Last week was one of the many that strong fundamentals played a huge role and elated the mood of the market. With the focus now turning to cryptocurrencies to watch this week, we’re bringing you a breakdown of your top assets as usual.

First, some fundamental news. Last week, the United States Department of Justice (DOJ) announced that it has recovered and returned 12.164699 BTC, worth around $483,595 to an elderly man who resides in Asheville, North Carolina.

Another was from HSBC as it announced a partnership with The Sandbox to engage with virtual communities in the metaverse. Bored Ape Yacht Club Launched ApeCoin during this timeframe.

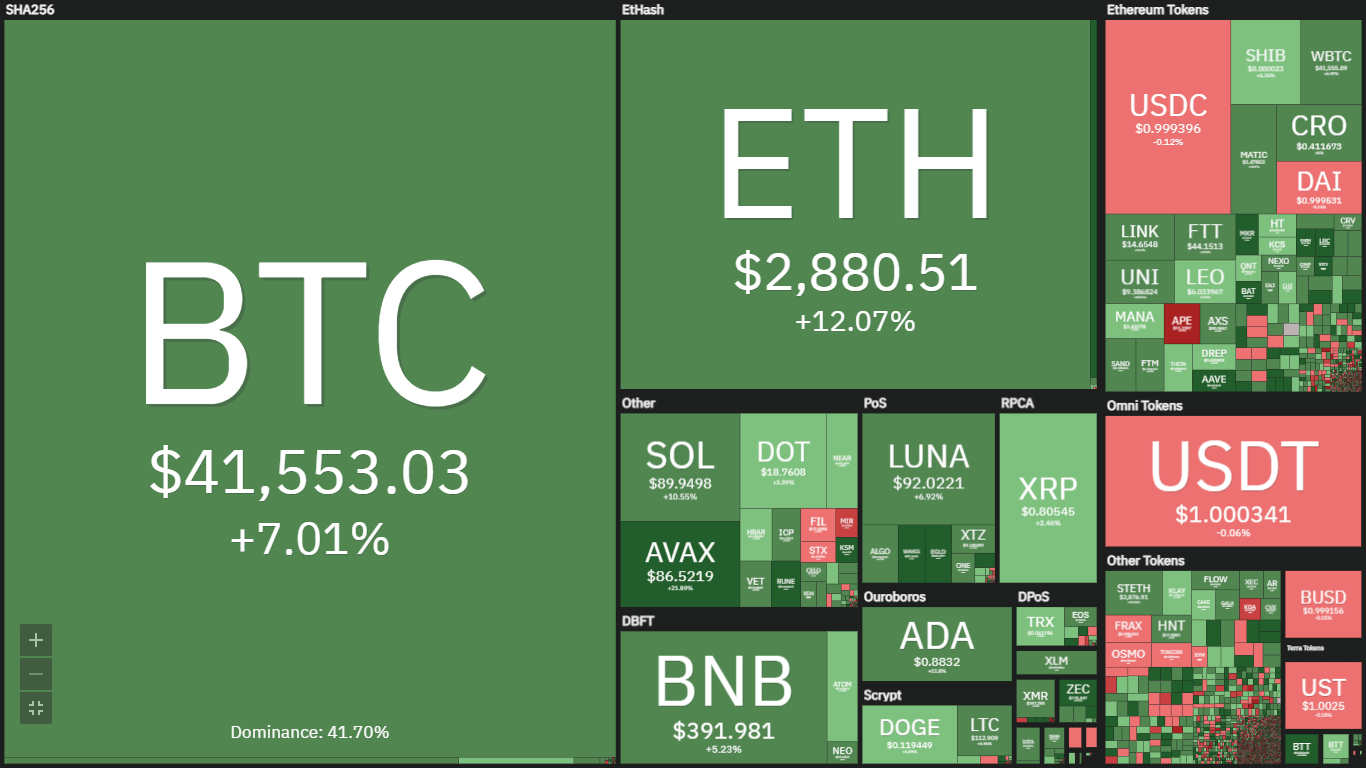

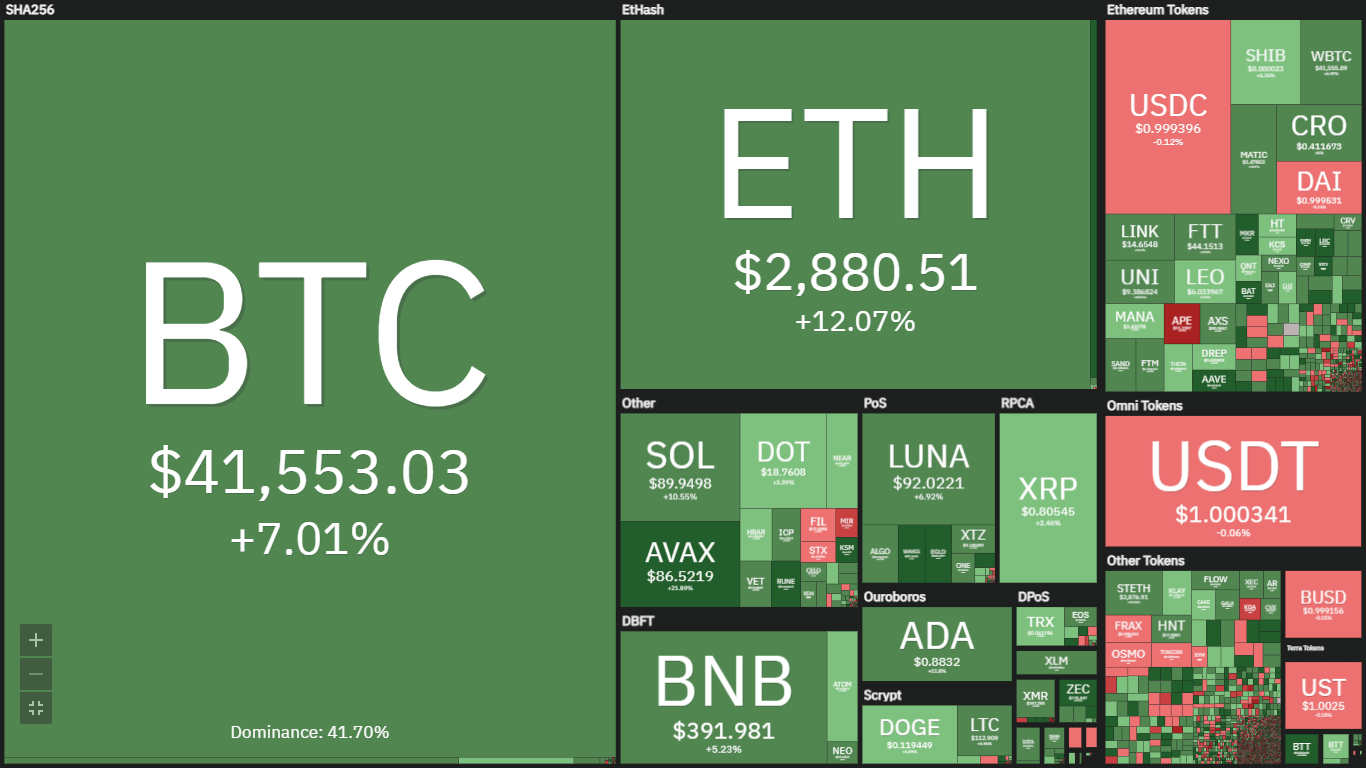

We observed that the sector saw notable increases in its worth. The past seven days seem to mark the start of a new alt-season. Many were thrilled to see many projects record significant gains. This is reflected on the entire crypto market as it closed with a more than 9% increase. It opened the week at $1.72 trillion and ended the timeframe at $1.87 trillion.

Additionally, the industry broke a two-week long trend that saw it open and close an intraweek session at the same valuation. Amidst the increase in prices of most altcoins, general market sentiment has not seen any notable increase.

This is reflected in the Fear and Greed Index. It is currently at 31 (fear) which is the highest it has attained since the start of the week.

