ETH saw a massive decline a few hours ago, plummeting to $3,302. The largest altcoin experiences lesser selling pressure than the previous day.

Nonetheless, the global cryptocurrency market cap significantly increased in value despite the declines. Some altcoins recovered, almost erasing Thursday’s losses. Valuations hit $3.42 trillion, representing a 3% positive change.

Bitget Token made waves despite the bearish sentiment across the market. Investors massively bought the asset, resulting in it flipping several key levels. It attained a new ATH a few hours ago. It flipped $8 and peaked at $8.49. BGB trades at $8.13, up by over 11% as it gradually loses momentum.

Solana-based memecoin Moodeng sees significant increases due to fresh fundamentals. Ethereum co-founder donated $290k in tokens to the zoo, caring for the internet sensation Hippo.

Asset manager Bitwise submitted a proposal to launch a new fund to help buy stocks of publicly traded companies with a Bitcoin reserve. The firm targets companies with valuations over $100 million and holds 1,000 BTC.

The crypto market is recovering after the massive losses it incurred on Thursday. Let’s examine how some assets in the top 10 are performing.

BTC/USD

Bitcoin saw more selling on Thursday as trading volume increased by more than 5%. Price action suggests that most of the volume was from selling actions. Onchain data revealed that the whale led the selloffs.

Data from sentiment showed that the addresses with over 1000 BTC limited their exposure after dumping their assets. Nonetheless, addresses with less than 10 BTC grew during this period.

Data from CryptoQuant revealed that US investors were more bearish as buying pressure hit a new low. The Coinbase premium remains negative in response. This is the same reading on the Korea Premium and funds premium.

Nonetheless, there is a significant buying pressure at the time of writing. Exchange reserves slightly decreased in the last 24 hours. More investors are moving assets from trading platforms into cold storage.

The one-day chart shows a the BTC/USD pair edging closer to the lower bollinger band. However, it lost momentum after peaking at $97,300 a few hours ago. Current price actions suggest reducing selling pressure and the bulls gradually gaining a foothold.

ETH/USD

Investors are moving more assets from cold storage to exchanges. The number of moved coins is five times higher than the previous intraday session. Nonetheless, the bulls are soaking up the growing supply as exchange reserves slightly decrease.

Data from the DeFiLlama shows growing bullish sentiment in the Ethereum ecosystem. Over the last 24 hours, the total locked value increased from 19.5 million ETH to 20.7 million ETH. However, more coins left the ecosystem. Outflows surged from 100 million ETH on Thursday to 137 million on Friday.

The ETH/USD pair peaked at $3,437 a few hours ago but retreated due to a significant change in trading conditions. It then tested the $3,300 support and rebounded. This is the second time the asset has tested this level in the last 48 hours. The growing pressure on it may result in the apex altcoin dipping below it.

The pair may find support at the 50% Fibonacci level. This is around the same price level as the pivot point, adding more strength.

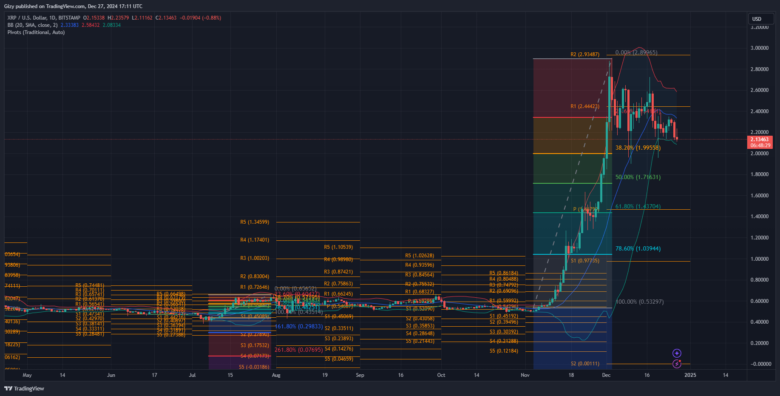

XRP/USD

XRP is marking its third day of consistent declines as it prints yet another red candle. On Thursday, it dipped from $2.30 to $2.12, closing with losses exceeding 6%.

The XRP/USD pair peaked at $2.23 a few hours ago but failed to continue the uptrend. It retraced, retesting the $2.10 support for the second time in two days. The mounting pressure on the barrier may result in its buckling. It may dip to the 38% fib level at $2.

Nonetheless, it may attempt to break out of the Bollinger band. As previous price movements suggest, XRP may meet a buyback at the lower SMA. The Fibonacci retracement points to a possible decline to the 50% level if the bulls fail to defend the $2 mark.

BNB/USD

Binance Coin is experiencing less selling pressure during the current intraday session. The bulls tried continuing the uptrend on Thursday but failed. The asset retraced after flipping its first pivot resistance and peaking at $719. It then dropped to a low of $682 before rebounding.

The BNB/USD pair failed to flip the R1 a few hours ago as it edged closer to it. It is back to its opening price after testing the $680 support, marking its second attempt at the mark. Rebounding off the mark suggests notable demand concentration.

Nonetheless, a slip may result in the pair testing the 38% fib level at $670. Failure to keep prices around this level may see the pair dip further to the 50% fib level.

SOL/USD

Data from DeFiLlama shows more Devs and users interaction with the Solana ecosystem. The total locked value increased from 42.8 million SOL on Dec. 26 to 44.5 million SOL on Dec. 27. The chain’s revenue increased to 9.6k SOL on Friday from 6.28k the day before.

The SOL/USD pair is yet to reflect the growing confidence in the asset. It peaked at $194 a few hours ago but retraced to a low of $182—nonetheless, current price action points to a lesser selling pressure. The decline of less than 2% may be an attempt at recovery following the 4% dip the previous day.

Although trading close to the 61% fib level, it risks further descent to the 78% fib level at $168. Nonetheless, the first pivot support may be the first defense before hitting the mark.

DOGE/USD

The DOGE/USD pair continues trading above $0.30. Nonetheless, it tested the mark a few hours ago but rebounded. It prints its first green candle in three days. This comes after a 6% dip that saw it retrace from $0.33 to $0.308.

Currently printing a green candle, the bulls are gradually gaining a foothold. The pair sees lesser selling pressure but risks further decline. If trading conditions worsen, it must reclaim the 38% fib level or may lose the $0.30 support.