XRP has been riding the recent altcoin surge wave, hitting a new all-time high on July 18. The token reached as high as $3.66 and moved around this range all through the week starting July 14.

The weekly session saw XRP start at $2.83 before gradually pushing above the $3 mark. The uptick continued, with the token eventually peaking at $3.66, its all-time high. Despite a minor pullback after the rally, it closed the session with a gain of over 21% over the previous week.

Before the surge above its all-time high, XRP’s July 16th 24-hour chart showed the token was struggling to break even at $3.10 but showed signs of a slow build-up amid mounting selling pressure.

Nonetheless, this changed on July 17 when news broke that the CLARITY and GENIUS Act, also known as the “Crypto Bill”, had been signed. This news triggered the token’s surge, sending a wave of optimism through the XRP community, with investors anticipating a more supportive regulatory landscape that could set up Ripple’s momentum for long-term growth.

Ripple’s CEO, Brad Garlinghouse, has praised the bill signing, calling it a “historic moment” and adding that it cements the US’s future as a leader in innovative stablecoin technology.

One key point in the bill is its stance on CBDC. The GENIUS Bill, alongside the Anti-CBDC Surveillance State Act, is against the issuance of a CBDC; it instead focuses on regulating stablecoin issuance through banks. This is important as Ripple has its stablecoin, RLUSD, that has drawn attention from speculators this year. A Fed-backed CBDC might stifle its expansion of privately issued stablecoins like RLUSD.

Investors expect RLUSD’s popularity to cause an increase in the use of the XRP Ledger. The XRPL’s usage is tied to its native token burn mechanism. An increase in usage would mean more XRP burning, which would then trigger a reduction in its supply and act as deflationary pressure.

Fundamentals aside, XRP appears to be entering a cooling phase. As momentum slows, speculations are heating up about how the token will perform in August.

XRP to See Massive Decline in the First Week

XRP has struggled massively in maintaining its upward price momentum since it broke its ATH. On July 23, the altcoin dropped significantly from $3.55 to $3.05, closing the day with over 10% in losses. The 24-hour chart shows bulls tried reviving the rally but failed as the coin bottomed out at $3.20.

XRP is currently trading at $3.03 with a loss of 2.29% as selling pressure mounts. Technical indicators suggest the coin will see further price declines in the coming days.

Additionally, the altcoin is currently trading beneath the middle line of the Bollinger Bands after an unsuccessful attempt to break above it. It had previously breached the upper band just a few days ago. However, its current position below the simple moving average (SMA) raises the possibility of a downward move toward the lower band.

The metric is currently hovering around $2.72. This level could be its early August trajectory. While historical price patterns hint at a possible bounce after touching the lower Bollinger Band, the coin will likely rebound.

If strong fundamentals continue to back the asset, XRP could be poised for a push toward a retesting of its all-time high and surpassing it. However, failure to hold the $2.70 support zone might result in a slip below $2.50 for the token.

SOL is on the Decline

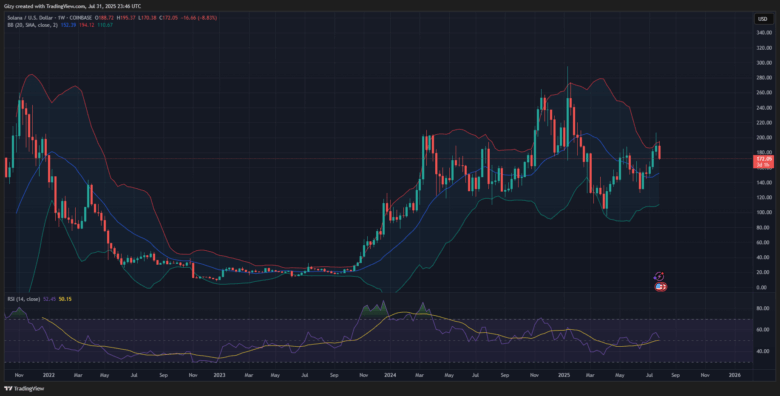

Solana has experienced significant downtrends, falling as far as 8% this week. It started the weekly session at $188, surging to as high as $195. It is currently trading at $173 as of the time of writing.

Notably, the 7-day Solana chart reveals a shift in market sentiment. The token is printing its first red candle following four successive green candles. SOL had previously broken above $200 the previous week, surging to a week-high of $206 before reversing its gains.

Despite the retracement, SOL has held its own and is backed by several fundamentals. Top asset managers have filed applications for spot Solana ETFs with the SEC. Its pending approval saw traders accumulate more SOL with renewed enthusiasm.

Solana has also seen heightened interest from institutional actors over the past few weeks. July 10 saw Chinese company Bit Mining Limited unveil a strategic plan to acquire Solana and expand into the token’s ecosystem. It revealed plans to raise about $250 million in parts to make the acquisitions

US-based Upexi also joins Bit Mining Limited on the list of institutional investors acquiring Solana. The company is planning on acquiring SOL using the proceeds from a signed equity line agreement with A.G.P./Alliance Global Partners, allowing it to sell up to $500 million worth of its stock. The capital raised will be used to pursue its Solana treasury strategy.

Solana Risks Crashing to $150

Solana’s performance will be off to a rocky start next month. Its weekly chart indicates bearish sentiments, and the token might see a steep pullback triggered if it fails to break past the upper Bollinger Band. Multiple rejection candles formed at resistance show increased selling pressure, meaning SOL could be dragged into a short-term downtrend.

The downward momentum shows no signs of slowing. If the current trend continues, Solana could fall toward the midline of the Bollinger Bands near $152, close to the $150 support level. A decline below that zone could potentially drag SOL down to $140.

However, the daily chart suggests a path to recovery for Solana. The Relative Strength Index (RSI) is at 48, showing neutral momentum. If selling pressure intensifies, the RSI could fall to 30, indicating the token is oversold.

Despite the predictions, it is unlikely the RSI will reach as low as 30. Technical indicators reveal that SOL could remain under pressure in the coming days. The likely outcome is the token bottoming out between $150 and $140 before the next rally.

Looking ahead, the second week of August may bring a shift in sentiment. Once SOL finds support, buyers could step back in and drive a modest recovery. However, with the current price at $173, the chances of SOL hitting a new ATH shortly remain improbable.

Find Cryptocurrencies to Watch and Read Crypto News on the Go Follow CryptosToWatch on X (Twitter) Now