XRP experienced significant surges on Monday, breaking above critical levels. The bulls rallied the asset in a quick burst as trading conditions improved.

However, the altcoin is struggling to maintain the momentum and sees notable retracements at the time of writing. XRP is witnessing a surge in trading volume as it rebounds after a slight dip.

The global cryptocurrency market cap was not notably affected by the latest change trajectory. Nonetheless, there are indications that the bullish increases will continue. One such is the increase in the fear and greed index. The metric is at 52, which is its highest in two weeks.

On the other hand, most assets that experienced significant surges are seeing corrections. PENGU v over 29% on Saturday but grappled with selling pressure as it retraced almost 4% below its opening price. While it recovered, it may signify growing negative sentiment among investors.

Nonetheless, the week is kicking off with a mixed trend. Some cryptocurrencies are rising while others decline. Let’s examine some key levels to watch

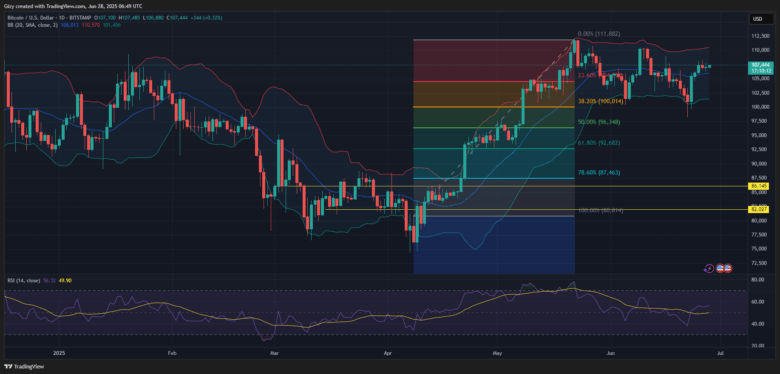

BTC/USD

On Sunday, BTC experienced a slight price improvement but was unable to sustain the uptick. On Monday, it dropped below $ 107,000 before slightly rebounding.

Bitcoin is likely to make fewer moves to fill the CME gap, which was created on Tuesday. And within the coming hours, it may retrace to $106,400.

Nonetheless, past price movements indicate that the coin is likely to experience a downward movement below $105k. This is because there is weak demand concentration, as well as a reduction in the relative strength index, resulting from the rise in selling pressure.

Regardless of that, it is still selling beyond the bollinger’s SMA, showing that there is a likelihood that the investors may cause a trend reversal. To guarantee a retest of $110k, Bitcoin must have $107k.

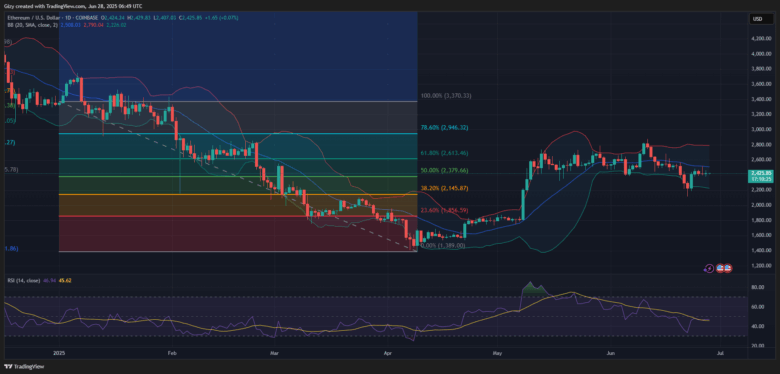

ETH/USD

On the four-hour chart, there is a looming breakout. Ethereum trades within a narrowing Bollinger Band. This trend began on Saturday, and as such, ETH is yet to break out. A trend change may occur within the next 48 hours; just a few hours ago, Ethereum experienced a surge beyond its Bollinger bands, yet it still trades below its middle band.

Both the Bollinger Bands and the MACD are displaying strong indicators, which may lead to a further downside movement and also indicate a potential retrace to $2,400.

The daily chart suggests a greater downturn, less than the highlighted mark. With Ethereum currently struggling to hold around $2,400 for the last week, the relative strength index is showing significant selling pressure. Nonetheless, the MACD on the daily chart indicates an upcoming bullish crossover. This is because the 12-day EMA is approaching the 26-day EMA, which would signal an early buy.

Ethereum is most likely to resume its uptrend, thereby breaking beyond $2,500, which is a positive MACD

The mark is losing its strength, increasing the likelihood of a drop to $2,380.

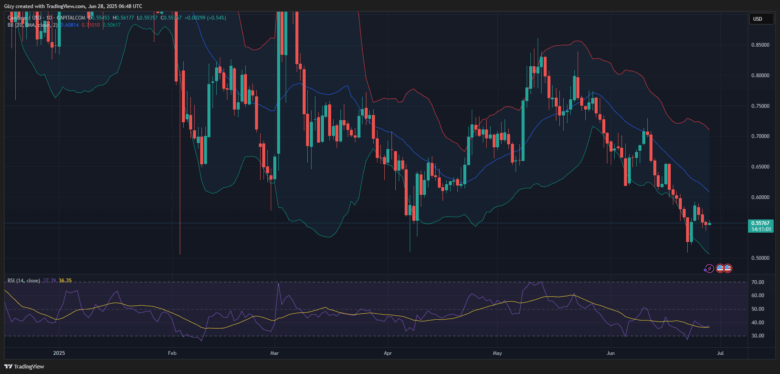

XRP/USD

On the four-chart, XRP is currently selling beyond Bollinger’s middle band. A few hours ago, it retraced after testing the SMA and is getting nearer to the upper band.

