Top Five Cryptocurrencies to Watch This Week (Feb 22)

The market closed the past week at $1.74 trillion. The sector was estimated to be over $1.88 trillion at the start of the week. It hiked above $1.90 trillion before the end of the intraday session on Monday.

Traders were thrilled as the industry peaked at $2 trillion over the past seven days – oblivious to the impending downtrend. The more than 8% that was lost due to the downtrend left the buyers in shock as we observed a rapid change in market sentiment.

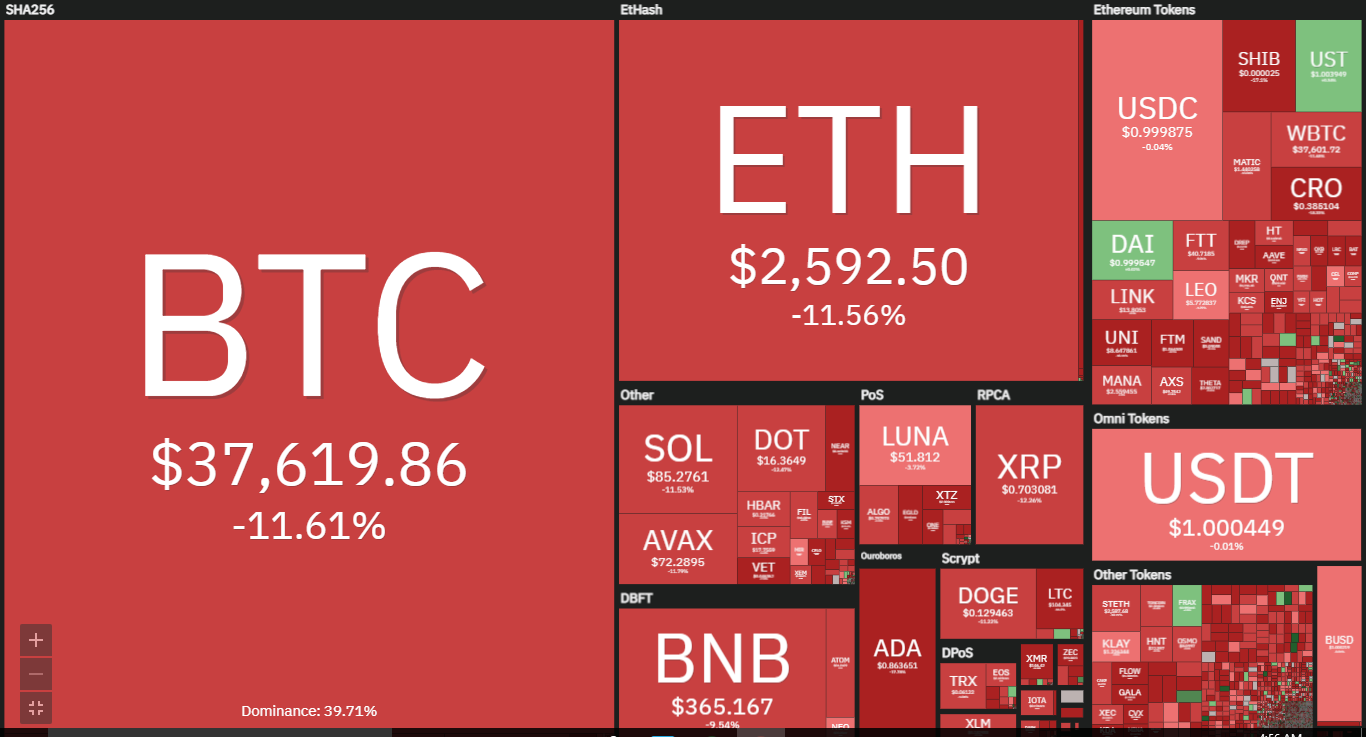

Following the start of a bearish grip on the market, most projects in the top 100 are down by a few percent. The image below further shows how some assets are in the top 100. EGLD is the top loser as it lost more than 30% during the current intraweek session.

Source: Coin

Market sentiment is returning to fear as the Fear and Greed Index is currently at 20. The absence of price defining stories has also contributed to the current state of the industry. However, mass adoption continues as Jared Polis, Governor of the U.S. state of Colorado, has confirmed that the state will soon start accepting cryptocurrencies for tax payments.

Many are unsure of the next market action as tensions between Russia and Ukraine have started to affect stocks. Will it affect crypto prices?

Table of Contents

The Top Five Cryptocurrencies to Watch This Week

1. Bitcoin (BTC)

Last week, Bitcoin opened trading a little dull as it closed the first day of the week with minimal loss. It picked up momentum as the intraweek session progressed. It gained more than 5% over the next 48 hours – sparking hopes of a return to $45k.

Unfortunately, expectations were squashed as the largest digital asset started a downtrend on Thursday. Like the previous session, BTC lost all its gains and may close the losing 9% as it opened the period under consideration at $42k and is currently exchanging at $37,500.

