ETH slipped to $3,753 a few hours ago amid intensified selling pressure but has since recovered, now trading near its opening price. The asset may be on track to close the day with minimal gains or losses, although momentum remains fragile.

According to CoinMarketCap, ETH’s trading volume has dropped by over 3%. The price has been less volatile in unison with the reduced activity, signaling weaker participation from traders.

This quiet movement isn’t unique to ETH. The crypto market is following the same pattern. Trading activity of both buying and selling has declined by over 7% in the past 24 hours. The reduced action is also weighing on the global crypto market cap, which has pulled back slightly.

A closer inspection of TradingView data shows the market has struggled to gain momentum since the beginning of the week. This comes as a surprise, considering several recent headlines highlight a surge in institutional adoption of digital assets.

Still, not all tokens are sinking. FORM has outperformed the market in the last 24 hours, rallying nearly 12% from a low of $3.28 to a peak of $3.86. XDC also posted a solid gain of over 5%, showing signs of bullish resilience despite the general market downturn.

Even with a few standout performers, the top 10 cryptocurrencies have shown little movement since the start of the week. Many are under increasing pressure as bearish sentiment grows. The fear and greed index v at 63, unchanged from the previous day but noticeably lower than last week’s reading, reflecting growing uncertainty and caution among investors.

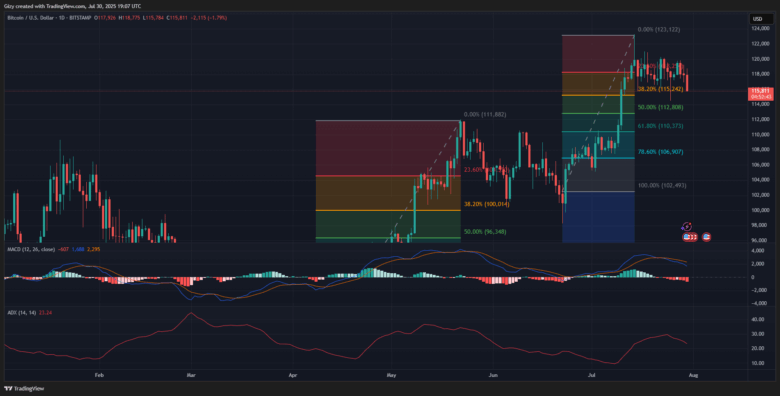

BTC/USD

Bitcoin opened Monday’s trading at $119,491 and quickly approached $120,000, only to face rejection at $119,856. After the failed push, BTC pulled back slightly and ended the day without any meaningful price change, signaling hesitation among buyers.

On Tuesday, the coin retraced to a low of $116,952 before bouncing to a high of $119,297. However, that rally didn’t last either, as Bitcoin closed lower than it opened. Continued selling pressure has kept it from regaining momentum and breaking through resistance.

As of now, BTC is forming one of its smallest daily candles of the week and remains range-bound around $117,800. Data from CoinMarketCap indicates a 7% decline in trading volume over the last 24 hours, a factor contributing to its sluggish performance and lack of breakout movement.

The daily chart reflects a weakening trend. MACD continues to flash sell signals, with the 12-day EMA still positioned below the 26-day EMA after last week’s bearish crossover. RSI holds steady but isn’t showing strength or signaling bullish divergence. ADX paints a clearer picture, trending downward and revealing the growing strength of the bears.

However, there is one technical point to monitor. Bitcoin is currently sitting near the 23% Fibonacci retracement level from its previous rally. Price action around $117,000 suggests a notable concentration of demand, which could offer temporary support if it holds. But if volume doesn’t pick up soon, this level might be tested again in the coming sessions.

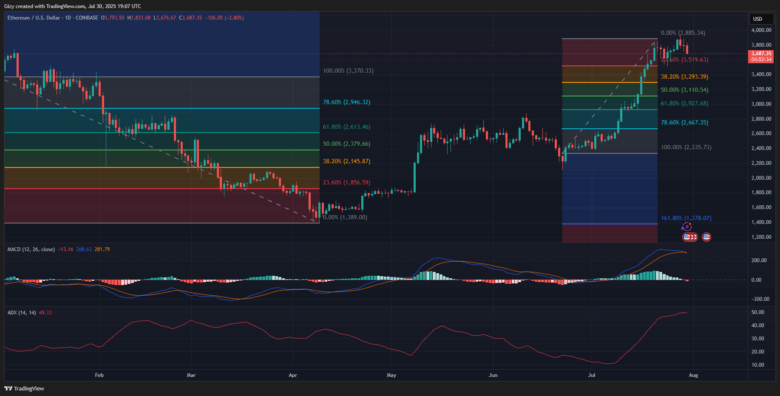

ETH/USD

Earlier today, ETH fell to $3,728 as bears increased pressure. The price now hovers just above this level with little sign of reversal, inching closer to Tuesday’s low.

