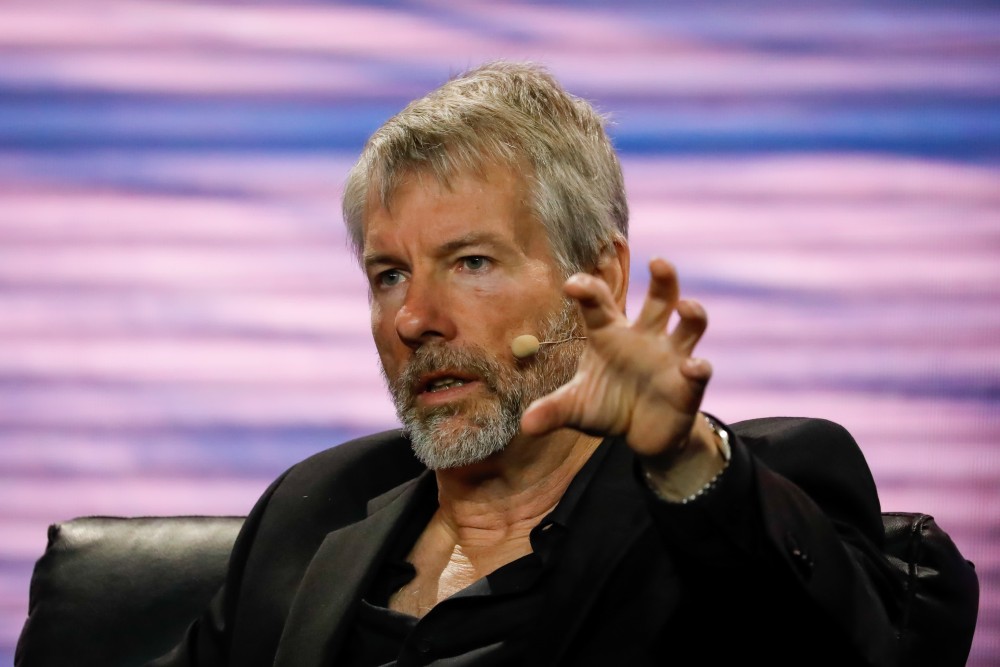

Michael Saylor, the executive chairman of business intelligence company MicroStrategy, aims to transform the firm into a trillion-dollar value and become the world’s leading Bitcoin bank. He unveiled this vision during an interview with analysts at asset management firm Bernstein.

What Fuels Saylor’s Vision?

Microstrategy’s investment thesis positions Bitcoin as the standout performer of the 21st century. Its chairman views the pioneer crypto as a groundbreaking form of digital wealth that provides unparalleled protection against inflation and a robust store of value over time.

Another source of Saylor’s conviction in bitcoin’s potential stems from the asset’s unique ability to attract investors seeking substantial returns despite its volatility. As the asset matures, the co-founder predicts it will become an invaluable component of both institutional and retail investment portfolios.

How Will MicroStrategy Achieve This?

Saylor plans to raise hundreds of billions through various financial instruments, including convertible notes and preferred stock, which will be used to purchase bitcoins. He predicts MicroStrategy’s value will skyrocket, dominating options and equity markets.

Anticipating Bitcoin’s price will reach millions per coin, Saylor believes MicroStrategy will become a trillion-dollar company, leading the financial industry. However, the vision does not end up being highly valued financially.

Having a significant amount of bitcoins worth trillions of dollars, MicroStrategy will become the leading Bitcoin bank, creating a wide range of BTC-based financial instruments such as equity, convertibles, fixed income, and preferred shares.

Saylor’s Unusual Banking Model

The MicroStrategy’s co-founder shared his unconventional approach to Bitcoin banking. Unlike traditional banks, it will borrow funds but not lend them out. Instead, the Bank will invest borrowed funds in bitcoin, leveraging its attractive average annual growth yield. This strategy, known as capital markets arbitrage, will generate returns without counterparty risk.

Saylor believes borrowing $1 billion at fixed income rates and investing in Bitcoin at a 50% annual return rate is more intelligent than lending to individuals or corporations at 12-14%. Even in a bear market, he predicts BTC will grow 22% annually over the next decade, questioning who can match the interest rate.

He further urges other institutions to adopt Bitcoin as a treasury reserve asset, arguing that traditional balance sheet management destroys shareholder value. Firms like Semler Scientific and Marathon Digital have already taken this stance, and Saylor expects more to follow.

Find Cryptocurrencies to Watch and Read Crypto News on the Go Follow CryptosToWatch on X (Twitter) Now