The past week was another memorable one for the entire crypto market as it closed a more than 10% increase. It opened at $1.84 trillion and closed above $2 trillion. A closer look at the chart reveals how the sector gradually picked up momentum as the session progressed.

The sector valuation crossed $2 trillion for the first time in the last 30 days on Thursday, which was widely anticipated due to the constant price most cryptocurrencies experienced at the time. Nonetheless, the most interesting day was Sunday, when most cryptocurrencies enjoyed massive hikes, adding to the gains over the seven-day period.

Following WAVES performance two weeks ago, there was several bullish speculation as to how it will perform over the next seven days. However, these projections failed as WAVES lost more than 5% and was the top loser.

There were notable strong fundamentals over the last seven days especially on Zilliqa (ZIL). The coin was enjoying a 5%-10% increase or decrease until the announcement of a partnership with Agora, and it surged by 100% at the following day. It ended the seven-day timeframe with a more than 150% increase.

The Crypto Fear and Greed Index also saw improvements as we observed that it is currently at 49 (neutral) has opposed to fear some weeks back. It peaked at 51 during the previous intraday session.

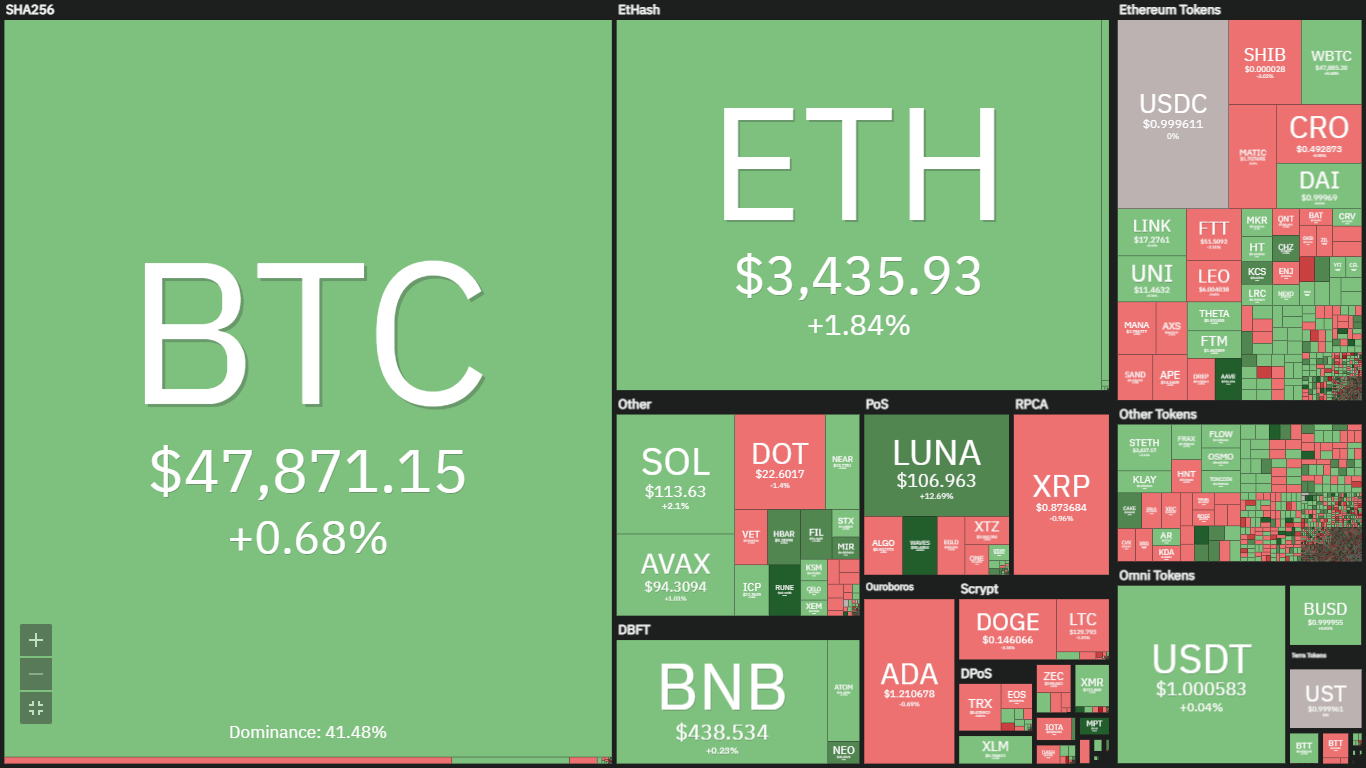

(Source: Coin360)

Currently, the previous sentiment seems to be dying. The image below further expresses the current state of the market. ApeCoin leads the losers with amore than 6% decrease. Will this continue for long?

Market fundamentals as of the time of writing hint at a possible price increase across the sector. One such indication is that MacroStrategy, a subsidiary of publicly-traded company MicroStrategy, has obtained a $205 million loan term to purchase more bitcoin. Blockchain ecosystem Terra has also been gobbling up BTC to back its controversial UST stablecoin.

If the purchases are enough to spark a continued market increase, which coins will benefit?

Top Five Cryptocurrencies to Watch This Week

1. Bitcoin (BTC)

Last week, Bitcoin opened trading at $41,293 but failed to impress as it lost a few percent on the first day. It dipped as low as $40,516 during this period and closed a little above $41,000.

However, Tuesday was different as we observed that the top coin started an uptrend that saw it gain a little above 3% and hit a high of $43,337. The next four days were marked by minimal price increases.

