Following a massive surge in the price of cryptocurrencies on the last day of the previous month, the bulls were convinced of a perfect start to the new 30-day period. The sector under consideration started February at $1.7 trillion and peaked at $2 trillion during the first seven days.

Concluding the said period at $1.9 trillion, the industry closed with gains of more than 10%. The sector saw strong fundamentals during that timeframe that served as a boost to buyers.

The crypto industry saw a lot of adoptions during this period. American mobility service provider Uber has revealed that it may accept cryptocurrencies as payment in the future. Singapore’s largest bank DBS Bank with over $500 billion in total assets has revealed plans to extend its crypto trading services to retail investors.

In the most recent development, Jared Polis, Governor of the U.S. state of Colorado, has confirmed that the state will soon start accepting cryptocurrencies for tax payments. We may expect a continuation of the increase in usecases over the next 30 days.

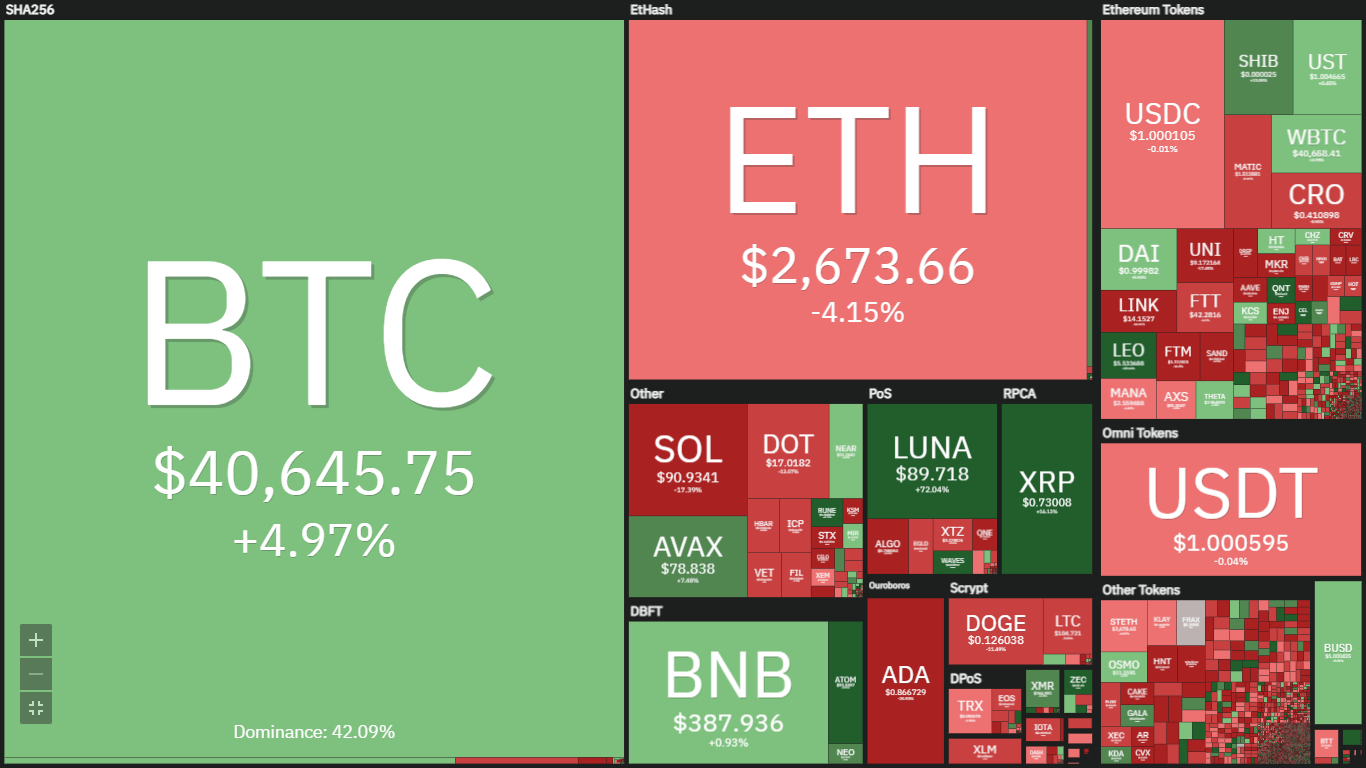

The image below shows how some cryptocurrencies fared during the past month. The top gainer over the period under consideration is Anchor Protocol (ANC) as it surged by more than 160%.

(Source: Coin360)

With February over, traders are looking forward to what the next 28 days hold.

Top Five Cryptocurrencies to Watch (March 22)

1. Bitcoin (BTC)

The past month kicked off with so much positivity that many assert the coin will exceed $48k and possibly hit $50k. Unfortunately, these projections failed as the largest digital asset hit a high of $45,850 and a low of $32,324.

BTC opened the past 30 days at $38,483 but closed at $43,178 – an indication that the top cryptocurrency gained 12% during this period. We note that although bitcoin was mostly bearish, the accumulated gains at the start and end of the month filled the gap.

How will crypto’s firstborn perform over the next 27 days? According to previous records, the third month of the year is known as the “almost average month.” One of the reasons for this conclusion is the amount of bearish dominance the asset under consideration have seen during that timeframe.

The highest the apex coin gained during this period under consideration is 195.1% while lost 45.9% – the highest loss. We also observed that of the eleven Marchs, only four came out positive as bitcoin recorded significant gains. However, the remaining seven saw BTC close with a few deficits.

