The cryptocurrency market witnessed a period of peak volatility last week. The past seven days ended with the bears being the undisputed winners during their struggle for dominance. Market fundamentals played a big role in the end result of the past week.

The biggest correction that ravaged the various cryptocurrencies during the time under consideration was in response to a new COVID-19 scare. Pfizer, one of the leading companies in the Corona Virus vaccine production, discovered a new COVID-19 variant, designated “Nu,” which some parties claim could pose a problem for vaccination.

The announcement was met with panic as both the crypto industry and stocks responded with massive selloffs, as many feared the worst. Amidst the panic, experienced investors took advantage of the retracement and added more coins to their portfolio.

For instance, El Salvador’s President Nayib Bukele revealed that the country added 100 Bitcoin (BTC), approximately $5.4 million to its portfolio. The country has continued to show no sign of ever going back on its bitcoin adoption decision as it continues to accumulate more of the digital asset.

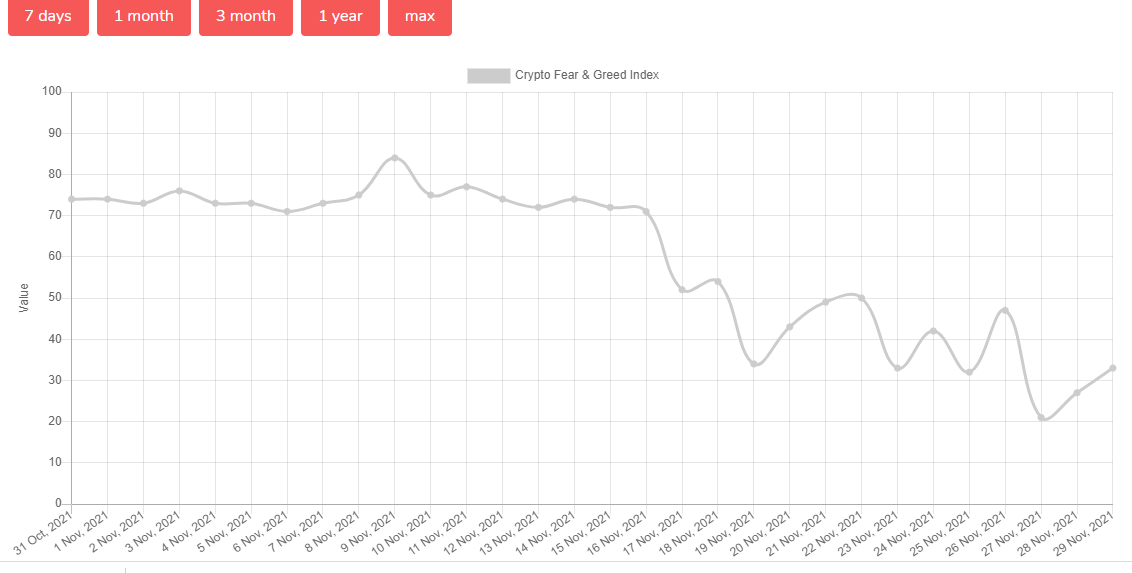

Some cryptocurrencies in the top 100 saw a late surge in the closing hours of the previous intraday sessions. Traders are looking more hopeful this week as reflected in the Fear and Greed Index. The metric dipped as low as 21 (the lowest in the last 30 days) last week but has gradually increased and is at 33 as of the time of writing.

