While the crypto community eagerly awaited Strategy’s usual Monday bitcoin (BTC) purchase announcement, the business intelligence firm did not report any BTC buys from the last business week. The last time Strategy ended a week without a BTC purchase was during the week of March 31 and April 6, around the end of Q1 2025.

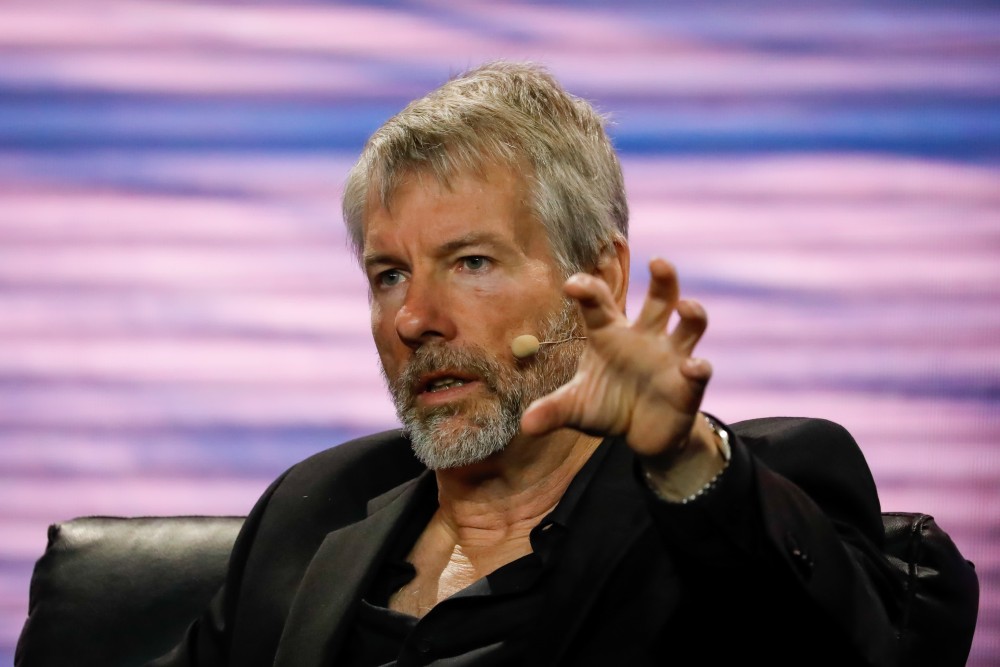

Although Strategy’s founder and chairman, Michael Saylor, posted the Saylor tracker on Sunday, which always serves as a signal for an acquisition notice on Monday, the firm did not announce any purchase, moving against general predictions.

Strategy Pauses BTC Buy Near Quarter-End

This marks the second time the firm pauses bitcoin shopping around quarter closing, sparking concerns in the crypto community on the reason why Strategy shies away from near-quarter-end BTC purchases.

Notably, before the firm pauses its BTC acquisition, it initiates a fundraising program in preparation for subsequent purchases. Concluding Q1, it had an ongoing $21 billion At The Moment (ATM) program, and today, it has revealed a $4.2 billion STRD offering.

Before its pause, the firm had purchased 149,140 BTC this year and holds 597,325 BTC in its reserve.

$4.2 Billion STRK Program

As revealed in the Strategy’s official release, it has entered into a sales agreement to issue shares of its 10.00% Series A Perpetual Stride Preferred Stock. It would be an ATM Program, allowing interested investors to grab the stocks at the current market price. Also, the program is flexible and does not have a fixed duration. Following its launch last year, Strategy’s STRD has experienced an 11% surge.

Commenting on the company’s plans for the to-be-raised $4.2 billion, the press release noted:

“Strategy intends to use the net proceeds from the ATM Program for general corporate purposes, including the acquisition of bitcoin and for working capital.”

$14B BTC Fair Value Gain

Concluding the second quarter of the year, the business intelligence firm has revealed $14 billion in bitcoin fair value profits, increasing the worth of its bitcoin bag to $64.36 billion. Notably, BTC saw about a 30% surge during the three months as it soared from around $82,000 to $108,000.

Meanwhile, BTC experienced a brief decline on Monday. After reaching $109,600 earlier in the day, it has plunged to $108,300.

Find Cryptocurrencies to Watch and Read Crypto News on the Go Follow CryptosToWatch on X (Twitter) Now