After two days of constant price decline, Bitcoin Cash is almost at the verge of printing its first green candle. This indicates a good sign as it shows an early sign of it bouncing back. Though it has not yet recorded any significant increase, the new candle displayed raises hope among the traders as this implies an increased interest from Investors.

It is important to note that in the last month, the calls for the beginning of the altcoin season have reached their lowest level. The inability of BTC to increase even after breaking above $123k is a result of the speculation that the alt season has begun.

There are other indicators, like last week, the CoinMarketCap Altcoin Season Index climbed to a high of 43. Nonetheless, as at the time of writing, it has recently gone down to 36, showing an increased doubt about the arrival of the alt season.

Bitcoin’s consolidation is the most significant trigger for the call of the alt season. Many other top altcoins over the last week have recently been experiencing notable selling pressure.

In more than a month, Ethereum is printing its first red candle for this week after five green candles. The coin began trading this week at $3,873, and it climbed to a top of $3,941 before it dropped to a low of $3,715.

The coin has risen to around the $3,804 mark under high selling pressure. If it ends around this level, it would show the second straight week of stagnation.

With the alt-market cap dwindling, most assets are declining. Nevertheless, some coins are experiencing the light that may trigger an increase in the coming days. Let’s take a look at them.

Top Five Altcoins

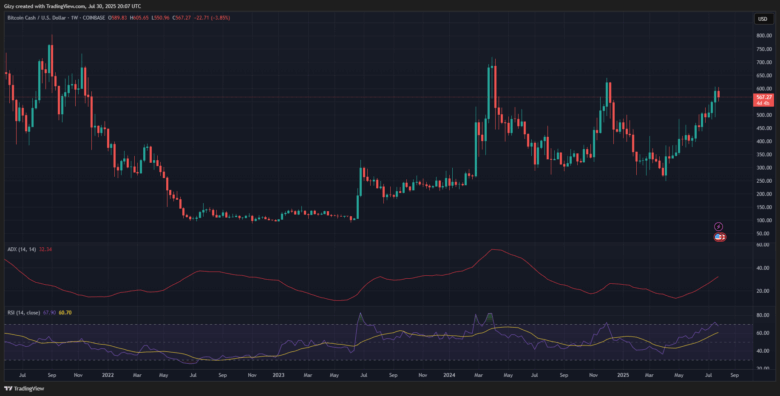

Bitcoin Cash

BCH has endured an intense selling pressure as it slipped on Monday from $0.145 to $0.137, followed by a 4% loss. It began the day at the rate of $589, then had a little increase in its buying pressure when it hit a peak of $605.

Then on Tuesday, the token began at a rate of $0.138 and then increased to $0.150 before correcting a little and finally closing at $0.145, making a profit of more than 5%. Nonetheless, the coin declined as the selling pressure became intense and hit a low of $569.

It later had a closing price of $572. However, Bitcoin Cash bounced back after it retraced to a low of $550. The seven-day chart implies that the newest green candle is likely to be the beginning of future price movements.

The ADX is yet to react to the recent drop in price. If the indicator remains positive and Bitcoin Cash fully recovers, then the bulls will look to push the asset to a high of $640.

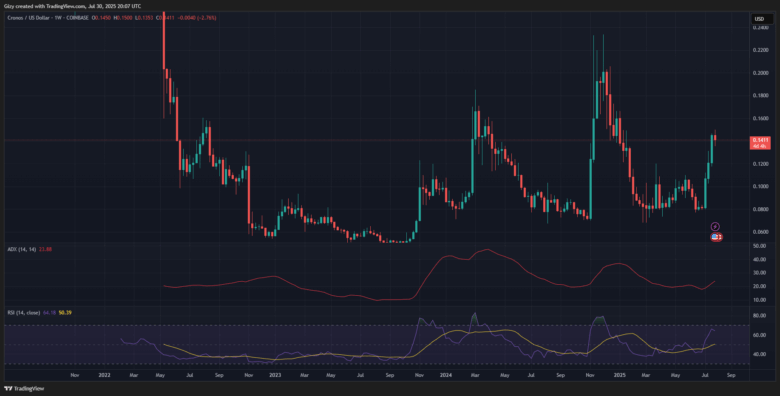

Cronos

On Monday, Cronos experienced significant selling pressure as it began the day with its price at $0.145 but later on hit a high of $0.149, showing a slight disparity between the starting price and the peak of the day. Also, as the price went down to $0.137, it declined the most. Cronus closed the day with a 4% loss.