Tuesday’s candle formed a doji, an indicator of indecision. The coin opened at $3,873, reached a high of $3,886, but eventually fell to $3,715 before closing just under its open.

Monday’s trading followed a similar path. ETH pushed toward $3,900 after opening at $3,873, but reversed and closed the day at $3,799. Selling pressure has returned to the market and appears to be accelerating.

The MACD indicator confirms the shift. A bearish crossover occurred as the 12-day EMA fell beneath the 26-day EMA, suggesting the uptrend has ended and a new downtrend may be developing.

At the same time, the ADX is beginning to rise, supporting the idea that bearish momentum is increasing. The RSI is gradually slipping as well, showing that sellers are gaining ground, though it’s not yet in oversold territory. Traders are watching to see whether the $3,700 support zone will hold.

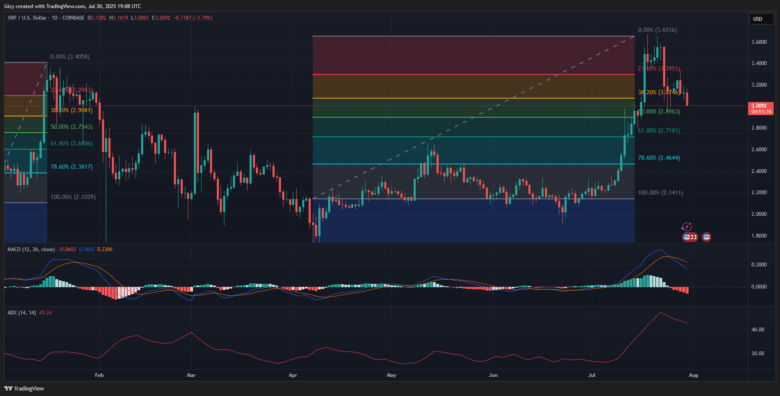

XRP/USD

XRP started the week with a sharp pullback, recording a 4% drop on Monday. It opened at $3.24, climbed to $3.331, then plunged to $3.107 before closing at $3.132.

On Tuesday, the price action was more muted. XRP printed a doji after peaking at $3.18 and closed marginally lower at $3.127.

XRP trades near $3.04 as downward pressure persists. Buyers attempt a rebound but fail to reclaim previous highs. Momentum stays weak. MACD shows both EMAs dropping, with a widening gap. ADX trends lower, confirming bearish strength. RSI hints at minor bull effort, but bears still lead.

BNB/USD

BNB is seeing continued downward pressure this week, with a 2% loss registered in the past few hours. The token fell to $780 but has slightly recovered to trade at $783. Today’s session began at $805, reached $811, then reversed and lost ground.

The trend started on Monday when BNB opened at $844 and rose to $861 before falling to $823 by the end of the day. Tuesday saw more of the same as the coin peaked at $835 and dropped to a daily low of $800 before ending the day at $805.

BNB’s indicators align with its bearish structure. MACD is showing signs of a potential crossover as the 12 EMA moves closer to intersecting the 26 EMA from above. This would strengthen the current downtrend and increase the risk of further losses.

Meanwhile, the ADX, which had been climbing, reversed on Monday and now trends downward, raising concerns about further price declines and the growing dominance of sellers in the market.

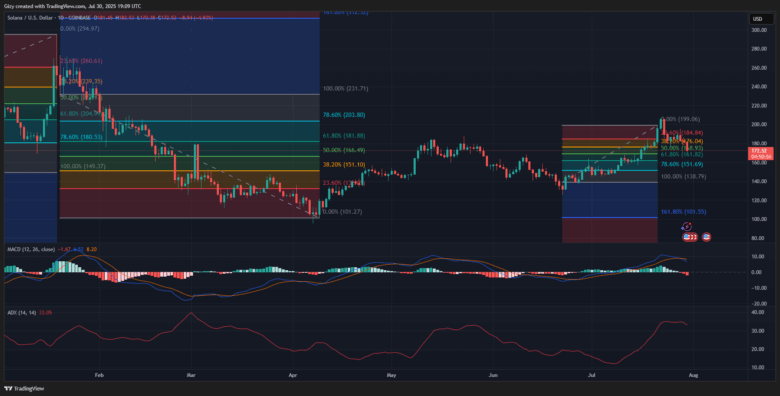

SOL/USD

Solana is nearing its third consecutive day of losses. The altcoin has dropped more than 4% in that span and shows no sign of reversing the trend yet, with volume still underwhelming and sentiment fading.

Technical readings are still bearish. MACD continues to print sell signals following last week’s negative crossover. The ADX, which had now moved sideways for a few sessions, has now tilted into a downtrend, suggesting SOL may struggle to regain traction unless crypto market conditions improve.

Find Cryptocurrencies to Watch and Read Crypto News on the Go Follow CryptosToWatch on X (Twitter) Now