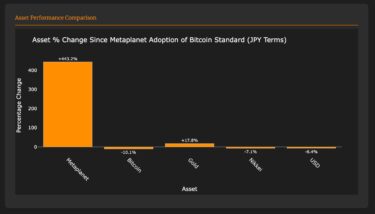

Japanese technology firm Metaplanet has seen a remarkable 400%+ increase in stock value in the last five months since it adopted a Bitcoin-focused investment strategy.

In April, MetaPlanet made a strategic decision to add bitcoin (BTC) to its corporate treasury and has since continued to accumulate and grow its crypto holdings. The company’s series of BTC purchases yielded a substantial 443.2% increase in its stock value.

Asia’s MicroStrategy?

Metaplanet has gained the nickname “Asia’s MicroStrategy” for its continuous Bitcoin buying sprees following in the footsteps of business intelligence software company, MicroStrategy.

Led by its founder, Michael Saylor, MicroStrategy became the first publicly traded company to added bitcoin to its primary treasury reserve.

Since then, the business intelligence company has continued to expand its treasury holdings through the strategic accumulation of the leading crypto asset.

As of September 13, 2024, MicroStrategy had a total of 244,800 BTC worth about $15 billion in its portfolio.

The company aims to preserve its leadership position in corporate Bitcoin ownership, with plans to further increase its holdings through strategic acquisitions. Recently, MicroStrategy proposed the issuance of $875 million in convertible notes for Bitcoin purchases and other purposes.

Furthermore, the company’s stock is up over 1,000% since it adopted Bitcoin.

Metaplanet’s Series of Bitcoin Purchases

After Metaplanet made a strategic move to add Bitcoin to its corporate treasury reserve with an inaugural purchase worth about 1 billion yen ($659 million) earlier in April, the firm has continued to mirror MicroStrategy’s strategic leadership in corporate crypto adoption.

MetaPlanet’s crypto investment was particularly noteworthy as the firm transitioned from a hospitality-centric company, formerly known as Red Planet, to a pioneering Web3 firm.

In July, the firm increased its total holdings to 161.3 BTC after purchasing $1.2 million worth of bitcoin.

In a subsequent move, Metaplanet expanded its total Bitcoin holdings by 57.103 units, valued at approximately $3.4 million, following a ¥1 billion (over $6.8 million) loan acquisition from MMXX Ventures Limited to facilitate further Bitcoin acquisitions.

Its recent purchase of 38.4 BTC worth about $2.1 million at the time of purchase, increased its total Bitcoin holdings to over 398 BTC.

Leave a Reply