However, Tuesday had a turn as it promised a little increase, as buying pressure increased. It began its trade at $0.138 but for the first time this week, it increased to a high of $0.1500. Though it went down to a low of $0.135, the asset bounced back and ended the trades at $0.145. It saw a gain of over 5%, closing the day on a positive note.

The seven-day chart suggests that the bulls are making an effort to retrace after the coin pulled back a few minutes ago. The relative strength index is 62 amidst the three-week increase, showing room for further growth. In addition, the average directional index is on the rise, showing that the buyers are maintaining significant pressure. The chart implies that Cronos’s following price action will send it nearer to $0.18.

Ethena

Ethena hit a peak at $0.643 after beginning at $0.633 on Tuesday. The selling pressure mounted and brought Ethena to a low of $0.555; it then bounced back and ended at $0.570. A significant drop was noticed with a 9% loss, indicating a notable selling pressure.

Monday, on the other hand, did not do any better, as a 5% loss was recorded. The asset hit a peak of $0.700, which was an uptrend from the starting price of $0.669. ENA experienced a drop as the selling pressure heightened, declining to a low of $0.625, then retraced and ended at $0.633.

Just like Bitcoin Cash, Ethena’s ADX remains on the uptrend despite a more than 14% drop since the beginning of the week. The indicator shows the strength of price moves, and its current reading implies that the uptrend is still strong and that the coin will continue its upward movement. The seven-day points at the coin breaking above $0.70 and increasing to a high of $0.85.

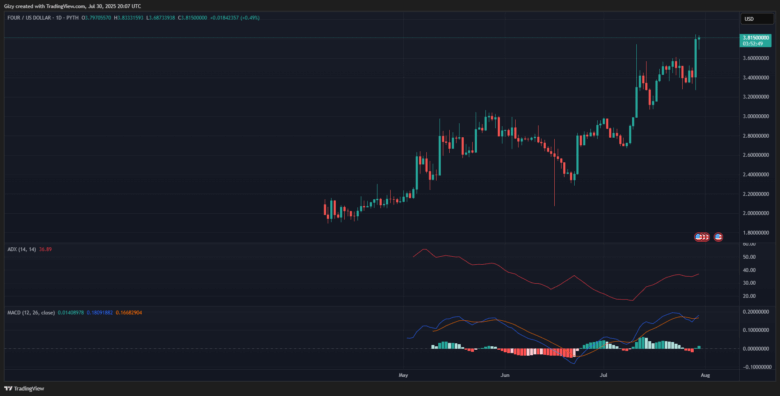

FORM

FORM’s seven-day chart shows that it has recently seen an increase in its buying pressure. The asset’s starting price is $3.47, rising to a peak of $3.84. So far, a 9% gain has been registered, and though the price rebounded to $3.271, buying pressure continues to increase, with the price recently trading at $3.788.

It is important to note that the coin is yet to show any indications of a looming decline. The 1-day chart suggests that the alt currently has a bullish divergence on the MACD. Furthermore, it is also worth noting that it recorded a new all-time high recently.

FORM in the days to come is likely to see a significant price consolidation and decline. Nonetheless, once it recovers, a recent all-time high is almost sure. It is expected to edge nearer to $5.

Conflux

CFX is just like the rest, experiencing an uptrend in price movement. The seven-day chart shows that so far, Conflux has seen a 10% increase in profit.

This week, the price started at $0.187 but dropped slightly to $0.181. It retraced and hit a peak at a high of $0.279. Nonetheless, after reaching the high, it rebounded and trades at $0.210.

It is crucial to note that, as pointed out in a past analysis, the trigger for the current surge is the Conflux Networks upgrade. The alt in the coming days is likely to edge closer to $0.32.

Find Cryptocurrencies to Watch and Read Crypto News on the Go Follow CryptosToWatch on X (Twitter) Now