Bitcoin continues to grapple with notable selling pressure around $103k. It remained stuck at this level since the day started, amid several attempts at buyback.

The apex coin is yet to recover from the significant selloff it had on Friday. It retraced from a high of $105,500 to a low of $102,309 but rebounded. BTC raised huge concerns as it slightly broke from its range-bound movement.

Nonetheless, traders are unable to resume the uptrend as the market lacks the needed catalysts. Fundamentals remain largely negative as the conflict in the Middle East continues to rage on. There is no clear indication of the next price direction, and investors struggle to determine the next cycle.

However, the apex coin is experiencing bullish activity at the time of writing, with a more than 26% increase in trading volume. The slight increase suggests growing bullish sentiment among investors.

The buyers are yet to soak up the excess supply. Several institutions sold their bags over the last seven days, including Ark, Bitwise, and Fidelity. On a lighter note, a wallet that held 300 BTC for eleven years has finally sold.

Data from Santiment reveals that institutions are not the only sellers. Wallets holding over 10 BTC grew by over 230 as more investors accumulated. However, wallets with less than 10 BTC declined by over 37,400 in the last 10 days.

The coin has since lost its appeal in recent days, as discussions about it on social media have decreased. Santiment noted an increase in references to other assets, such as Tron, Tether, and Dogecoin, ahead of the apex coin.

Bitcoin New Money Dries Up

Data from CryptoQuant shows that the apex coin is experiencing a massive decline in liquidity inflow. It noted that new money is drying up as short-term holders now hold 4.5 million BTC, an 800k decrease since May.

The report revealed that the asset is seeing a demand deficit. Demand momentum sinks to -2 million, the lowest ever recorded.

However, data from Santiment indicated that Bitcoin is experiencing a divergence between the trajectories of larger wallets and smaller ones. It suggests that this trend happens near the end of the selloff, hinting at a possible reversal.

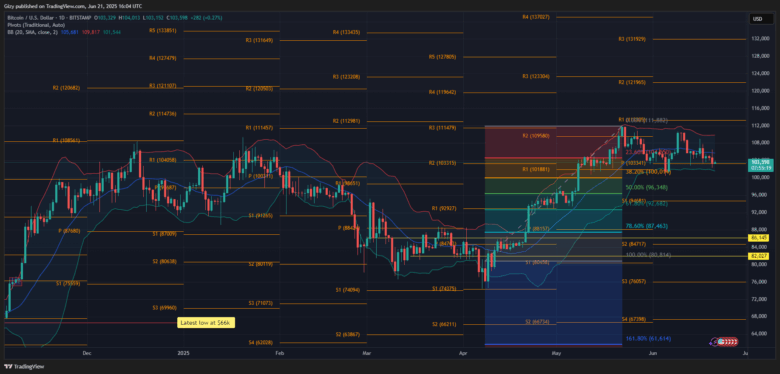

Indicators on the 2-hour chart support this claim, as the RSI is on the rise, indicating increased buying pressure. MACD prints buy signals as the 12 EMA edges closer to the 26 EMA in a bullish convergence. Bollinger Bands hint at the coin’s possible return to $105k.

However, previous price movements on the 1-day raises concerns over the price action. It is worth noting that the apex coin broke below its seven-day low on Friday. A drop to $100k is almost inevitable as the demand concentration around the $103k support dwindles.

The pivot point standard suggests that Bitcoin may continue to hover around $103,000 before a major breakout. Other indicators like the Bollinger bands hint at an impending descent to $101k.

Conversely, the apex coin was in a range-bound movement over the last three days. It may continue this trend, hinting at a return to $105k. The relative strength index remains neutral but indicates a slight increase in buying pressure.

Find Cryptocurrencies to Watch and Read Crypto News on the Go Follow CryptosToWatch on X (Twitter) Now