Source: Alternative

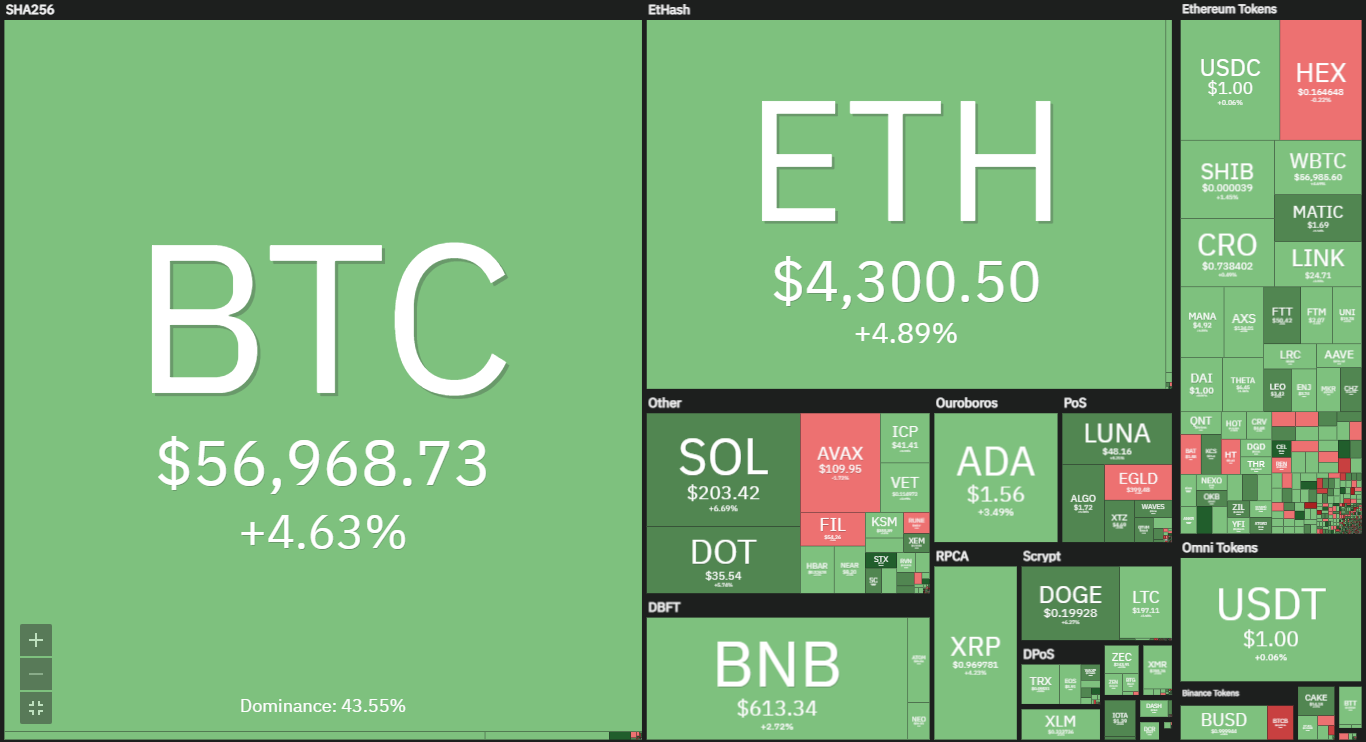

Still fired by the late surge yesterday, most coins are holding on to their leads as shown in the chart below. On average, almost every cryptocurrency has gained 3% over the past 24 hours.

(Source: Coin360)

Will the bulls follow up on the price growth or will the bears seize control? Here are the top five cryptocurrencies to watch over the next seven days.

1. Bitcoin (BTC)

The most valued cryptocurrency opened the week at $58,600 after suffering a more than 10% decrease last week. The king coin has shown a lot of progress six days ago as it gained more than 5% – sparking hopes of a return to $60k . The surge saw it leave the low for the week and take a step closer to $60,000 but falling short by less than $500.

Bitcoin saw a low of $53,524 and was about to end the past seven days in losses adding up to 5% but saved as a result of a rally over the past 24 hours. The top coin lost a little above 2% as it closed the week at $57,338.

One question on the minds of traders is whether the current price hike will continue through the next seven days. The answer to that question lies within how market fundamentals will play out in the coming days.

Adding to the worries of the buyer is that the most valued coin is trading below the Pivot Point at $57,250. The last seven days have seen the apex coin edge closer to testing the first Pivot Support at $47,500.

On the part of trend indicators, they all seem flat as there is no improvement since the assets crossed their various boundaries except one. The Moving Average Convergence Diveregence (MACD) is giving a spark of hope as the fast line is about intercepting the slow – hinting at an incoming uptrend.

The buyers may rally the apex coin as high as $60k this week as it is trading $57k. It is also important to note that the $59k resistance is one tough level to reckon with. Further slip into bearish dominance may result in Bitcoin dipping as low as $52,000.

2. Binance coin (BNB)

The largest exchange native token is one of the few cryptocurrencies to close in the past week in profit. The project closed at an almost 5% increase higher than it started. BNB has been hitting new highs en-route to a blockchain upgrade that is expected to make the asset more deflationary.

The last seven days saw the project hit a low of $550 and suggest that we may see a better low in the next seven days. Trading at $620 as of this time, $570 may be a level to bank on as most attempts to flip have been futile. Additionally, BNB may revisit $680 in the days leading up to the upgrade.

3. Ripple coin (XRP)

The last seven days marked the third consecutive period of loss. The sixth coin by market cap continued its downtrend after losing more than 10% two weeks ago as it loses 8% over the past seven days. The Moving Average Convergence Divergence (MACD) shaded more light as to why the seventh-largest crypto-asset keeps dipping.

Now MACD is showing a bit of good news as the bearish interception that took place and triggered a massive selloff is about to hit the reverse. This may be the needed boost to surge above $1.2 in the next seven days. The current price of XRP still suggests that the $0.90 support is still open for testing.

4. Sandbox (SAND)

SAND has been in a league of its own with the tremendous hikes it’s been experiencing. The project has made flipping its all-time high a tradition. The coin has seen a growth of more than 87% over the last seven days.

Trend indicator: Pivot Point Standard shows that $SAND is extremely bullish as it is currently trading above the fifth pivot resistance. MACD also agrees with the latter as both readings are the same.

On the other hand, price movement is painting a different picture. The SAND/USD pair have tested the $6 support thrice over the last six days but failed. We may see a retest and possible flipping mark this week.

5. Decentraland (MANA)

Following a more than 200% increase during the last seven days of October, the metaverse token took a short break and returned to bullish. The uptrends extended to the past week as Decentraland gained 41%.

As with Sandbox, the Pivot Point Standard shows that MANA is extremely bullish as it is currently trading above the fifth pivot resistance. MACD also agrees with the latter as both readings are the same.

On the other hand, price movement is painting a different picture. The MANA/USD pair have tested the $4.37 support thrice over the last six days and with just one success. We may see a retest and possible flipping mark this week.

Conclusion

This article highlighted five cryptocurrencies to watch this week. The above predictions coming true largely depend on market conditions remaining bullish for most parts of the next seven days, which of course is not guaranteed. The volatile nature of the crypto space means investors and traders must do their own research and always keep an eye on the charts

Find Cryptocurrencies to Watch and Read Crypto News on the Go Follow CryptosToWatch on X (Twitter) Now