BTC had another massive decline a few hours ago. It plunged lower after the previous day’s decline, hitting a low of $92k.

The entire crypto market bleeds as several assets register significant losses. The global cryptocurrency market cap $3.13 trillion from $3.36 trillion earlier on Friday. Traders’ fear further declined as the fear and greed index significantly dropped.

The sector under consideration saw a significant increase in trading volume over the last 24 hours. Price action suggests that a bulk of the volume are from investors taking profit. Exchange-traded funds registered significant losses, with outflows exceeding $732 million during the previous intraday session.

The crypto market suffers from a flurry of negative fundamentals. One of the biggest was the interest rate cut; it was lower than expected. The feds also forecasted possible inflation in January.

Tensions are rapidly increasing among nations as the Middle East boils over again. The Houthi rebels launched a barrage of attacks on Israel on Thursday, resulting in massive response. Russia today announced the declaration of war on its people. While many speculate the reason for such an announcement, the US president and vice hastily return to the White House.

Crypto’s top 10 see significant losses due to the several news. Let’s examine their current state.

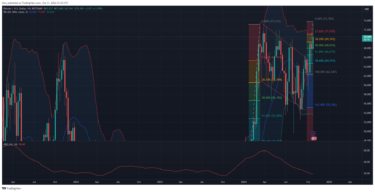

BTC/USD

The BTC/USD pair briefly dropped below a critical level due to the latest dip. Nonetheless, it rebounded and trades at $95,552. It returns above the 23% Fibonacci retracement, a vital support for the asset.

The bulls are yet to fully recover from the selloff as the relative strength index dips lower. It dropped from 54 to 46 in three days as downhill movement enters day three. The accumulation and distribution chart shows almost equal pressure from the bulls and bears as buyback begins.

Bollinger bands suggests an imminent surge as BTC fell below the lower SMA. A dip below this metric indicates the asset is experiencing massive selling volume. Reading from the A/D chart support claims of a possible uptick.

The BTC/USD pair may remain stuck between the $95k and $102k channel for the rest of the week. Further dip may result in a dip to below $90k, with lows set at $85k.

ETH/USD

The ETH/USD pair made a full recovery from its earlier dip. It retraced from a high of $3,500 to $3,095, its lowest value since the first week of November. It currently trades at its opening price following the rebound.

The accumulation and distribution chart point to an ongoing buyback attempt. The trial yields result as the currency pair erased all losses. RSI trends parallel, indicating equal pressure from both market players. Nonetheless, this is the first time in the last four days it halted its downtrend.

Bollinger bands predict that a surge may follow the rebound. The ETH/USD pair broke out from the bands, dipping below its lower band. Such price move hints at the asset seeing almost peak selling pressure.

The pair bounced off the 61% Fibonacci retracement level but trades closer to the 38% Fib at the time of writing. The 50% level remains one of the toughest levels and ETH may rebound off this mark again in the event of another dip. Nonetheless, it may range between $3,2250 and $3,700 before a breakout.

SOL/USD

The SOL/USD pair retraced to its lowest valuation since Nov. 6. It dropped to a low of $175 a few hours ago before rebounding. The downtrend enters day three, and the pair sank lower as the relative strength index nears the sub-30s.

The pair has been on the decline for most of December. Nonetheless, it edged closer to the 78% fib level before rebounding. RSI shows huge of possible declines below it. The accumulation and distribution chart shows ongoing buyback, and prices react accordingly.

Losing the 78% level may result in the pair slipping below $160. The Bollinger bands suggest an imminent surge as SOL fell below the lower SMA.

XRP/USD

The bollinger bands are closing in, indicating that the XRP/USD pair is less volatile than it previously did. Nonetheless, it dropped below the lower band earlier on Friday, briefly losing its $2 status after hitting a low of $1.95. Its rebound shows an ongoing buyback and bulls gearing up for a possible uptrend. This coincides with the assertion that a slip below the bollinger band will result in trajectory change.

The pair consolidated for most of December. Nonetheless, it edged closer to the 50% fib level before rebounding. RSI shows a huge possibility of declines below it. The accumulation and distribution chart shows ongoing buyback, and prices react accordingly.