Solana opened Monday at $181 but slightly retraced to $178. It rebounded and surged above $190. The asset peaked at $199 but is currently trading lower at the time of writing.

The abrupt end to its bid at $200 shocked many, as they had expected the coin to surpass the mark. Nonetheless, SOL is up by over 8% over the last 21 hours.

The altcoin continues the bullish sentiment from the previous day, breaking above levels it lost in February. The latest increase thrilled many investors who took to X to express their excitement. While some celebrated, others were speculating about more surges.

SOL saw a massive 85% surge in trading volume in the last 24 hours. Other assets in its ecosystem are experiencing a similar trend. One of its top-performing tokens is the PENGU. It opened at $0.030 and then shot up after a slight decline, breaking above $0.040. Although the token trades lower than its high, it is up by over 15%.

Why is Solana up?

The coin is seeing massive institutional accumulation. DeFi Dev Corp recently announced that it added to its bag, buying an additional $19 million. Its latest purchase brings its total holding to 999,999, worth $194 million at the time of writing.

Another firm joined the frenzy, launching a new treasury strategy that includes Solana. Mercurity Fintech Holding Inc. announced a $200 million equity line of credit with Solana Venture Ltd to facilitate its new strategy.

The news from both companies indicates a growing belief in the long-term prospects of the asset. Investors caught on to this and added more units to their holdings.

Data from DeFiLlama indicates another reason for the latest price surge. Solana’s total locked value surged to an all-time high. The asset registered a previous ATH of 138.3 million SOL on Jun 22. It topped the figure on Monday, with TVL rising to 138.9 million SOL.

It’s worth noting that decentralized exchanges within the project registered notable volume over the last 24 hours.

Where Next?

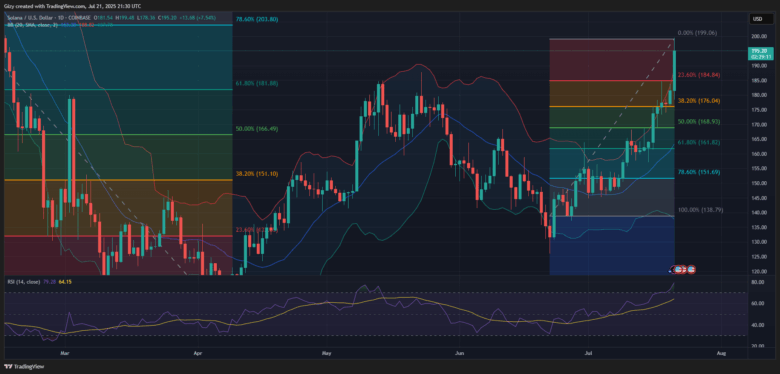

Solana has trended close to bollinger’s upper band since Jul 10. The trend traditionally indicates an impending trend reversal. However, the coin continued upward, defying the metric. The surge may be coming to an end as the entire crypto market loses momentum.

It is worth noting that this is the highest the coin has surged above the bollinger bands, increasing the likelihood of a massive retracement.

Additionally, the asset recently became overbought. The relative strength index broke above 70 on Friday and has since trended above it.

Previous price supports predictions of an impending retracement. Solana retraces experiencing a massive surge as it’s seeing. A repeat of this trend will result in notable corrections for the asset.

Nonetheless, the bollinger bands indicate a drop below $188. It is about the same level as the 23% fib level. Failure to defend the mark will see the altcoin plummet to the 38% fib level at $176.

The 4-hour chart reveals that the bulls are struggling to restart the uptick, with limited success. Nonetheless, indicators in this timeframe suggest notable demand concentration around $182. This might be the next level to watch.

Find Cryptocurrencies to Watch and Read Crypto News on the Go Follow CryptosToWatch on X (Twitter) Now