Bitcoin thrilled many investors with its fresh milestone. It opened Thursday at $109,696 and surged after a slight retracement.

The apex coin broke the $110k resistance, setting a new all-time high, greater than January’s. The surge continued until it peaked at $112k. Traders now have a double celebration: one for Pizza Day and the other for the ATH.

Since attaining the latest milestone, Bitcoin has been grappling with significant selling pressure. As a result, it trades at $110k, over $1,000 from the high.

Nonetheless, the reaction to the new ATH was tremendous. Many took to X to express their excitement about the asset hitting $112k. Others traded those who sold earlier and praised buyers who bought around $76k when others panicked and sold.

The latest event strengthened investors’ resolve to buy more Bitcoin. One such is Strategy. The world’s first corporate bitcoin holder announced plans to increase its fundraising by $2.1 billion through a new stock offering. While the company said the funds would go to other needs, it hinted that it would buy more BTC with some.

Fundamentals continue to play a significant role in the uptrend. The week started with institutions and the government expressing confidence in the largest cryptocurrency. Texas joined the list of bullish states in the US by passing the SB21 bill, which allows the state to create a Bitcoin reserve.

Nonetheless, the ATH was not all rosy for everyone. The bears lost over $107 million in the last 24 hours, and the short positions were liquidated after the bulls lost over $20 million.

Derivatives Remain Active

Despite losses, traders remain active in the derivatives market. Open interest grew by almost 7% in the last 24 hours. The takers’ buy-sell ratio is above 1, signifying that the asset is seeing notable buying pressure.

However, these are the only bullish trends across onchain data as the apex coin may be gearing for a massive correction. Exchange reserves are increasing amid the bullish milestone. They increased by over 0.20% in the last 24 hours. The enormous change and gap between the exchange inflow and outflow is responsible for this reading.

The total number of BTC moved into these trading platforms exceeded 49k, as opposed to 43k outflow. This increase means fewer investors are moving to cold storage or other utilities. They are slowly becoming bearish and taking profit.

The Fund Market Premium is currently negative as more ETF holders are selling their positions. Fund Holdings shows a slight decline in holders over the last 24 hours.

What’s Next for Bitcoin?

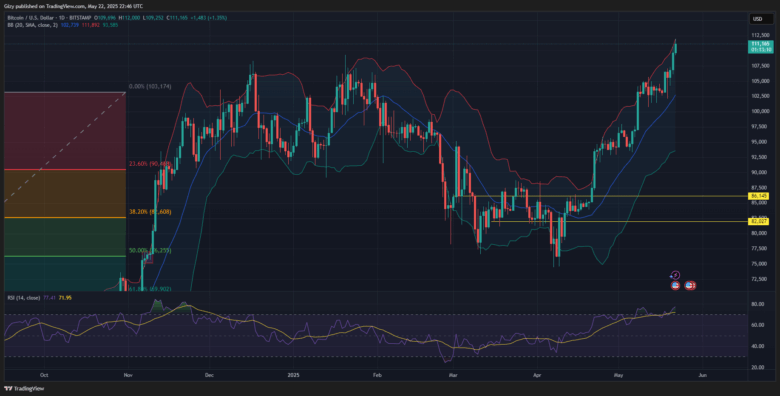

Bitcoin tested the bollinger upper band but failed to breakout. The current price shows that although it is close to breaking out of the band, it may see further price increases. This is the same reading on the average directional index. The metric is on the uptrend and shows no signs of halting as the buying pressure continues. Some traders predict a possible surge above $115k soon.

On the other hand, the largest coin is overbought. RSI is at 77, which means it is due for corrections. When this will happen is one that only time will answer. Nonetheless, BTC will slip as low as $102k.

Find Cryptocurrencies to Watch and Read Crypto News on the Go Follow CryptosToWatch on X (Twitter) Now