DOGE and most of the assets in the top 100 are grappling with significant selling pressure at the time of writing. They approached a level they failed to break a few days ago and retraced.

Data from CryptocurrenciestoWatch shows that DOGE is seeing a notable increase in trading volume. This is a similar trend across the crypto market. Buying and selling volume surged by over 20% in the last 24 hours.

Nonetheless, some crypto assets are breaking out of their rangebound movement. PancakeSwap surged from $2.42 to a high of $2.94. It failed to break the $3 resistance due to a massive rejection at the peak. Nonetheless, it is testing the highlighted level for the first time since February.

Quant follows behind with a 7% increase, surging from $104 to $113. Both assets are experiencing notable selloffs that may persist until the end of the day.

The market sees little positive fundamentals at the time of writing. Trump’s latest statement, committing $2.5 billion to the Strategic Bitcoin Reserve, sparked a slight reaction from investors. It failed to erase the bearish sentiment across the crypto market fully.

Nonetheless, Strategy announced that it added another massive scoop to its Bitcoin bag. The CEO doubled down on the reason the company is investing in the asset, stating he is investing money he can’t afford to lose.

Some crypto assets are gearing up for a breakout. Let’s examine some critical levels to watch.

BTC/USD

Onchain data from CryptoQuant shows that the apex coin is seeing a slight decline in exchange reserves. These trading platforms are seeing massive outflows compared to inflows as some investors are moving their assets in preparation for a long-term strategy.

The derivatives market is less active as open interest remains relatively low. Funding rates have since plunged. Reading from on-chain metrics suggests that Bitcoin is gearing up for a massive breakout.

The bearish divergence on MACD suggests that the asset may see further declines. This will mean BTC tests the $106k support again. Its failure to surge over the last three days may indicate growing selling pressure that may break the highlighted mark. In such a case, the $102k support is one level to bank on.

On the other hand, RSI indicates that the apex coin is experiencing a slight increase in buying pressure. Further improvement may take it above $ 112,000.

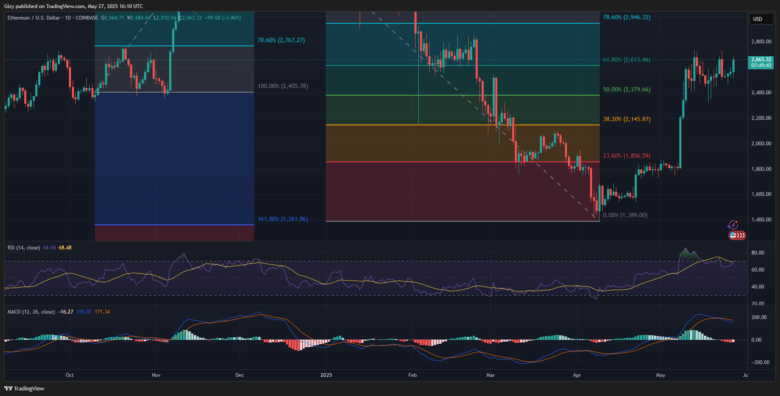

ETH/USD

Ethereum is seeing an increase in buying pressure, as highlighted by the relative strength index. The metric surged from 64 to 69 within the last 24 hours. Fears of massive retracement grow as the asset may become overbought if the uptrend continues.

ETH was stuck in its rangebound movement, similar to DOGE, for most of the last three days. The one-day chart shows that the apex altcoin breakout and attempt at the $2,700 mark may yield positive results. RSI indicates that the asset is experiencing notable buying volume, which may propel the altcoin as high as $2,800.

Nonetheless, onchain data shows that exchange reserves are growing. It is up almost 0.40% in the last 24 hours. Readings from this metric may mean further declines. The apex altcoin risks slipping $2,500 and $2,400 if the bulls fail to defend the mark.

XRP/USD

XRP is on the threshold of the $2.35 resistance at the time of writing. It edged close to the mark a few hours ago but fell short as it saw notable rejections. It retraced to a low of $2.26 but rebounded.

A close at the current price will see the coin end the fourth consecutive day below the highlighted level. It has yet to break out of its rangebound movement, like DOGE. Nonetheless, its consistent attempt at the highlighted mark indicates an impending trend change.

A flip of the highlighted mark will result in a surge above $2.40. Previous price movements suggest that the asset may struggle to break $2.50. On the other hand, the asset risks dipping to $2.20.

BNB/USD

Binance coin had a breakout a few hours ago. It surged after a brief decline to $666, attempting $700. It failed as it experienced massive rejections at $697. Currently up by almost 3%, the altcoin will look to continue the uptrend.

Several indicators are positive, indicating further increases. BNB will break above $700 in the next 24 hours if trading conditions remain the same. It may attempt to break the $720 resistance next but risks a trend reversal.

The one-day chart indicates that the cryptocurrency risks retesting the $660 support level in the event of a spike in selling pressure.

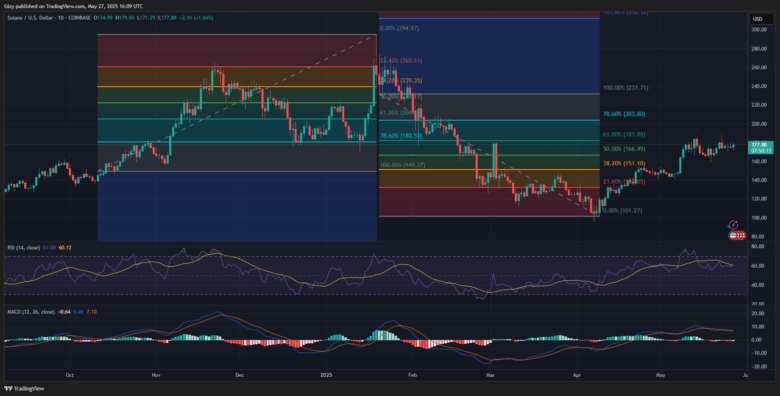

SOL/USD

Solana may be on the verge of a breakout. It trades at $178, less than $2 away from its four-day high. The altcoin has remained in a rangebound movement since its over 3% loss on Friday. The one-day chart indicates that efforts to reclaim lost levels are yielding no results due to a decline in trading volume.

Nonetheless, its consistent attempt to break above $180 indicates an impending breakout. Flipping the critical mark will send the coin to $190. Price action two weeks ago suggests that it may linger around $185 before the retest.

Conversely, Solana may retrace to $170. Failure to defend the mark may result in a decline to $160.

DOGE/USD

DOGE peaked at $0.232 a few hours ago but retraced. It is recovering from a dip to $0.220. The asset tested a critical support and risk slipping below it. Price actions over the last fourteen days suggest that the memecoin may rebound to $0.21 if trading conditions deteriorate.

Nonetheless, the current-day high is slightly above the three-day high. This may mean that DOGE is gearing up for further upward movement. Previous price action suggests that $0.236 is another level with significant selling pressure.

Dogecoin will flip $0.240 and may attempt $0.255 after breaking out.

ADA/USD

ADA is seeing the same trend as DOGE. It remained locked in a rangebound movement since the massive 7% decline it had on Friday. Nonetheless, indicators suggest that the sideways trend may soon come to an end.

With a breakout imminent, MACD favors more upward movement. This will result in the asset testing the $0.80 resistance. Further increases may see it attempt $0.80.

Conversely, further downtrends will send the altcoin below $0.72. Previous price movements suggest that failure to defend this mark will result in a dip to $0.65.

Find Cryptocurrencies to Watch and Read Crypto News on the Go Follow CryptosToWatch on X (Twitter) Now