Bitcoin saw its biggest surge on Sunday as it hiked by more than 5% and flipped the $46k resistance for the first time in 30 days. It also made an attempt at the $47k resistance but failed as it was met by retracement at $46,750.

The hikes resulted in the top coin flipping its pivot point, hence suggesting that the it is bullish. We also observed that the most recent price increase has resulted in the apex coin edging closer to its first pivot resistance.

The Moving Average Convergence Divergence (MACD) also supports the previous reading as we note that both lines are above 0 and are gaining more stability above the mark. The histogram associated with the indicator shows the constant increase in buying pressure over the last seven days.

BTC is currently enjoying small hikes that have resulted in the Relative Strength Index surging above surging closer to 70. We may see the apex coin step out of this boundary and become overbought if the current momentum is maintained.

Additionally, the largest coin by market cap is trading above $47,000. If this trend continues, it may flip the $48,50o resistance over the next six days.

2. Ethereum (ETH)

The candle that represented last week Monday was an inverted hammer. This candlestick pattern indicated the end of a downtrend, which proved true during the previous intraweek session.

Although the session ended with ETH recording very little gain, it was the start of a new uptrend. The next day offered more in terms of price increase as the largest alt tested the $3k resistance and flipped it but failed to gain stability above the mark.

The said level succumbed to bullish pressure the next days as the coin achieved a close above $3,000. The hike continued over the next three days with little pause. However, the biggest gain came during the final intraday session that saw ether gain almost 5%.

Ethereum closed the period bullish as per the Pivot Point Standard. It flipped it pivot point. Like BTC, the Relative Strength Index edged closer to 70. MACD is also bullish as its histogram has been constantly on the rise over the last seven days. Additionally, both lines were above zero.

The previous intraweek session saw the largest alt trade very close the first pivot resistance. The most recent price suggests that the second largest coin has flipped the mark and is exchanging above it.

Unfortunately, ether is currently overbought and may retrace soon. Nonetheless, we will see an attempt at the $3,700 resistance. However, the impending retracement may send ETH as low as $3,200.

3. Cardano (ADA)

The previous seven-day period Cardano opened trading at $0.87, and saw a lot of bullish actions on the first day of the week. It hiked by more than 4% as it hit a high of $0.93. Following a bullish start to the week, ADA was bullish for most of the period.

The biggest break came on Wednesday as the asset gained more than 13% during that session. Additionally, that marked the first time the seventh largest coin by crossed $1 since February 19.

The hikes continued over the weekend as ADA solidified it stay above $1 with a flip of the $1.1 resistance. It gained more than 7% during this period and hit a high of $1.18. It ended the week a more than 34% price change.

As per MACD, Cardano flipped bullish on Thursday as both lines steadied above 0. However, the Relative Strength Index (RSI) was a source of concern to the bulls as the digital asset under consideration was overbought. Nonetheless, ADA closed above its pivot point and edged closer to testing the first pivot resistance.

The coin has shown signs of continuing its price growth this week but has been met by sellers’ congestion. This was in response to the pair being overbought. After the retracement, we see may the seventh largest coin by market cap attempt flipping the $1.3 resistance.

4. Terra (LUNA)

It was established that LUNA had a bearish divergence last week. The bulls struggled to keep the coin afloat and succeeded as it closed with little gain. However, the effect of this signal is still felt over the last seven days.

Nonetheless, buyers pushed back with a very strong need for pressure as Terra kicked off the previous intraweek session very strongly. It closed the period with a more than 5% increase and hit a high of $97.

Terra was mostly bullish last week but recorded its biggest loss on Friday as it dipped by almost 4%. A closer look at the chart reveals that the asset saw three days of retracement that almost wiped out the first intraday session gains. However, the last 24 hours session saw it gain almost 4%.

LUNA closed the previous intraweek session with an almost 4% increase. We observed that the eighth largest digital asset saw a gradual hike in RSI amid the price fluctuation. It also experienced more improvement on the Moving Average Convergence Divergence (MACD).

Terra seems to be back on the bullish path, as it has been up by almost 9% over the last 18 hours. MACD’s histogram is printing bullish signals as we observe an increase in buying pressure that may play a vital role over the next six days. An increase in demand concentration will result in bullish convergence within the next six days.

Additionally, LUNA will experience a bullish divergence soon, which makes it a worthy candidate for the list of cryptocurrencies to watch.

5. Waves (WAVES)

In the last two weeks, Waves closed in profit – making it the fourth week of consecutive gains. We noticed the bulls build on the bullish signal from the Moving Average Convergence Divergence (MACD).

Additionally, it gained stability above its DMA and its third pivot resistance. However, the 38th largest cryptocurrency was not off to a good start as the first day of the intraweek session was marked by Doji.

WAVES flipped the $32 resistance but relinquished the level as market sentiments changed. Nonetheless, it has regained composure and closed above the mark. The previous seven-day session was different as the asset failed to surge.

This is indicated by the several dojis that were seen on the chart. Additionally, the coin had a bearish divergence that left the bulls struggling to hold the it above $30. Has the situation changed?

WAVES is one of the biggest gainers in the market. It kicked off the week strong as it gained 33% on the first day. Currently up by more than 13%, we may conclude that WAVES will continue its uptrend.

Additionally, it is set to see a bullish divergence which may be the final proof of a volatility-filled intraweek session.

Conclusion

This article highlighted five cryptocurrencies to watch this week. The above predictions coming true largely depend on market conditions remaining relatively stable for most parts of the next seven days, which of course is not guaranteed. The volatile nature of the crypto space means investors and traders must do their own research and always keep an eye on the charts

Find Cryptocurrencies to Watch and Read Crypto News on the Go Follow CryptosToWatch on X (Twitter) Now