Following XRP’s rebound, MACD is printing a green signal. The recent bullish convergence indicates that the uptick is likely to continue.

However, the coin is currently selling at a delicate level, and this mark may lead to future declines.

Similarly, this applies to the 1-day chart. Efforts to decisively break the mark have all failed. Nevertheless, following a retest of the mark, XRP saw a significant downturn. And it may further decline to $2.10.

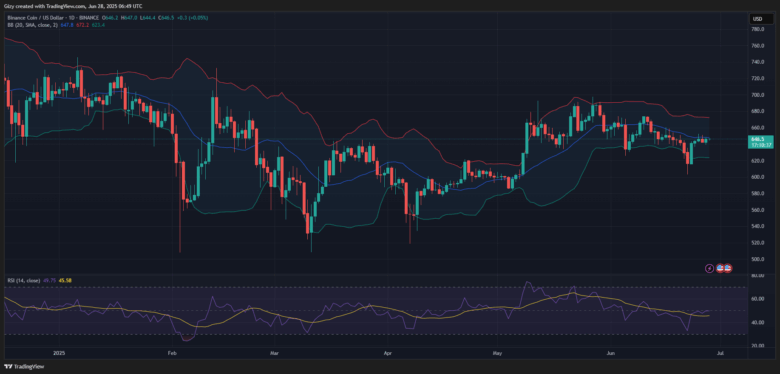

BNB/USD

At the time of writing, the 1-day chart indicates that Binance Coin is experiencing a slight surge. The coin is likely to maintain its four consecutive days of increase.

The coin is likely to continue moving upward as it sells beyond Bollinger’s middle band.

Nevertheless, BNB is getting to its fourteen-day high at $660. Historical price movements indicate that retracements may be possible. The coin will likely retrace to $640. On the other hand, flipping the mark will send BNB above $670.

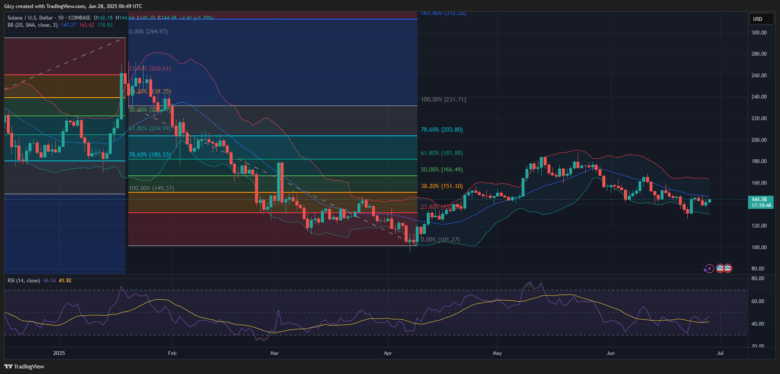

SOL/USD

Solana has seen a slight surge in the past 72 hours, thereby hitting beyond $160. The coin experienced selling congestion at $163, resulting in a significant price decline.

Solana is selling at $157, which is almost 3% higher than its opening price. In the coming days, the Bollinger band cautions of future decline. Just a few hours ago, the coin rebounded off $150, repeating the same pattern on Sunday. Investors must learn to defend the mark, as any future slip may send the coin as low as $140.

DOGE/USD

The largest meme coin, DOGE, is likely gearing up for another uptrend, as seen on the 4-hour chart. And just within a few hours, it has rebounded from $0.17 to $0.161.

DOGE has seen support and remains stable. It is currently selling beyond Bollinger’s middle band and eyes, resuming its uptick. The coin is likely to reclaim $0.17 in the coming hours, but it remains vulnerable to further decline. The MACD is indicating a possible decline.

Nonetheless, as the relative strength index rises, so does the trading volume. There is also the likelihood of continued upward movement, leading to further increases.

On the occasion of a trend reversal, the bands of the Bollinger are suggesting a slide to $0.157.

ADA/USD

ADA is gathering momentum for future increases to come. The moving average convergence divergence displays a bullish divergence that is likely to mark the beginning of another uptrend.

Trading activities happening on Monday may be the beginning as ADA sells over 2% beyond its opening price. It rose to a high of $0.58 but then declined, losing its value. The Moving Average Convergence Divergence’s reading indicates that the efforts at the mark are imminent. Cardano may continue to move upward and surpass $0.60.

The rising RSI suggests heightened optimism among traders. This will catalyze more future upticks.

Find Cryptocurrencies to Watch and Read Crypto News on the Go Follow CryptosToWatch on X (Twitter) Now