The start to December was not what most traders and investors anticipated when picking cryptocurrencies to watch. The market is off to a slow start as various cryptocurrencies see little or no increase on the first day of the month and this trend is still present at the time of writing.

The slow start becomes more evident in the past week as the crypto market went from the little skirmishes between the bears and the bulls to an all-out confrontation that left the latter defeated and the industry losing more than $300 billion.

Following the price drop that saw the industry dip as low as $2 trillion, we are seeing buybacks across the market at this time. As a result, the industry is up by more than 5% over the past 24 hours. The market is currently worth more than $2.38 trillion. The current valuation of the market shows a slight recovery from $2.05 trillion – in the last seven days.

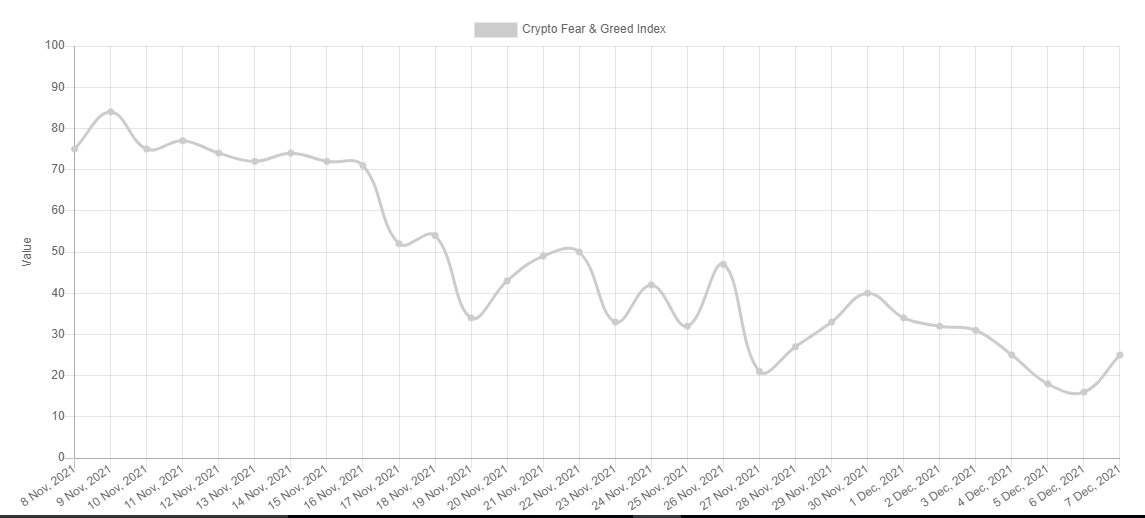

Market sentiment at this time shows various cryptocurrencies enjoying more hikes and coming out of bearish dominance. The image below further explains the current situation of the industry. However, it is important to get an overview of what transpired in November as it will help project the possible outcome for this month.

During the first ten days of the past month, we note that the industry has seen tremendous increases in trading activities that have resulted in all-time highs for some cryptocurrencies. Unfortunately, the market was plagued by multiple FUDs that caused it to conclude in losses for the largest crypto assets.

One notable event that preceded the dip is China’s issuance of stern warnings to its state-owned enterprises (SOEs) against involvement in cryptocurrency mining activities. Other personalities like former presidential aspirant to the United States Hillary Clinton voiced negative concerns about cryptocurrencies.

The bulls also had the spotlight as Michael Saylor, revealed that MicroStrategy has bought about 7,002 BTC for a whopping $414.4 million in cash. El Salvador joined the firm in showing that it is unwilling to give up its position as one of the largest holders of bitcoin, as it also bought more than 150 units.

The Fear and Greed index hit 21 – its lowest over the past thirty days. The market was notably bearish over the last 15 days of the eleventh month. The industry is currently the same as the metric displays 25 as its current reading and hints at extreme fear in the market.

Following the massive wipeout last week, there has been no solid reply from the bulls aside from the small surges. Will we see a retaliation or will the bears extend their dominance?

Cryptocurrencies to Watch in December 2021

1. Bitcoin (BTC)

Bitcoin came out of the preceding month with losses of more than 7% as it closed at $56,974. The top coin saw a low of $53,300 and hit a high of $69,000 (ATH). Starting the last few days of the year on a rather cold note, many are skeptical of BTC outcome at the end.

Considering the ever-changing scene of the crypto market, it is only logical to consult previous records to get a little incite into the apex coin actions in the next few days. December is one of the many bullish months of the year.

This is illustrated in the image below as it shows only four of the eleven Decembers since 2010 have ended negatively for BTC. Although the four losses have nothing in common, a pattern is created when we split these months in two.

Another notable thing about the period under consideration is that the last month of the year seems to have a cushioning effect from the eleventh. For example, in 2018, bitcoin lost 32% in November and 9% in the next month. The same was seen in 2019.

Unfortunately, this is not the case with the largest cryptocurrency right now. The situation is worse than it was in November, as bitcoin is down by 13%. Are the records useless in this case? We note that BTC has also seen relative stability as it consolidated especially in 2018/19.

Following the same trend, the apex coin may range for the rest of the year, with few hikes and dips. What do the charts say? The charts only show how deep the first existing cryptocurrency is in its bearish dominance and shows no signs of recovery anytime soon.

2. Ethereum (ETH)

Last month, traders were hopeful that the second largest asset will hit $5,000 but it failed after surging to an all-time high above $4,800. The largest altcoin closed the preceding month at a 7% increase. Now, the hope seems to dwindle following the recent happenings in the market.

Nonetheless, previous market actions over the last two months of the year hinted at the possibility of Ether retesting, perhaps exceeding its all-time high. The image below suggests that overall, December is one of the bullish months for the asset under consideration.

The depiction also suggests that the last month of the year is better than the preceding in terms of price hikes. Considering the level of increase ether saw in the eleventh month, we may expect better performance in the concluding days of the year, and possibly a 10% increase as per the observations.

What do the charts say? As with BTC, the charts only show how deep ethereum is in the bearish dominance and show no signs of recovery anytime soon. However, we spot an uptrend in the making that started three days ago.

3. Terra (LUNA)

On November 30, Styllar recently announced their release of collectible NFT avatars on Terra (LUNA), each completely custom and of the highest quality on the blockchain. The collection is said to merge pop culture, fashion and NFTs into life

Many will remember Solana as one of the fastest rising coins. The secret to the surge the token saw was the launch of an NFT collection on its ecosystem. Similarly, Terra also has the same opportunity and so far has shown a lot of potential earning a place in the top cryptocurrencies to watch this December.

Last week, LUNA became the tenth largest coin by market cap as it rose as high as $85 – the new ATH. The above chart shows that the coin is not slowing down as it still maintains the uptrend. This crypto could end the year above $90.

4. Polygon (MATIC)

Polygon is one of the many cryptocurrencies to watch this month as it is in a league of its own. The coin closed the past week at a 24% increase and starting a new week with the same bullish trend. The coin is still on the rise at the time of writing.

Trading above $2.5, MATIC is showing no signs of slowing down as it has been up by 24% since the start of the week. Judging by this pace, it is safe to conclude that Polygon may end the year above $3.

Conclusion

This article highlighted five cryptocurrencies to watch this month. The above predictions coming true largely depend on market conditions remaining relatively stable for most parts of the month, which of course is not guaranteed. The volatile nature of the crypto space means investors and traders must do their own research and always keep an eye on the charts

Find Cryptocurrencies to Watch and Read Crypto News on the Go Follow CryptosToWatch on X (Twitter) Now