XRP climbed above several key levels last week, attaining levels it lost a few months ago. However, the new week is promising as the coin is off to a good start.

XRP will continue the uptrend over the next six days as trading conditions are favorable. The fear and greed index is at 71. Although significantly down from the 73 the previous day, the market still holds bullish sentiment.

However, major cryptocurrencies are seeing significant losses at the time of writing. The global cryptocurrency market cap is $3.29 trillion, losing over $5 billion in the last 24 hours. It is noteworthy that trading volume is rising amid the growing bearish sentiment.

The latest declines follow several positive fundamentals. News of lessening tariffs between China and the US, a drop in the price of pharmaceutical products, and a possible peace deal between Ukraine and Russia were some of the biggest stories in the last two days.

However, the trigger for the ongoing decline came after the Strategy announced that it acquired more Bitcoin. The trend of notable declines following such a purchase is gradually becoming constant.

Nonetheless, the market is yet to respond to other positive fundamentals. Will it react to them this week?

Top Five Cryptocurrencies to Watch

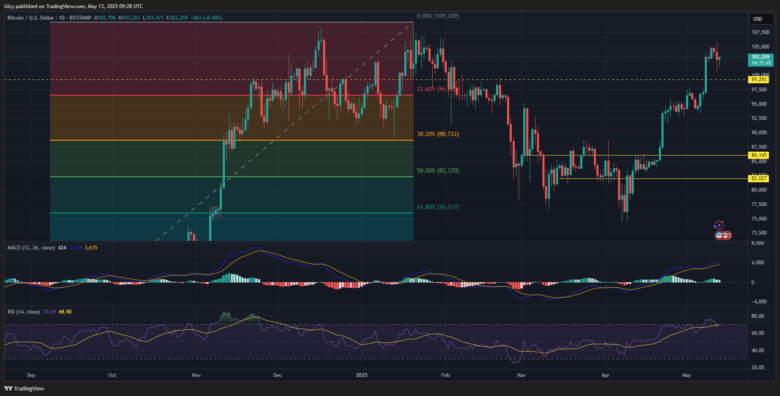

BTC/USD

Bitcoin was on the verge of breaking $106k on Monday but failed. After peaking at $105,706, it faced massive selling pressure. As a result, it retraced below its opening price and lost the $102k support. It rebounded at $100k but closed above the highlighted barrier.

Speculations that the asset may not surge anymore are gradually gaining a foothold. It is worth noting that the apex coin struggled to break above $105k for more than three days. Trading action after the flip suggests that BTC may not attain this mark.

The relative strength index was above 70 on Monday. However, it slipped below the mark as selling pressure spiked. A drop in such volume may continue throughout the week. Bitcoin may dip further as it lost the $102k barrier a few hours. The previous day’s low point to a possible slip below $100k within the next six days.

The moving average convergence divergence gives further reasons to anticipate more declines. Its 12-day EMA halted its uptrend and is currently edging closer to the 26-day EMA. The ongoing trend is a bearish convergence, which may signal further downtrends.

Conversely, fundamentals may alter this prediction, causing the apex coin to surge.

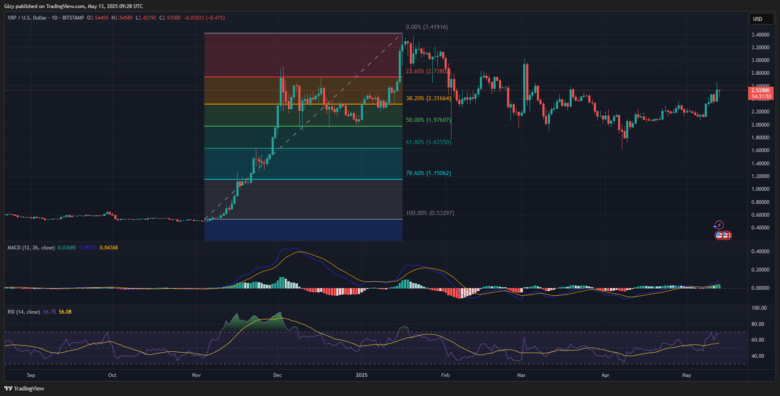

XRP/USD

XRP was off to a good start on Monday, gaining over 7%. It opened trading at $2.36 and surged to a high of $2.65. However, it lost momentum and retraced to a close at $2.54. The asset succumbed to the growing bearish sentiment across the market.

At the time of writing, the altcoin is seeing notable declines. It dipped to a low of $2.42 a few hours ago but rebounded and now trades at $2.50. While the current price shows notable recovery, XRP risks further descent.

RSI shows that the asset is seeing notable selling pressure. The metric dipped from 67 to 64 as the selling congestion intensified. If the selling trend continues, the cryptocurrency may slip further. Its short-term support at $2.36 may not hold this week. It risks dipping to the $2.20 barrier.

However, MACD remains positive at the time of writing. It indicates that XRP may recover and retest the $2.70 resistance again.

SUI/USD

Sui was on the verge of breaking the $4.30 resistance on Monday but failed. Nonetheless, it surged to its highest value since January, peaking at $4.29. It experienced a drop in momentum, resulting in a massive decline that sent prices to a low of $3.81. Although it rebounded, it closed with a red candle. It continues Sunday’s trend of price decline. It lost almost 3% during the session.

The downtrend is ongoing, as the asset dipped to the previous day’s low. At the time of writing, indicators print sell signals. The moving average convergence divergence shows the 12-day EMA very close to the 26-day EMA. If trading conditions remain the same, a crossing may occur in the coming hour, signaling further declines.

The relative strength index showed that the asset was overbought a few days ago. The ongoing downtrend is the correction the coin needs. Both metrics suggest that SUI may experience further price declines in the coming days. It slip below $3.60 after losing the $3.80 support.

WIF/USD

Dogwifhat is going through another cooldown following its massive increase on Monday. The token surged from $0.91, breaking the $1 mark for the first time since February. It continued upwards, breaking $1.20 and peaking at $1.32. After peaking, the asset saw massive selling pressure, sending prices to a close at $1.14.

The over 26% increase it had on the first day if the week may be fizzling out WIF dipped to a low of $1.05. It rebounded and trades close to its opening price. Nonetheless, indicators point to an impending downtrend.

The RSI surged above 70 last Friday and has since remained above the mark, indicating that the token is overbought. The asset may experience a shift in volume that may see the bears more active. Dogwifhat may dip below $1 if trading conditions worsen.

Nonetheless, MACD points to a possible continuation of the uptrend. If this happens, it may surge above $1.50.

BSV/USD

Bitcoin SV is seeing further price declines. The one-day chart shows that the downtren started on Sunday with a more than 6% decline. It continued the trend on Monday, dipping from a high of $42.8 to $38.4. Although it recovered, it closed with losses exceeding 2%.

The asset is off to another breaking satrt as it retraced to a low of $38 a few hours ago. It recovered and trades at $39.5 but remains down by over 2%. Indicators offer reasons to anticipate further downtrends.

The moving average convergence divergence shows the 12-day EMA very close to the 26-day EMA. If trading conditions remain the same, a crossing may take place in the coming hour, signaling further declines.

The relative strength index showed that the asset was overbought a few days ago. The ongoing downtrend is the correction the coin needs. BSV may dip to $35 this week if trading conditions remain unchanged.

Find Cryptocurrencies to Watch and Read Crypto News on the Go Follow CryptosToWatch on X (Twitter) Now