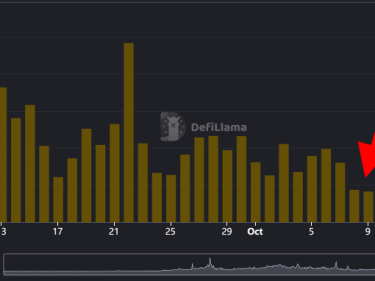

The current crypto bear market has seen several sectors within the industry set new records on the wrong end of the charts. The decentralized finance (DeFi) market is the latest to hit a new unpleasant record.

According to data on the industry tracker, DeFilLama, the total trading volume for decentralized exchanges (DEXes) hit a new low during the past weekend (October 8 and 9). The cumulative trading volume fell below the $1 billion mark, the first time it has fallen below that threshold since 1st January 2021.

(Source: DeFilLama)

The latest metrics are not entirely surprising given the overall cryptocurrency market cap has dropped from nearly $3 trillion approximately a year ago to under $900 billion at the time of writing. The prolonged crypto winter, buoyed by unfavorable macroeconomic conditions, has reduced volume and user demand for DEX swaps.

Amid the drop, however, several leading DEXes, including Uniswap, PancakeSwap, and Curve, have remained predominant. Ethereum-based Uniswap boasts 55% of the total valued locked (TVL) in DEXes. Pancakeswap ranks second with a distant 13% market share, and Curve completes the rankings with 9.30%.

Three of the top leading DEXes controlling roughly 77% of the global market share, provide insight into how lonely things have become on DeFi street. The TVL locked across DeFi protocols currently sits at $54 billion, representing an over 60% decline from last year’s November highs.

Is the bottom in?

Records on the wrong end of the chart might indicate that the market decline is close to its bottom, and a reversal may be in sight. However, investors will be keen to see other signs that life is returning to the DeFi space and the broader crypto market.

Ideally, a reversal of volume metrics for DEXes will be a crucial indicator that winter may be finally over and that spring is near!

Find Cryptocurrencies to Watch and Read Crypto News on the Go Follow CryptosToWatch on X (Twitter) Now