The Bitcoin maximalist public company MicroStrategy recently raised $563.4 million to bolster its holdings. The fund was raised by selling 7.3 million shares of its 8.00% Series A Perpetual Strike Preferred Stock (STRK). Notably, the company currently holds 471,107 bitcoins worth over $49 billion.

$563M Raised via STRK Offering

The perpetual strike preferred stock, priced at $80.00 per share, has a liquidation preference of $100 per share and accumulates cumulative dividends at a fixed rate of 8.00% per annum. The stock is convertible into MicroStrategy’s class A common stock, and the company has the right to redeem the shares under certain conditions.

According to the company’s official press release, the net proceeds from the offering will be used for general corporate purposes, including acquiring additional Bitcoin and working capital. The move is not surprising to its customers as it is a consistent strategy used by MicroStrategy to invest in the pioneer crypto.

Claiming to be a leading business intelligence and mobility software company, MicroStrategy has been at the forefront of corporate Bitcoin adoption. Earlier this month, it announced plans to raise as much as $2 billion in the first quarter through perpetual preferred offerings.

The recent deal’s success sets a strong tone for the company’s future fundraising efforts. The capital raise exceeded the company’s initial target of $250 million, doubling the expected amount. This demonstrates investor confidence in the company’s strategy and the growing recognition of Bitcoin as a viable investment option.

MicroStrategy Remains Undeterred

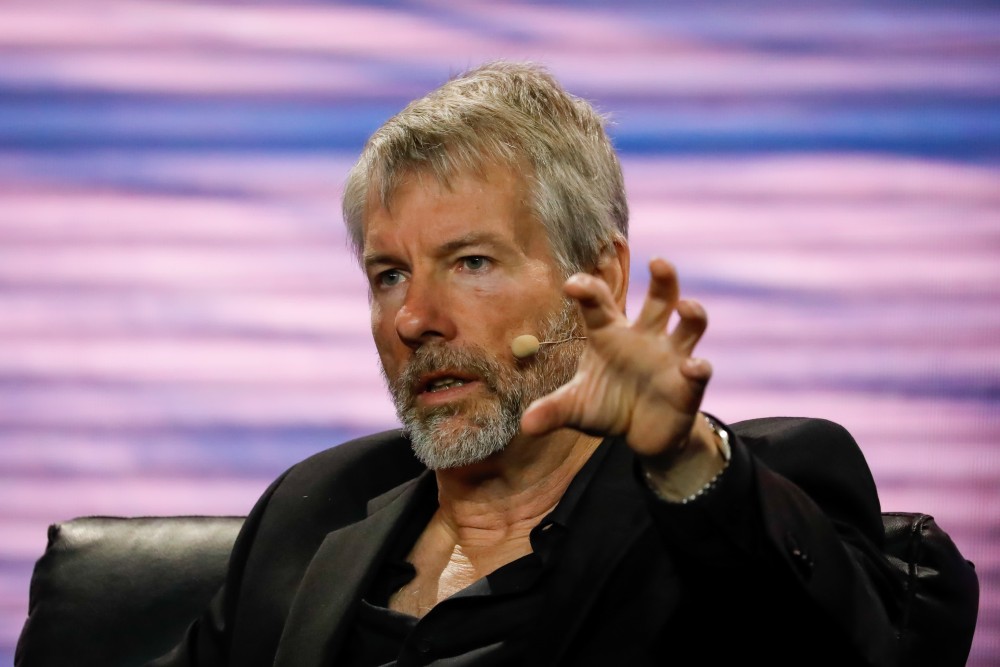

Despite facing tax challenges and criticism from prominent traditional investors, MicroStrategy remains resolute in its commitment to Bitcoin investment. The company’s CEO, Michael Saylor, has been a vocal advocate for Bitcoin.

The tax issue at hand refers to the potential tax implications of MicroStrategy’s Bitcoin holdings. As the company’s Bitcoin portfolio grows, so does its tax liability. However, the company is exploring various strategies to mitigate these tax concerns.

Meanwhile, some traditional investors and financial experts question the wisdom of investing heavily in Bitcoin. Some have expressed concerns about the crypto’s volatility and lack of regulatory oversight. Nonetheless, Saylor and MicroStrategy remain convinced that Bitcoin has a bright future ahead.

Undeterred by these challenges, MicroStrategy continues to bet big on Bitcoin. Saylor’s resolve is rooted in his conviction that Bitcoin is a store of value and a hedge against inflation. He believes the crypto’s decentralized nature and limited supply make it an attractive investment opportunity.

Find Cryptocurrencies to Watch and Read Crypto News on the Go Follow CryptosToWatch on X (Twitter) Now