SOL is experiencing notable upside movement following its massive decline on Sunday. It edges closer to completely erasing the losses on Monday as the bulls staged a comeback.

The altcoin is experiencing a 14% increase in trading as it attracts investors seeking to acquire assets. SOL may see further increases if the momentum remains constant.

Other assets, such as FORM and Sonic, are seeing a similar increase. Four opened at $2.40 on Monday and surged to a high of $2.58. It remains close to its peak and may end the session with gains exceeding 6%.

Although Sonic is seeing a slight decline at the time of writing, it remains 6% higher than it started the day. It surged from $0.26 and peaked at $0.29.

The crypto market is slightly up, with trading volume increasing by over 24% as liquidity gradually floods the sector. However, traders remain on edge as they continue their risk-off strategy. The Crypto Fear and Greed Index is at 34 as uncertainty increases.

The conflict in the Middle East remains the main driver of the ongoing downtrend. There is no indication that the situation will improve in the near future. The top cryptocurrencies are largely volatile during this period. Let’s examine key levels to watch.

BTC/USD

The apex coin was off to a good start on Monday, hitting a high of $102,200. However, it lost momentum and may be on the verge of another massive selloff.

Bitcoin has yet to fully recover from the previous day’s loss. It dipped from $103,387 and broke the $100k support for the first time in almost two months. The largest coin has since recovered above the highlighted barrier but risks slipping below it again.

The previous drop below the mark suggests weakening demand concentration. If the bulls fail to hold prices above $102k, a retest of the $98k support may be imminent.

Nonetheless, a shift in fundamentals may cause the coin to halt its downtrend, leading to a surge above $103k. The Bollinger band hints at a further uptick, as the apex coin recently resumed trading after breaking. The metric suggests a potential retest of the SMA at $105,200.

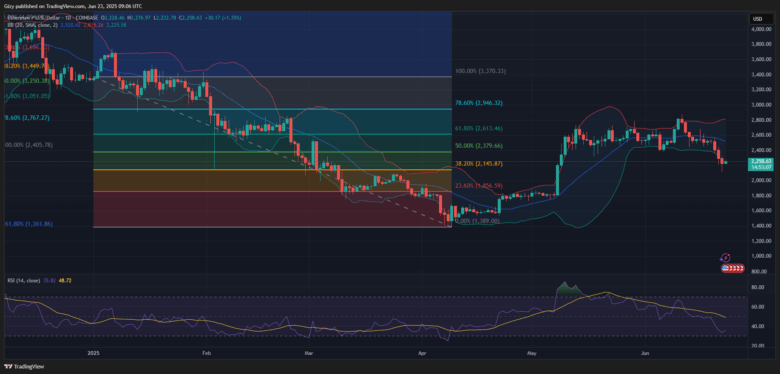

ETH/USD

Ethereum broke the $2,200 support on Sunday, dipping to a low of $2,113 before rebounding. The largest altcoin experienced notable buybacks but ended the session with losses exceeding 3%.

The bulls are struggling to sustain the buying pressure at the time of writing. They recorded small success as the asset peaked at $2,276 a few hours ago. However, it lost momentum and trades slightly above its opening price.

Previous price movements suggest that ETH risks plummeting below $2,200 again. The 2-hour chart shows a gradual rise in the selling volume, placing pressure on the highlighted support. Nonetheless, the coin may rebound at $2,100 as it did during the previous session.

Conversely, a slip below Bollinger’s lower band may indicate the end of a downtrend. This happened on Sunday. Ethereum could surge, edging closer to $2,400.

XRP/USD

XRP has yet to exhibit any significant change since the start of the day. It saw a slight uptick, causing it to peak at $2.03. However, it retraced following this price increase, dropping below $2 again. It trades at its opening price, hovering around the mark for the past four hours.

The 2-hour chart shows no impending change in trajectory, suggesting the asset may end the session with no significant improvements. Nonetheless, the altcoin’s retest of the $2 mark shows dwindling demand concentration around it. It risks slipping below the barrier again, retesting $1.90.

Conversely, XRP is trading above its bollinger’s lower band after reclaiming it a few hours ago. The indicator suggests that the asset may see further upside movement, pushing it above $2.10.

BNB/USD

Binance coin trades slightly higher than its opening price. The asset grapples with selling pressure as its trading volume declines by over 10%. The buyers may be losing this round as the asset trades lower than its peak.

BNB’s attempt at recovery is stalling due to a lack of needed momentum. The 2-hour chart indicates that the altcoin is experiencing a surge in selling volume. Failure to dispel this trend will result in the cryptocurrency plummeting. Previous price movements suggest another retest of the $600 support.

However, the bulls will look to reclaim $625 as it may serve as a launchpad for a return to $640.

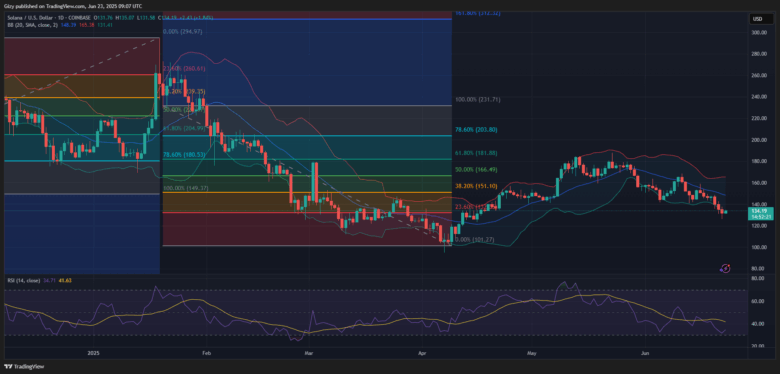

SOL/USD

SOL is seeing the same trend as BNB. It peaked at $137 a few hours ago, surging from $131. However, it experienced massive selling congestion, resulting in a gradual descent. The 2-hour chart indicates that the trend is unfolding as the relative strength index retraces.

With more price decline in sight, the altcoin may lose its accumulated gains. SOL may retest the $130 support after it loses $133. Previous price movements suggest that the altcoin may dip below the mark, hinting at a rebound at around $125.

Notably, SOL could potentially surge as it trades above a level with demand concentration. Trading actions on April 23 and 24 indicate that the altcoin may see further upward movement, potentially flipping to $140.

DOGE/USD

Dogecoin peaked at $0.156 as it faced stiff resistance to its bid to reclaim $0.16. The coin surged from $0.145 after a brief decline a few hours ago. It attempts to reclaim levels it lost on Sunday and may be yielding notable results as it trades 3% higher than its opening price.

However, like SOL, it is seeing a slight increase in selling pressure. Previous price movements suggest that it is trading above the critical level with demand concentration. Losing this mark will cause it to lose the $0.15 support, leading to a decline to $0.14.

Conversely, the memecoin may continue its uptick, flipping the $0.16 mark.

ADA/USD

Cardano plummeted from $0.566 to $0.50 on Sunday, ending the day with losses exceeding 7%. Recovery began shortly after and is ongoing, as the asset now trades more than 4% higher than its low.

The bulls are struggling to maintain the $0.54 mark, following a spike in selling volume at $0.55. They must continue to defend this mark, as failure to do so will lead to an almost inevitable retest of the $0.50 support level.

However, continuing the uptick will result in the asset reclaiming $0.60 in the coming days.

Find Cryptocurrencies to Watch and Read Crypto News on the Go Follow CryptosToWatch on X (Twitter) Now