The image below further depicts the state of the market. The top gainer over the last six days is Apecoin as it is up by more than 1000%. Meanwhile, the top loser is Anchor Protocol, as it is down by 11%.

With a brief overview of the crypto market performance over the last seven days, questions of if we will see a continuation of this trend in the new week arises.

Top five cryptocurrencies to watch this week (March 21)

Still talking of breaking a trend, Bitcoin had a very good start the previous seven-day period as it gained almost 5% on during the first intraday session. Reduced trading volume and more selling pressure were seen on Tuesday as BTC retraced and failed to close in on the greens.

The top crypto saw a lot of trading on the third day as it dipped to a low of $38,865 and hit a high of $41,693. This intraday session could be considered the most active as the as it possesses the largest candle for the intraweek session. The apex coin continued with minimal gains and losses through the next three days.

However, BTC recorded its biggest loss on Sunday as it dipped by almost 3%. We observed that the top coin had a bullish divergence on the Moving Average Convergence Divergence (MACD) four days ago which signaled the start of the uptrend. The asset went as above its Displaced Moving Average (DMA) is currently above it.

At the end, Bitcoin gained almost 10% over the last six days. Amidst bullish readings from various indicators, the Relative Strength Index (RSI) is taking a dip after a more than four-day hike as a result of a decrease in demand concentration.

