Coinbase App Downloads Sees Decrease Ahead of Q1 Report

Publicly-traded cryptocurrency exchange Coinbase is expected to report its first quarter (Q1) earnings after the market closes on Thursday. The report might influence its share price and the general narrative surrounding the firm and crypto.

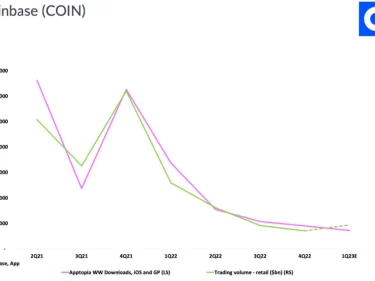

Nonetheless, a key indicator to suggest the progress of Coinbase suggests the results might turn out negative for the company’s investors. According to a research firm called Apptopia, which monitors metrics connected to app usage, the number of individuals downloading the Coinbase app continues to decrease even though crypto prices have considerably recovered.

Tom Grant, the vice president of Apptopia Research, made a presentation this week. During his presentation, Grant said his data portrays a more bleak picture for Coinbase than consensus expectations. He shared a chart that shows how the firm’s app download continues to decrease even as trading volume has slightly increased.

Notably, a download decline does not give complete insight into Coinbase’s performance. Given that the price of Bitcoin has doubled since last quarter and as volume bounced back, the company’s income from trading, which accounts for the most significant portion of its revenue by far likely, jumped considerably in Q1.

According to Grant, the Coinbase app saw a significant boost in the first two months of the year, then faced a considerable decline in March. This issue affected both power and casual users, constituting 20% of Coinbase’s customer base but accounting for 80% of the time spent on the app.

When Coinbase releases its earnings on Thursday, investors will speculate on its valuation by looking at volume trends. Investors will also learn how the firm plans to survive in an increasingly aggressive regulatory environment. They might look at how Coinbase’s revenue from USDC has been affected by the stablecoin’s drop in market cap.

According to analysts, Coinbase should report a first-quarter net loss of $329 million or $1.38 per share, compared with a $429 million loss or $1.98 a share in the same quarter a year ago.