Metaplanet, a Japanese investment firm, has acquired an additional 107.91 Bitcoin worth $6.9 million at an average price of $64,100 per BTC. The purchase brings the company’s total Bitcoin holdings to 506.74 BTC, worth about $32 million at the current price.

Notably, the latest purchase is just one of Metaplanet’s series of BTC acquisitions, with its first in April. To show its commitment to being crypto-focused, the company rebranded from Red Planet, a hospitality-centric entity, to a Web3 investment firm.

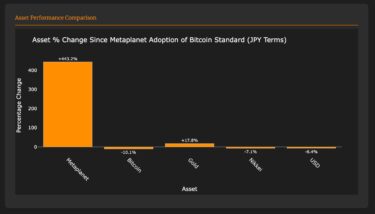

The news of the firm’s latest Bitcoin purchase has positively impacted its stock price, which jumped over 4%. This surge reflects investor confidence in the company’s strategy, which has led to a remarkable 495% increase in Metaplanet’s stock value year-to-date.

Why Metaplanet Keeps Acquiring Bitcoin

Metaplanet has adopted a bold “Bitcoin first, Bitcoin only” strategy, prioritizing Bitcoin over traditional assets like the yen to safeguard against inflation and economic uncertainty. This approach mirrors MicroStrategy’s playbook, which has utilized BTC as a hedge against currency devaluation.

Metaplanet’s approach centers on consistently acquiring Bitcoin, regardless of market volatility. The Asian MicroStrategy believes that by doing so, it will protect its investments and capitalize on Bitcoin’s expected future growth.

As one of Japan’s few publicly traded companies to embrace digital assets, Metaplanet is pioneering the country’s crypto market. Its bold strategy has already yielded positive results, with its stock price surging significantly. The firm’s Bitcoin acquisition approach may inspire other companies to follow suit.

Bitcoin Demand Surges

Recently, Bitcoin’s popularity has increased due to whale investors and large investment funds. This is because central banks in countries like the United States and Canada have lowered interest rates, making investing in Bitcoin more appealing.

In the last month, investment funds focused on Bitcoin, like BlackRock’s IBIT and Fidelity’s FBTC, have received around $2 billion. Companies like MicroStrategy are also investing more in Bitcoin.

This growing interest in Bitcoin shows that big investors and institutions are now considering it a legitimate investment option. As more people invest, Bitcoin becomes more accepted and attractive to others.