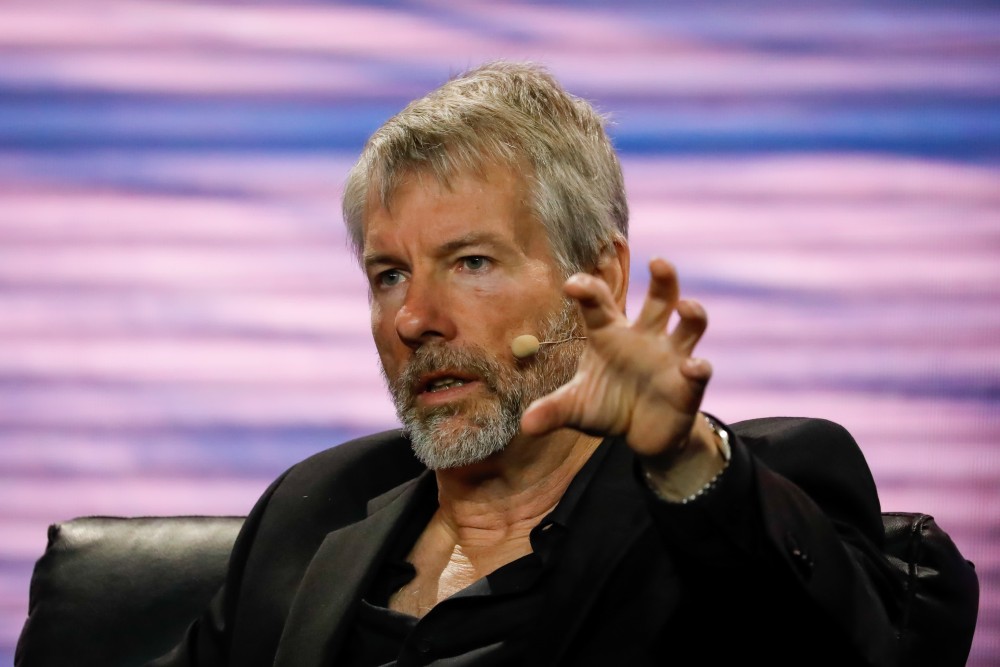

Publicly traded business intelligence company MicroStrategy, led by Michael Saylor, has revealed its intention to launch a whopping $700 million aggregate principal amount of convertible notes to qualified institutional investors. The company’s latest announcement follows the latest U.S. Securities Exchange Commission (SEC) amendment of Rule 144A under the Securities Act of 1933.

MicroStrategy to Acquire More BTC with Notes

MicroStrategy’s latest announcement shows the company’s plan to use funds from the convertible notes to redeem all $500 million outstanding principal amount of its senior secure notes while using the remaining amount to boost its bitcoin stack and settle other general corporate duties.

The business intelligence firm is introducing a flexible offering structure for its latest note issuance to cater to the diverse needs of many institutional investors. This structure provides early-bird purchasers with a range of attractive options. One of these options allows institutions to secure notes within a limited 13-day window starting on the issuance date.

The notes will bear interest, paid semi-annually on March 15 and September 15 of every year, and mature by 2028. However, MicroStrategy may redeem all or some portions of the notes for cash before the maturity date.

The company will only sell its convertible notes to investors believed to be qualified institutional buyers under the latest Securities Act of 1933. As noted by the company, any offer of the notes will be made only using a “private offering Memorandum.” This means that the sale of MicroStrategy’s notes and stocks will not be registered under the securities laws.

MicroStrategy Set Bitcoin Adoption Pace

MicroStrategy has gained popularity in the crypto industry for being the first public company to invest in BTC in the United States. Since 2020, the business intelligence company has not paused its bitcoin acquisition spree. Currently, the firm holds 244,800 BTC worth more than $14 billion.

Saylor, the company’s crypto-enthusiastic chairman, recently revealed that he owns over $1 billion in bitcoin and has not stopped adding more BTC to his stack.

Following MicroStrategy’s footsteps are Japanese company Metaplanet, which adopted Bitcoin as its primary reserve asset earlier this year, Marathon Digital, Bitcoin Miner Cathedra, which has suspended its Bitcoin mining to focus on acquiring the crypto from the open market, and a few other publicly traded companies across the globe.

Find Cryptocurrencies to Watch and Read Crypto News on the Go Follow CryptosToWatch on X (Twitter) Now