded over the weekend enabled the coin to leave the oversold region. Interestingly, there was no massive impact to MACD’s 12-day EMA. The metric continued its uptrend.

Like the preceding asset, all of the highlighted indicators hit their their highest in more than 14 days. We can conclude that NEAR has continued its uptrend as it ended the previous intraday session with a more than 11% increase.

It is also edging up a retest of its first pivot support. If the current upward trajectory is maintained, we may expect an attempt at the $8 resistance. Failure to sustain it may result in flip of the $5.5 support

Conclusion

This article highlighted five cryptocurrencies to watch this week. The above predictions coming true largely depend on market conditions remaining relatively stable for most parts of the next seven days, which of course is not guaranteed. The volatile nature of the crypto space means investors and traders must do their own research and always keep an eye on the charts