Many critical levels were lost during that time. One such is the $40,000 support lost its strength as it flipped on Sunday and the largest cryptocurrency dipped as low $38k. As the correction intensified, the $37,000 support also broke the apex coin hit a low of $36,350 a few hours to the time of writing.

The week ended with BTC experiencing a bearish divergence as indicated by the Moving Average Convergence Divergence (MACD).Additionally, the histogram associated with the Moving Average Convergence Divergence also prints a gradual downtrend in demand.

The Pivot Point Standard also suggests that the top asset may have fallen into another bearish dominance as it is currently trading below its pivot point. In other words, the past intraweek session closed with the bulls having more to worry about.

Bitcoin is gradually picking up momentum as at the time of writing. However, many worry that a repeat of the past seven days of events may play out. If this happens, BTC may be left trading below $35k. Nonetheless, if the current trajectory is sustained, the apex coin may resume exchanging above $40k.

2. Ripple (XRP)

XRP was one of the few coins that recorded significant gains two ago. The buyers would have hoped for a continuation of the past momentum as XRP was one of the few tokens to end that period in profit. The digital asset gained more than 17% during that time.

Unfortunately, the reverse was the case as the closing price suggests that ripples have succumbed to the general market sentiment as it is down by more than %4. Nonetheless, the coin saw a high of $0.86 and a low of $0.75.

Currently down by more than 12% over the last seven, the buyers will hope for a rally. However, this is unlikely as MACD’s histogram indicates the increase in selling pressure as the bulls fail to concentrate demands at $0.75 – leading to the token trading at $0.70 as at the time writing.

If the bears’ dominance on the market continues, XRP may close the week exchanging below $0.65. A change in the coin trajectory may guarantee a retest of the $0.72.

3. Decentraland (MANA)

Decentraland lost almost 5% last week as it saw a low of $2.61 and a high of $3.4. The end result of the previous intraweek session was not favorable as the buyers appeared to have the upper hand in the market at the start of that period.

Some of the critical levels that were lost during the timeframe include $3.3 as well as $2.8. As the token lost these levels, it opened the $2.5 support for testing. Currently trading close to the highlighted mark. It is only a matter of time until the barrier gets tested.

Unfortunately, we can’t turn to indicators as they are all still bearish. Why is MANA one of the cryptocurrencies to watch this week? Decentraland experienced a bearish divergence barely five days ago. However, we note that as bigger coins fail to surge, the token is known to be a safe haven for investors.

The above scenario played out last month and may likely be repeated this week. Nonetheless, we note how the bulls are currently holding $2 support. Further defense of this mark may result in the metaverse token testing $2.8 and flipping further resistance. Additionally, a slip of the $2.5 mark may send MANA as low as $$2.

4. Sandbox (SAND)

Sandbox is one of the worst-hit coins by its bearish dominance. The token hit a high of $4.46 but closed at $3.16. Opening in the past seven-day period at $4, the closing price shows a more than 20% deficit. The week ended with the Bulls plotting a comeback.

Recent attempts have failed as the metaverse token the retracement extends. SAND briefly went below its 200-day MA over the last 24 hours. However, the buyers appear to have gotten a grip on the market as the coin has gained 5% since the start of the intraday session.

The sudden turn of events during the past 24 hours has resulted in the token regaining the $3 support and gaining little stability above it. Nonetheless, SAND is down by a few percent in the weekly timeframe and is leading traders to ask if the asset will keep defying prevalent market sentiments.

Why is Sandbox one of the cryptocurrencies to watch this week? Current price movements suggest that the coin may experience more uptrends. Additionally, the metaverse token saw a bearish divergence barely five days ago. However, we note that as bigger coins fail to surge, the token is known to be a safe haven for investors.

The above statement is further proven as we observe the increase in cryptocurrency trading volume with buying pressure exceeding supply. We also note how the bulls are currently holding $3 support. Further defense of this mark may result in the metaverse token testing $3.5 and flipping further resistance. Although the grip on this level is not strong a price slip may send SAND as low as $2.8.

5. Gala (GALA)

GALA lost more than 10% last week as it opened at $0.28 and closed at $0.25. The cryptocurrency was a high of $0.36 and low of $0.24. Gala lost the 50-day MA during that time as it failed to sustain the early it had.

The fairly new project is currently exchanging at $0.23 per unit – a stark reminder that the digital asset lost critical levels during the past intraweek trading sessions. One of the key supports that was lost during that period is the $0.25 which led to further downtrend.

The last three days have seen GALA stay above $0.20 – making the mark a critical support. However, the coin is experiencing the same sentiment as the preceding cryptocurrencies, as we noticed that the cryptocurrency is down by almost 7%. Why is it one of the cryptocurrencies to watch this week?

Current price movements suggest that the coin may experience more uptrends. Additionally, the fairly new token saw a bearish divergence barely five days ago. The most recent uptrend may soon see the coin enjoy a bullish convergence.

Conclusion

This article highlighted five cryptocurrencies to watch this week. The above predictions coming true largely depend on market conditions remaining relatively stable for most parts of the next seven days, which of course is not guaranteed. The volatile nature of the crypto space means investors and traders must do their own research and always keep an eye on the charts