Currently, the on-chain data correlates with the latest movement BTC is experiencing. It’s printing more bearish action than bullish. Nonetheless, we observed that transactions more than $100k exceeded $160 billion over the last seven days.

Trading above $41k, bitcoin may aim to flip the $43,000 resistance in the next six days. However, the top coin is at risk of dipping as we note that the most recent decrease in price has resulted in both RSI and MACD seeing a downtrend.

The previous seven-day period marks Terra’s fourth week of consecutive gains. Following the 47% at the start of the trend, the margin seems to be getting tighter. The asset is known to be very volatile and has lived up to this expectation even in the current intraweek session.

The coin experienced a bearish divergence at the start of the current intraweek session owing to the gradual decrease in buying volume. Traditionally, this has been a signal for more downtrends. However, the bulls managed to keep the asset above its opening price.

Interestingly, terra was mostly bullish over the last six days but recorded its biggest loss on Tuesday as it dipped by more than 6% – almost making the previous day’s gains void. The project hit a high of $95 and a low of $82.

Like the preceding assets, LUNA fell back to its previous pattern of retracement over the weekend. The candle representing Sunday is red, indicating that the asset closed that intraday session down by a few percent.

Terra has regained momentum as it’s currently up by more than 4% over the last 14 hours. One of the many reasons you may place the asset under consideration in the list of cryptocurrencies to watch this is because it is currently trading above its DMA.

LUNA may see more uptrends over the next six days and may retest its first pivot resistance. Moreover, we observed that the token is close to a bullish divergence on MACD which may mean the start of a massive rally.

Kicking off the previous week at $25, the largest alt recorded notable increase and was off to a good start. Following that good start, the asset was bullish all the way and experienced uptrends for most of the week.

Tuesday saw minimal gains compared to Monday but closed with a green candle to signify a slight increase. The next three days were a continuation of the prevalent sentiment as ether hiked by more than almost 8%.

The digital asset experienced the highest hike on Saturday as it gained almost 22%. ETC tried testing the $44 resistance during this period but fell short as it faced huge resistance at $40.9.

Like BTC, we observed that the Ethereum classic had a bullish divergence on the Moving Average Convergence Divergence (MACD) five days ago which signaled the start of the uptrend. The asset went as above its Displaced Moving Average (DMA) is currently above it.

At the end, ETC gained more than 50% over the last seven days. However, we may expect the coin to take a break from the uptrend as it is currently overbought. This may result in the asset experiencing a downtrend.

Why is the 29th coin by market cap on the list of projects to watch this week? Following a brief dip, the token is back on track and is up by a few percent. ETC also just experienced a bullish divergence on the weekly chart.

Seeing almost the same sentiment as two weeks ago, Waves fell back to its previous pattern of retracement over the weekend. The candles representing both Saturday and Sunday were dojis, indicating massive trading volume but failing to end the day with any significant increase.

The asset closed the previous seven-day period in profit – making it the fourth week of consecutive gains. We noticed the bulls build on the bullish signal from the Moving Average Convergence Divergence (MACD).

Additionally, it gained stability above its DMA and its third pivot resistance. However, the 38th largest cryptocurrency was not off to a good start as the first day of the intraweek session was marked by doji. The next day saw the coin gain momentum and hiked by almost 6%.

Another doji followed as the token attempted to gain stability above $32 but failed as it was hit by increased selling pressure. WAVES flipped the $32 resistance but relinquished the level as market sentiments changed. Nonetheless, it has regained composure above the mark as at the time of writing.

Waves is one the cryptocurrencies to watch this week as we may expect a repeat of the past intraweek session. However, we note that the asset has been evading near bearish convergence. it may take place within the next six days.

An analysis noted that RUNE facing rejection at the $8.6 resistance is a good sign for the bid to $10 as a retest could flip the mark and place the token between the $8.6 and $12 channel. The token closed the past seven days with a 35% increase.

Interestingly, the Bulls were able to sustain the uptrend until the current seven-day session. The coin is currently on an uptrend as it is on its second day of consecutive gains. It has gained a few percent and is still experiencing price increases. The asset has seen a low of $8.2 but is exchanging at $8.8 as at the time of writing.

Additionally, RUNE is trading above its DMA, which spells goodwill for the asset as it may see more hikes. Based on the most recent sentiment, the asset may test the $9 resistance. If the bulls continue their grip on the market, we may see the token retest $10 and close between $9 and $7.5.

Conclusion

This article highlighted five cryptocurrencies to watch this week. The above predictions coming true largely depend on market conditions remaining relatively stable for most parts of the next seven days, which of course is not guaranteed. The volatile nature of the crypto space means investors and traders must do their own research and always keep an eye on the charts