The second-largest cryptocurrency, Ethereum, has seen positive upward price movements since Sunday, following weeks of decline. The altcoin king is in a relatively strong position. However, it is facing significant resistance and is approaching a critical support zone that could determine its next major move.

Ethereum rose to $2,500 a few hours ago, hitting an intraday high of $2,520, a figure it has struggled to reach in weeks. However, the price increase was accompanied by a corresponding rise in ETH exchange inflows. This caused increased selling congestion, ultimately resulting in the coin struggling to maintain its upward trajectory.

Data from Cryptoquant shows that 833k ETH was moved out of exchanges in the last 24 hours. Investors recorded a 931k ETH inflow in the same timeframe, surpassing the earlier outflow. The increased inflows created more selling pressure, which halted the ETH uptrend and led to a slight price decline below $2,400.

The derivatives market also tells a similar story. Data from Coinglass shows huge sell orders between $2500 and $2530 on the ETH/USD order book. The pressure from the orders around this critical mark meant that ETH was unlikely to sustain its bullish trajectory.

Data from Cryptoquant and Coinglass both indicate growing bearish sentiment towards Ethereum. On the 24-hour chart, momentum appears to be fading after earlier gains, hinting that bullish strength may be waning and the trend could be entering a decline phase. Additional data also suggests the asset is attracting less liquidity as trading volume experienced a slight drop today.

Ethereum experienced minimal price fluctuations over the past two days as buying interest gradually waned. The tensions in the Middle East further exacerbated the situation, and the market becoming increasingly dormant means there’s very little chance for an uptrend anytime soon.

Ethereum Long Surges

Despite the news, many investors, like Evan Luthra, remain confident in a price rally shortly. He tweeted a chart of ETH Accumulator Addresses Inflow on X. The chart showed a spike, indicating that the cryptocurrency had recently experienced a significant liquidity inflow.

Evan captioned the chart, “THE WHALES ARE HEAVILY BUYING $ETH! FADING ON ETHEREUM WILL BE THE BIGGEST MISTAKE YOU WILL MAKE THIS CYCLE!”. The comments were also bullish on the chart, with a commenter adding that whales were responsible for the spike and that they never buy for no reason.

Other metrics are also pointing to a potential rally. Santiment recently released a report suggesting traders were pulling Bitcoin and Ethereum in opposite directions. According to the report, traders were shorting BTC more in expectation of a pushback, while ETH saw more long positions.

Additionally, data from DeFiLlama shows that investors are choosing to withdraw their funds from ETH, as evidenced by the decline in its Total Value Locked. With fewer staked funds, they are instead choosing to take more risks with their assets.

News, however, implies that the coming days might be positive for Ethereum. On Thursday, Coinbase announced plans to launch a US-inspired perpetual futures style on its derivative platform. This is the platform’s first-ever attempt at recreating offshore perpetual contracts. The change might lead to an increase in buying action from the United States in the run-up to its eventual launch on July 21.

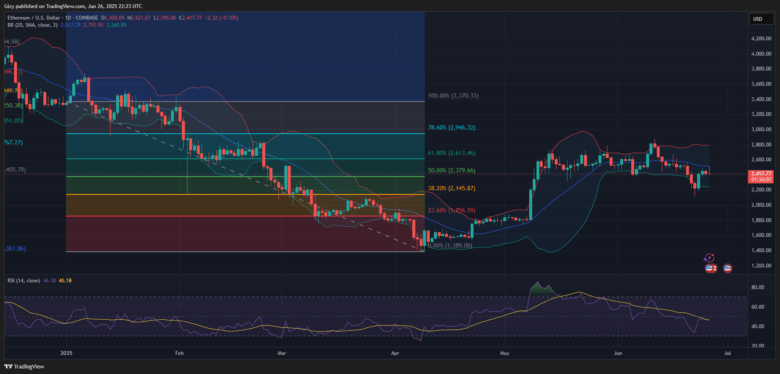

Despite the positives, the fact that Ethereum retested its key level, $2,380, three times is a cause for concern, especially among traders. Further analysis suggests the asset may reach $2500 and then pull back to 50% Fibonacci levels before having a chance at a future rebound.

Find Cryptocurrencies to Watch and Read Crypto News on the Go Follow CryptosToWatch on X (Twitter) Now