United States: Page 2

Arizona Senate Committee Passes Strategic Bitcoin Reserve Bill

3 months ago

Senate Approves Pro-Crypto Scott Bessent as U.S. Treasury Secretary

3 months ago

Trump Signs Executive Order on Establishing Crypto Reserve

4 months ago

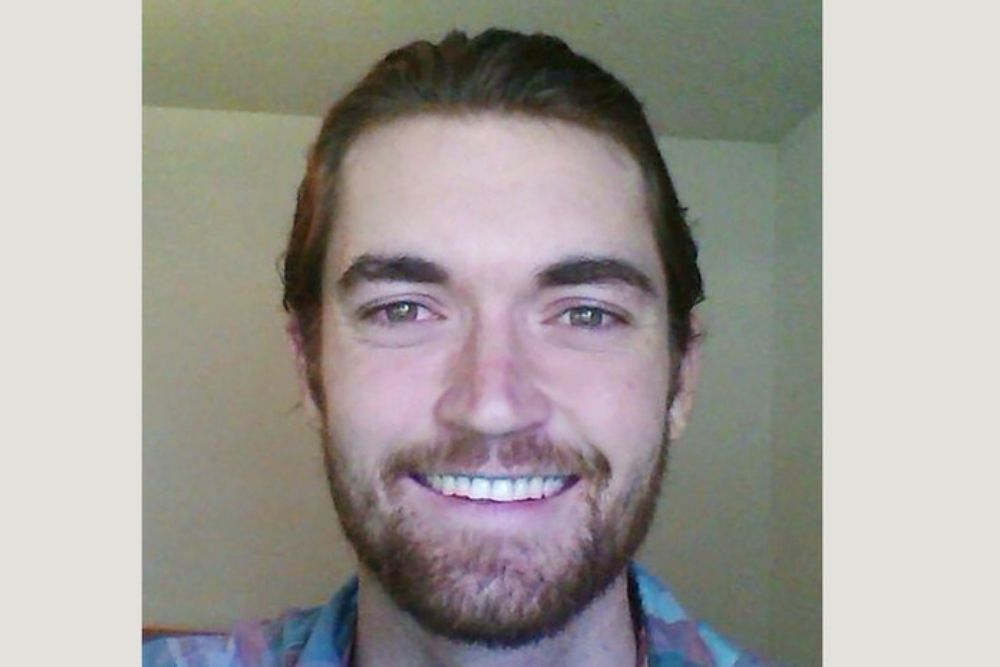

I’m Grateful to Have a Second Chance: Ross Ulbricht

4 months ago

President Trump Declares US as Future World Capital of AI and Crypto

4 months ago

U.S. Court Orders Reversal of Tornado Cash Sanctions

4 months ago

Trump Grants Pardon to Silk Road Founder Ross Ulbricht

4 months ago

Trump’s First 200 Executive Orders Includes Crypto: Bitcoin Magazine CEO

4 months ago

Oklahoma Senator Proposes Bitcoin Freedom Act to Enable BTC Payments

4 months ago

Ohio Lawmaker Proposes Bitcoin Reserve Bill to Enable State BTC Purchases

5 months ago

Cynthia Lummis Meets With Future Treasury Secretary to Discuss Strategic BTC Reserves

5 months ago

Ex-US Treasury Secretary Criticizes National Bitcoin Reserve as ‘Crazy’

5 months ago

Coinbase CEO Says US Govt Should Never Sell BTC, Amid Market Panic

5 months ago

Trump Appoints Former SEC Chair Clayton as U.S. Attorney for Manhattan

6 months ago

Pennsylvania House of Rep Wants to Hold Bitcoin as a Reserve Asset

6 months ago

FBI Raids Residence of Polymarket CEO Shayne Coplan

6 months ago

Florida CFO Pushes to Include Bitcoin in State Pension Funds

6 months ago

Brian Armstrong Says Next SEC Chair Should Apologise to Americans

6 months ago

DOJ Charges Crypto Exchange Operator with Money Laundering and Tax Crimes

6 months ago

VanEck’s Matthew Sigel: Bitcoin’s Bullish Setup Mirrors 2020’s Pre-Election Rally

6 months ago