ETH had another quick surge a few hours ago. It tested another critical level days after it broke above $2,700.

The largest altcoin is trading close to its opening price at the time of writing. ETH grapples with notable selling pressure as bearish sentiment across the crypto market spreads. The Fear and Greed Index decreased over the last 24 hours, dropping from 68 to 65.

Other crypto assets are seeing notable increases amid the negative trend. LDO surged from $0.93 and peaked above $1. SPX6900 is not left out of the uptrend, surging from $1.03 to $1.21. Currently up by over 13% over the last 12 hours, it is one of the fast movers.

A shift in fundamentals caused the hikes across the market. The FOMC released the minutes of its May meeting. The gathering was not one that investors had high expectations for. However, the feds surprise traders with promises to cut interest rates by 25 basis points, once or twice before year-end.

Nonetheless, readings from the fear and greed index suggest that the news was enough to prompt investors to move past the prevalent bearish sentiment. On the other hand, the crypto market saw fresh liquidity injection as trading volume surged by 7%.

Most assets in the top 10 have since struggled with notable selling pressure. Will it change on Thursday? Let’s examine some key levels.

BTC/USD

Bitcoin retraced below $107k for the first time in three days. The slip occurred during the previous intraday session, as the asset experienced increased selling pressure. Although it recovered, fears of a massive retracement loom.

Its retest of Wednesday’s low a few hours ago heightened the fear. Nonetheless, it rebounded and trades above $ 108,000. BTC will look to flip $109k but risks rejection at the resistance. Previous price movement shows that the largest coin may see massive declines after flipping it.

RSI indicates that the asset is experiencing notable buying pressure despite a slight decline in trading volume. However, other metrics remain negative. Readings from the relative strength index suggest a potential return to $ 110,000 within the next 24 hours. Nonetheless, the average directional index shows that the push to this level is weak, hinting at a possible retracement.

ETH/USD

Ethereum is the biggest mover in the top 10. Its retest of the $2,800 resistance came at a time when many expected a slight pullback after the sharp price spike on Tuesday. It recovered from a slight decline and continued its upward trend on Thursday.

ETH faced notable resistance at $2,789 but remains green. The ether community is calling for further increases, anticipating the possibility of reaching the highlighted mark. ADX suggests that the flip may occur soon as the surge has sufficient support—the metric hints at a possible surge to $2,900.

However, ETH is overbought. The relative strength index is at 71 amid the slight price decline. The altcoin risks slipping lower. Previous price movements show that $2,700 is not a tough level due to low demand concentration. It hints at a slip to $2,600 in the event of a trend reversal.

It is worth noting that Ether is experiencing an ongoing bullish convergence on the MACD.

XRP/USD

XRP continues its struggle to surge. It retraced lower on Wednesday, dipping to a low of $2.22. The price action is unfolding as previously predicted. However, the bulls are staging a buyback as the asset edges closer to reclaiming the $2.30 mark.

The relative strength index indicates that XRP is experiencing notable buying pressure, coinciding with a more than 29% increase in trading volume over the last 24 hours. This may be a recipe for attempting to break the $2.40 resistance.

However, the average directional index suggests that the altcoin’s latest hike may be in response to bullish fundamentals, indicating that a retracement is near.

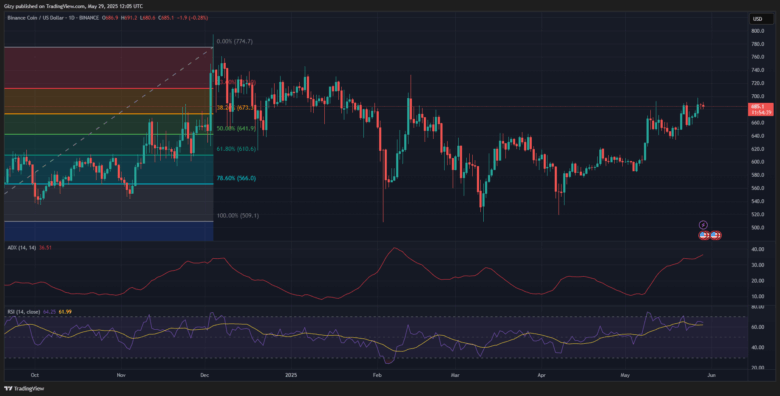

BNB/USD

Binance coin is seeing a similar performance as the previous day. Nonetheless, it is seeing more volatility amid the over 2% increase in trading volume. The asset is grappling with significant selling pressure following its failed attempt to break the $700 resistance.

The relative strength index is declining in response to the ongoing trend. RSI gives no hint of an impending surge. Nonetheless, the average directional index remains in an uptrend, indicating that the altcoin retains some bullish momentum.

Previous price movement suggests the asset will see further retracement. It held $680 over the last 28 hours but risks losing and retracing to $660. Conversely, it may attempt $700.

SOL/USD

Solana slightly slipped below $170 on Wednesday. It lost almost 3% before slightly rebounding. The asset retested the highlighted support a few hours ago but recovered and is now trading above its opening price.

The altcoin may see further declines as indicators remain bearish. Readings from RSI reveal that the coin is experiencing a slight increase in buying volume. The doji representing the current-day trend suggests that it is not enough to see it break out from its rangebound movement.

However, ADX shows that the latest upward push lacks any significant support and may fizzle out soon. SOL risk slipping below $2.20.

DOGE/USD

Dogecoin is seeing notable upward movement like the ETH. It surged from $022 to a high of $0.228 a few hours ago. However, it is retracing and may return to its opening price. The one-day chart shows that the asset remains in its sideway trend amid the hike.

The relative strength index indicates that DOGE is experiencing notable buying pressure, coinciding with an over 8% increase in trading volume over the last 24 hours. This may be a recipe for attempting to break the $0.235 resistance.

However, the average directional index shows that the altcoin’s latest hike may be in reaction to the bullish fundamentals, hinting that further retracement is near.

ADA/USD

ADA’s failure to surge higher will see it sit below $0.77 for the sixth consecutive day. However, a surge is unlikely as indicators show no impending breakout.

Readings from RSI reveal that the coin is experiencing a slight increase in buying volume. The doji representing the current-day trend suggests that it is not enough to see it break out from its rangebound movement.

However, ADX indicates that the latest upward push lacks significant support and may soon fizzle out. ADA risk slipping below $0.70.

Find Cryptocurrencies to Watch and Read Crypto News on the Go Follow CryptosToWatch on X (Twitter) Now