DOGE is one of the biggest losers in the top 10. It is seeing its largest decline since March and shows no notable signs of recovery.

DOGE continues to experience massive declines amid a 69% increase in trading volume. Dogecoin’s ongoing price trend suggests that it is experiencing a significant surge in selling pressure.

The crypto market enters its fourth day of consistent decline. The global cryptocurrency market cap is at $3.30 trillion, an over 2% drop in the last 24 hours. Nonetheless, the sector is seeing massive trading activity on Friday. Buying and selling pressure surged by 12%.

A shift in fundamentals is responsible for the ongoing selling congestion. News of the possible resumption of the trade war sparked adverse reactions across the market. Investors are shifting liquidity from the sector and investing in lower-risk assets following Donald Trump’s hint at levying additional tariffs on China. This comes on the back of intended levies on the EU.

Ethena is one of the top losers in the last 24 hours. It opened at $0.37 and dropped to a low of $0.31. The asset is down by over 14% amid its slight rebound. Arbitrum follows behind with a decline of more than 10%, dropping from $ 0.39 to $0.38.

The massive losses across the market leave traders wondering when it will end. Let’s examine some key levels.

BTC/USD

On-chain data reveals an ongoing bid to force further recovery. At the time of writing, Bitcoin is experiencing massive buying pressure from the US and Asian markets. The Coinbase and Korea premium are positive due to this inflow.

This reading coincides with the coin’s rebound from a low of $103,703. Nonetheless, it remains red and may end the day with its fourth consecutive day of decline. The one-day chart indicates that the asset risks further decline.

The relative strength index is at 52. A closer look at the mark reveals that it has slightly altered its trajectory, as it experiences a significant increase in buying volume. BTC slipped below bollinger middle band, suggesting a buyback may be imminent.

The coin will look to return to $105k in the hours if the bulls sustain the ongoing uptick. However, it risks retesting the $102k support.

ETH/USD

Ethereum is rebounding as the rest of the market. Like DOGE, it lost another key level a few hours. It lost the $2,600 support, declining to a low of $2,534. It rebounded and edges close to reclaiming the lost level.

Onchain data show that the asset is seeing a spike in buying pressure over the last hour. Its exchange reserves are reducing as the bulls soak up the excess supply. Others are moving assets out of these trading platforms and sending them to cold storage.

However, the derivatives market is not positive as open interest plummets by over 4%. It suggests that the coin is not out of danger. It risks further declines, dipping below $2,500. The average directional index suggests that this may be the case, as it remains in a downtrend.

Nonetheless, ETH may continue upward if the bulls sustain the ongoing recovery. Previous price movement suggests that the largest altcoin will attempt $2,700 after reclaiming $2,600.

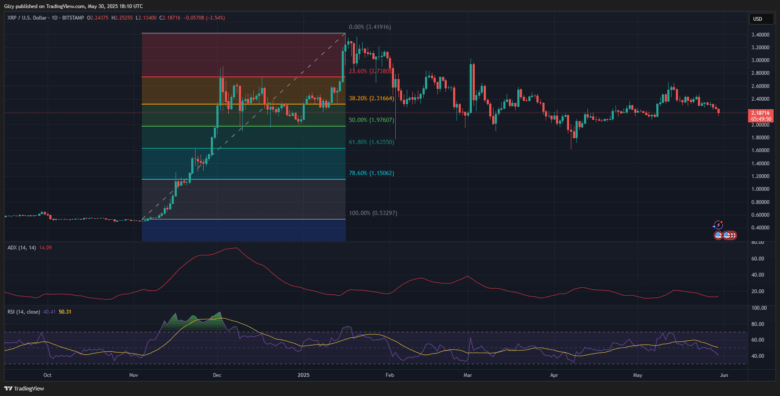

XRP/USD

XRP is experiencing a significant recovery following its plunge to a low of $2.13. It started the day at $2.25 and lost $2.20. Nonetheless, it has reclaimed the mark and hints at more uptick.

Indicators on the 2-hour chart suggest that the trend may continue upward as buying pressure intensifies. The moving average convergence divergence prints a buy signal as the lower EMA halted its decline. It indicates an ongoing bullish convergence, suggesting an impending retest of the $2.30 mark.

Conversely, the one-day chart shows that the altcoin risks a retest of $2.10. The average directional index on this metric remains negative despite the slight recovery.

BNB/USD

Binance Coin is on the verge of reclaiming $670 after rebounding from $660. The altcoin trades at $666 following a massive shift in trading sentiment.

The 2-hour chart reveals massive buying action at the time of writing. Nonetheless, like DOGE, the change happened in the past hour. BNB is rebounding off bollinger’s lower SMA, hinting at further increases.

The altcoin risks massive retracements if the bulls fail to maintain the ongoing momentum. The ADX suggests that it may dip to $650 as the downward pull remains strong. Other indicators on the one-day chart are yet to flip bullish.

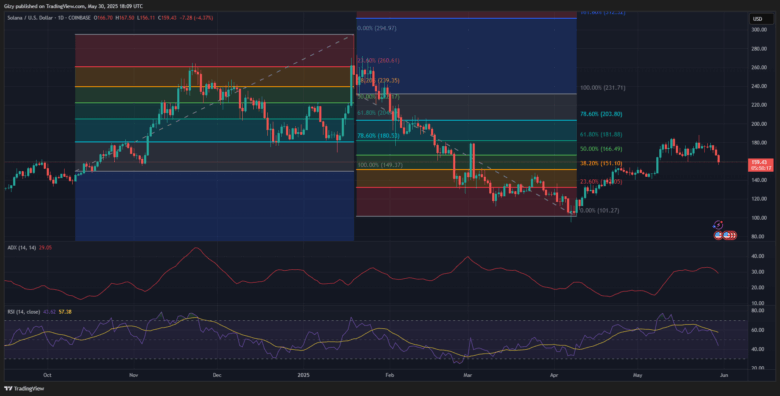

SOL/USD

The 2-hour chart shows that Solana slipped below its bollinger bands a few hours ago. Its ongoing rebound may be in response to the decline. Nonetheless, the coin retraced to a low of $156 after it kicked off trading at $166.

MACD, in this timeframe, is reacting to the change in trajectory. The lower EMA has halted its downtrend and may initiate a positive convergence, signaling further increases. SOL will aim to completely erase all its losses, returning to its opening price.

Nonetheless, indicators on the one-day chart support the prediction of further declines. SOL may retest the $150 support if the downtrend resumes.

DOGE/USD

DOGE is experiencing a spike in buying pressure. It saw a sudden change in sentiment in the past hour as bulls rallied the coin. The 2-hour chart indicates that it may see further increases following its slip below the bollinger bands.

The coin retraced to a low of $0.19 for the first in the last two weeks. While the 2-hour chart hints at the possibility of a full recovery, indicators on the one-day chart suggest a drop to $0.18.

The shorter-term chart shows that DOGE is struggling to sustain the buyback, indicating that the bearish pull remains strong.

ADA/USD

Cardano edges closer to full recovery. The 2-hour chart suggests a potential surge to $0.75 within the next 24 hours.

MACD on this timeframe is reacting to the latest shift in trading sentiment. The lower EMA has halted its downtrend and may initiate a positive convergence, signaling further increases. SOL will look to completely erase all of its losses, returning to its opening price.

Conversely, indicators on the one-day chart favor further declines. ADA may retest the $0.65 support if the downtrend resumes. Its recent dip to $0.68 supports this claim.

Find Cryptocurrencies to Watch and Read Crypto News on the Go Follow CryptosToWatch on X (Twitter) Now