Bitcoin bears may be winning the struggle for dominance, as the apex coin retested a significant level a few hours ago.

The 2-hour chart shows that the cryptocurrency began a decline at noon (UTC), which resulted in a retracement from $109k to $107k. It rebounded but left the bulls with notable losses as long positions worth $29 million were liquidated.

Although this is not the first time apex coin has hit this level, there are several concerns this time. The one-day chart indicates that this is its lowest in three days. Fears of further declines are intensifying as analysts predict further downside movement.

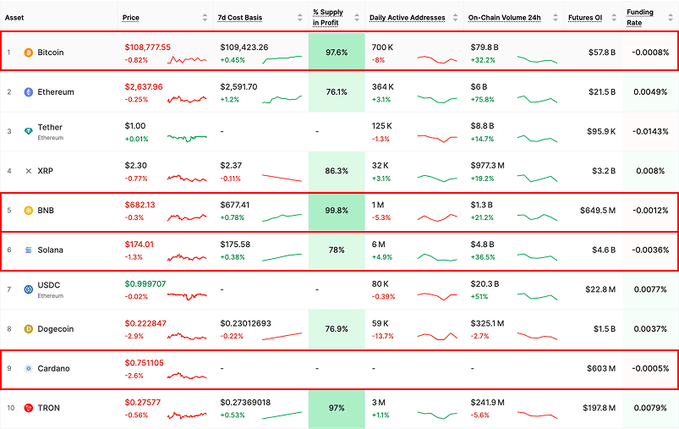

Data from Glassnode indicates that BTC may be in for further price decline as several on-chain metrics shift bearish. There is an increase in spending from addresses between 1 and 5 years. The platform shows this is the highest since February. Further breakdown reveals that the largest spending comes from addresses between 3 and 5 years old.

The platform shows more reasons for concern. The chart above depicts the funding rate across several exchanges. BTC funding rate is negative, indicating a significant decline in liquidity inflow. A lack of inflow will result in further decline as selling pressure intensifies. The bulls will be unable to soak up the excess supply. It is worth noting that there is a surge in short positions as the bears anticipate further retracement.

Nonetheless, the number of whales is growing. Bitcoin currently has over 1,455 large holders. These players are following the example of large institutions. Strategy announced another massive purchase a few days ago. BlackRock revealed it went shopping, acquiring over $400 million worth of the asset.

Bitcoin Remains Positive on the Derivative Market

Data from CryptoQuant shows that the apex coin is receiving notable attention in the derivatives market. The taker buy-sell ratio is above 1, indicating that the asset is seeing significant long position creation. This may be the case as Open interest slightly increased in the last 24 hours.

However, the spot market continues to print further bearish signals. The Fund Market Premium is negative and has remained this way for most of the previous seven days. Fund holdings have declined significantly over the last 48 hours. The Coinbase and Korea Premium are both negative as the asset sees less funding from these regions.

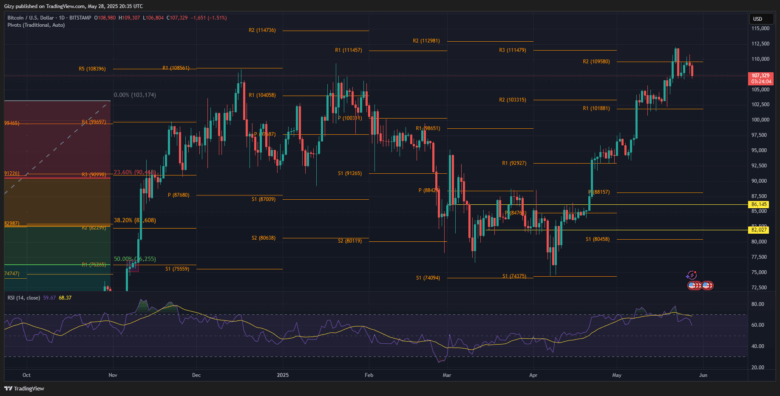

Indicators are currently bearish. The moving average convergence divergence displayed a negative crossing last week. The divergence is ongoing, with no signs of improvement at the time of writing.

It is worth noting that the relative strength index was above 70 a few days ago. The ongoing downtrend is in response to the asset being overbought. RSI is at its lowest value in the last three weeks as selling pressure increases.

The average direction index is declining. It has been on the decline since Friday, suggesting that the downward pull outweighs the push for more surges.

The pivot point standard indicates that the apex coin has failed to decisively break the second resistance level over the last five days. Following its repeated failure, Bitcoin may retrace to the first pivot resistance at $101,800. Nonetheless, it sees notable demand concentration around $106k

Find Cryptocurrencies to Watch and Read Crypto News on the Go Follow CryptosToWatch on X (Twitter) Now