On average, the largest coin by market cap increases by more than 2.1% every third month of the year. Looking at previous records, there may be uncertainty as to how March will turn for the coin.

How high will it surge in case of a surge? Bearing in mind that the third month of the year does not see a massive uptrend, we may expect a 2%-10% increase. In the event of a downtrend, we may expect the same figures.

With the previous statement in mind, the apex cryptocurrency may test $45k. However, bitcoin is at risk of dipping below $40k in the coming days as it may lose its momentum.

2. Ethereum (ETH)

Like Bitcoin, ETH started the previous month with high momentum and also closed on the same note. A positive start to the period under consideration saw many bullish predictions.

One of these speculations was that the second largest asset may retest the $3,500 resistance. However, ether reached a high of $3,284 – a reminder that the prediction failed. The coin saw a low of $2,300.

The largest alt opened at $2,689 and closed at $2,923. The distance between the open and the close indicates that the asset under consideration gained more than 8%. How will ETH perform over the next 27 days?

Using the monthly heatmap, we deduced that March is the list performing period for ether. This is due to the bearish dominance the asset under consideration have seen during that timeframe.

The highest the second largest cryptocurrency gained during the period under consideration is 219.6% while it lost 53.7% – the highest loss. We also observed that of the six Marchs, three came out positive as ether recorded significant gains.

However, the remaining seven saw ETH close with deficits. On average, the largest alt gains more than 14% every third month of the year. It is hard to accurately predict how the asset under consideration will perform this March.

However, previous records suggests that ETH may experience lower trading volumes compared to February. How high will it go in case of a surge? Bearing in mind that the third month of the year does not see a massive uptrend, we may expect a 5%-10% increase. In the event of a downtrend, we may expect the same figures.

The ascertion above eliminates any possible speculations of ETH testing $3,500. However, ether is still at risk of dipping as low as $2,200.

3. Terra (LUNA)

January was 0ne of the most unprofitable for Terra, as it lost more than 38% during that time. The past month offered more relief from the bad start to the year. The asset kicked off trading at $52 and closed at $91.

The coin no doubt gained almost 76% and hit a high of $95 and a low $46. The bulls wanted a spillover from that period to the current 30-day timeframe and seemed to have their way as they continually deter any threat to the $80 support.

Will this mark continue to hold? The price level under consideration is considered a fragile one as there have been no buyers’ concentration at the mark. This means that a little selling pressure could see this support flip.

Additionally, the $80 mark is not a strong resistance as it will break once the needed pressure is applied. How will the coin perform this month? Although not a strong level, the said point is considered a barrier between the bears and the bulls.

Once the support under consideration flips, we may expect a retest of the $70 support with LUNA at risk of further downtrend. However, maintaining above $80 could open the way to test $100.

4. Fantom (FTM)

Like the preceding token, FTM has shown a lot of volatility and may be considered one of the most volatile altcoin. The asset performance over the past two months affirmed the previous statement as Fantom saw much price movement but failed to record this input or output at the end of the trading session.

January saw it lose 9.17% but reached a high of $3.3 and a low of $1.7. The downtrend continued into the previous month as the token opened the session at $2 and closed at $1.78 – losing 12.8%. During this period, we noticed the $1.3 support had held out.

Will this mark continue to hold? The price level under consideration is considered a fragile one as there have been no buyers’ concentration at the mark. This means that a little selling pressure could see this support flip. Nonetheless, we observed that after $1.3 gives out, price lingers above $1.2

Additionally, the $1.3 mark is not a strong resistance as it will break once the needed pressure is applied. How will the coin perform this month? Although not a strong level, the said point is considered a barrier between the bears and the bulls.

Once the support under consideration flips, we may expect a retest of the $1.1 support with FTM at risk of further downtrend. However, maintaining above $1.5 could open the way to test $2.

5. Monero (XMR)

XMR is currently trading at $166. The Pivot Point Standard suggests that the asset is bullish. The most recent price trajectory suggests that the altcoin may test its pivot point. This is no surprise as Monero has been mostly bearish over the past 60 days.

January was 0ne of the most unprofitable for the token as it lost more than 35% during that time. The past month offered more relief from the bad start to the year. The asset kicked off trading at $146 and closed at $170.

The coin no doubt gained almost 15% and hit a high of $187 and a low $132. The bulls wanted a spillover from that period to the current 30-day timeframe and seemed to have their way as they continually deter any threat to the $130 support.

Will this mark continue to hold? The price level under consideration is considered a fragile one as there have been no buyers’ concentration at the mark. This means that a little selling pressure could see this support flip.

Additionally, the $130 mark is not a strong resistance as it will break once the needed pressure is applied. How will the coin perform this month? Although not a strong level, the said point is considered a barrier between the bears and the bulls.

Once the support under consideration flips, we may expect a retest of the $120 support with XMR at risk of further downtrend. However, maintaining above $150 could open the way to test $200. It is especially important for buyers to sustain the current price as price movement over the past two months has been on descending order.

Conclusion

This article highlighted five cryptocurrencies to watch this month. The above predictions coming true largely depend on market conditions remaining relatively stable for most parts of the next 27 days, which of course is not guaranteed. The volatile nature of the crypto space means investors and traders must do their own research and always keep an eye on the charts.

Find Cryptocurrencies to Watch and Read Crypto News on the Go Follow CryptosToWatch on X (Twitter) Now