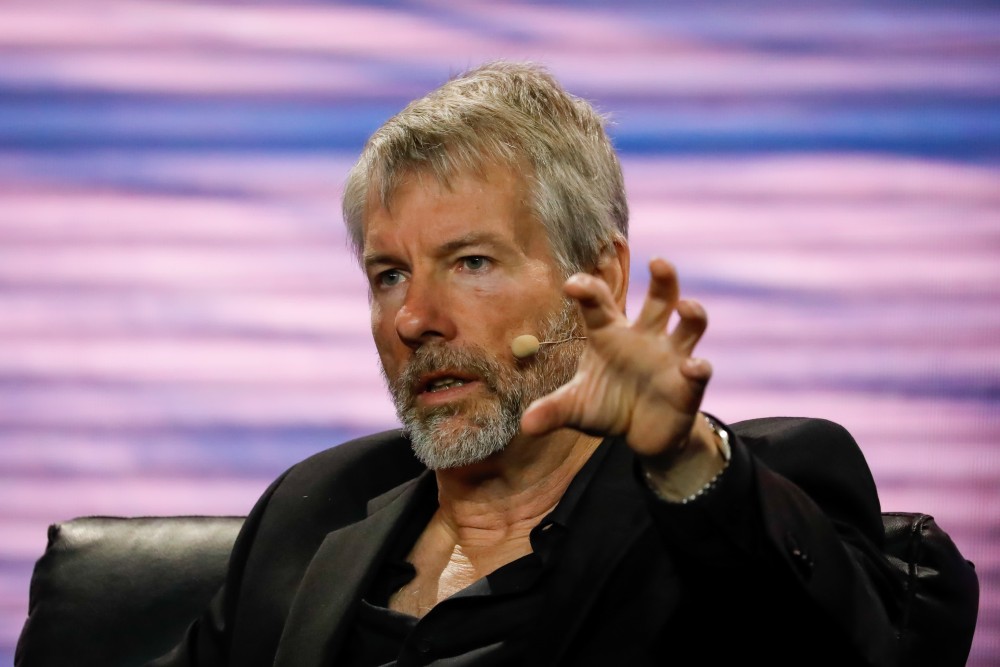

Since the invention of Bitcoin in 2009, many people have confidently invested in the cryptocurrency, while some doubt its genuity. On the other hand, Michael Saylor, founder of business intelligence software company MicroStrategy, has become one of Bitcoin’s biggest proponents.

Michael Saylor exhibited his complete confidence in Bitcoin on 11th August 2020 when the company purchased 21,454 bitcoins worth $250 million at an average price of $11,653 per bitcoin. At the same time, MicroStrategy adopted Bitcoin as its primary treasury reserve asset.

In a press release from MicroStrategy on that day, Michael Saylor said: “Our investment in Bitcoin is part of our new capital allocation strategy, which seeks to maximize long-term value for our shareholders,” He further expressed much belief in Bitcoin as indicated in the report. With this purchase, MicroStrategy became the first publicly traded company to invest in cryptocurrency.

Furthermore, in September 2020, MicroStrategy spent $175 million to acquire 16,796 bitcoins at an average price of $10,419 per bitcoin. Three months later, in December 2020, MicroStrategy purchased 2,574 bitcoins for $50 million at the rate of $19,472 for each bitcoin.

MicroStrategy’s Continuous Bitcoin Optimism

Since their first purchase, MicroStrategy continues to invest in Bitcoin, not minding the bull or bear market. This was evident in April 2021 when the company purchased 491 bitcoins for $59,289 per BTC, also in December 2022, they acquired 810 bitcoins for $16,790 for each BTC.

Explaining why he is so bullish and confident in Bitcoin, Michael Saylor shared the below tweet on 12th September 2020.

#Bitcoin is a swarm of cyber hornets serving the goddess of wisdom, feeding on the fire of truth, exponentially growing ever smarter, faster, and stronger behind a wall of encrypted energy.

— Michael Saylor⚡️ (@saylor) September 18, 2020

The post remained pinned on his personal Twitter account to this day.

Michael Saylor Makes Bitcoin Core for MicroStrategy’s Business

In August 2022, Saylor stepped down as CEO of MicroStrategy to become the company’s Executive chairman to focus more on the company’s Bitcoin acquisition strategy. He said at the time, “As executive chairman, I will be able to focus more on our bitcoin acquisition strategy and related bitcoin advocacy initiatives.”

As of December 2023, MicroStrategy has a total of 189,150 bitcoins which was acquired for approximately $5.9 billion. Currently, amounting to approximately $8.1 billion.

MicroStrategy’s investment in Bitcoin surely has increased the general confidence of many other investors, leading many other companies to adopt Bitcoin as a treasure reserve asset.

Judging by Michael Saylors’ optimism about Bitcoin, no doubt the company will continue to invest in Bitcoin.