The month of July is ending with Ethereum experiencing one of its most substantial gains in the past 3 years, marking a significant shift in momentum.

This performance comes as a surprise, especially considering that historically, the third quarter is known to be the least bullish three-month stretch for the apex altcoin. Yet, against all odds and market predictions, Ethereum has delivered a near-flawless start to the fourth quarter.

Concerns about price movement were raised as ETH failed to make any significant upward moves in June. The asset registered a decline of nearly 2% last month, a complete opposite to the massive 41% gain it saw in May.

This sudden turnaround led many investors and analysts to believe that a correction was imminent. Consideration about the coin’s direction in July was widespread, with sentiments angled towards a further downtrend.

However, the coin defied expectations, encouraged by a mix of strong institutional interest and fundamentals. One of the key instigators that shaped Ethereum’s performance in July was the passing of what has popularly been termed the “Crypto Bill” in the United States.

The bill, aimed at bringing regulatory clarity and fostering innovation in the Blockchain sector, was met with enthusiasm by the market.

ETH’s price began to rise in buying pressure before the bill was officially signed, and continued to surge after the announcement. It recovered its previous highs and established new momentum levels. Nonetheless, institutional players had a significant impact on Ethereum’s price movement throughout the month, beyond the legislative wins.

Institutional Confidence Fuels the Rally

Several institutions made aggressive moves towards ETH in July, indicating a broader shift in sentiment. One of which was BTCS, a blockchain infrastructure company listed on NASDAQ. The firm recently filed to raise $2 billion through the sale of its shares. According to its filing, the capital will be used to support crypto acquisitions and fund other business operations.

What drew even more attention was BTCS’s Ethereum accumulation. A day before filing, the company revealed that it had acquired 14,240 ETH. This purchase brought its total ETH holdings to a staggering 70,028 ETH, which is currently valued at approximately $265 million.

BitMine, another key player, also made headlines with its massive Ethereum purchases. The firm announced a $1 billion stock buyback program as part of its strategy to increase the value of its crypto-assets per share. Notably, BitMine’s focus shifted from Bitcoin to Ethereum, dropping its BTC holdings to acquire 625,000 ETH at an average purchase price of $3,755 per coin. This raised its total Ethereum reserves to a valuation exceeding $2.36 billion.

Spot Ethereum ETFs Break Records

Week ending July 11, a massive surge was registered for Spot Ethereum ETFs, documenting its weekly total as the second-highest following its introduction. A 42% surge was registered on July 10, as noted by SoSoValue.

The United States Spot Ethereum Exchange traded funds recorded its largest influx of $1.85 billion. BlackRock’s ETHA noted a new entry of $440 million, according to SoSo Value.

ETH was especially bullish in July as an increase in ETF inflows likely drove the price upward.

The 1-week chart indicates that ETH saw an uptrend and broke above 3k in the first week, a milestone not reached in the last 4 months. More than 15% gains were noted at the session.

A Bullish July in the Charts

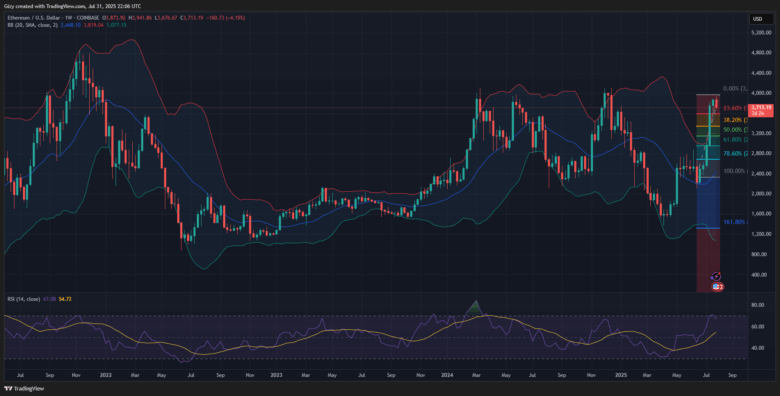

Ethereum records a 5% profit on average every July. The chart below indicates that the coin may see an upward movement in price. Prior speculations reveal a possible downtrend after reaching certain levels. The apex altcoin recorded a surge in the last 30 days.

Ethereum surges and registers higher profits during August, as it is proposed to be a bullish period for the asset. It is worth noting that the average increase surpasses 7% unlike the 7th month, which records 5%.

However, Ethereum has recorded losses six times since its introduction in 2015. The highest drop in price happened in 2018, losing 34% after a similar trend the previous year.

On the other hand, the asset has experienced a remarkable four times, registering its biggest gains in 2017 when over 87% was profited. Notably, the apex altcoin has recorded losses for many months but is still showing an uptrend in price movement, according to previous data.

No specific sequence to the outcome has been noted. However, observing price movement these past two months indicates trading conditions worsen in August, and if this pattern continues, a notable decline will be recorded in Ethereum in the coming month.

Ethereum Shows Signs of Weakness

The chart reveals a dip as buying pressure decreases. The 1-week chart paints a bleak picture of how price movement will act in the coming days as the whales are displaying signs of fatigue.

Current trends reveal an impending downtrend that will cause prices to dip as the asset has slowed down its uptick, consolidating in the past two weeks.

The Bollinger band indicates that ETH saw an upward movement, breaking above its mark two weeks ago. Currently trading above it, a dip below the upper band might occur if trading conditions get worse.

Nonetheless, Ethereum will dip as previous price movement suggests, accompanying its breakout from the Bollinger band, retesting the middle band. However, the altcoin may not dip to the current metric, which is below $2500, this August.

The relative strength index is currently seen at 68, indicating that ETH was overbought two weeks ago. The selling pressure increases, and following this trend will guarantee a bearish period in the next 30 days.

The Fibonacci retracement level suggests a mark to watch with both indicators pointing to an upcoming downtrend. It is worth noting that there is a demand concentration around the 23% mark at $3,500. However, Ethereum is more likely to lose this mark.

It remains to be seen how prices will react as Ethereum may dip to as low as the 38% Fibonacci level around $3,300 after it tests the mark. On the other hand, the demand for ETH to break above $4k is high. Nonetheless, there is a huge chance that the apex altcoin will reach this mark.

Find Cryptocurrencies to Watch and Read Crypto News on the Go Follow CryptosToWatch on X (Twitter) Now