Most cryptocurrencies are yet to recover from the previous intraweek session. It was one that many would love to forget. One of the reasons for such a conclusion is the major correction the entire crypto industry suffered. Almost every cryptocurrency lost notable worth during this period.

The dip cannot be overemphasized as the crypto market value dips to its lowest in almost 10 months. In July 20, 2021, the crypto market was worth $1.2 trillion and since then, the sector has peaked at $3T.

For the first time in such a long while, the global cryptocurrency market cap is down by 20% in less than six days. Affirming this, the market opened the week at $1.57 trillion and then retraced below $1.3 trillion – losing almost 20%.

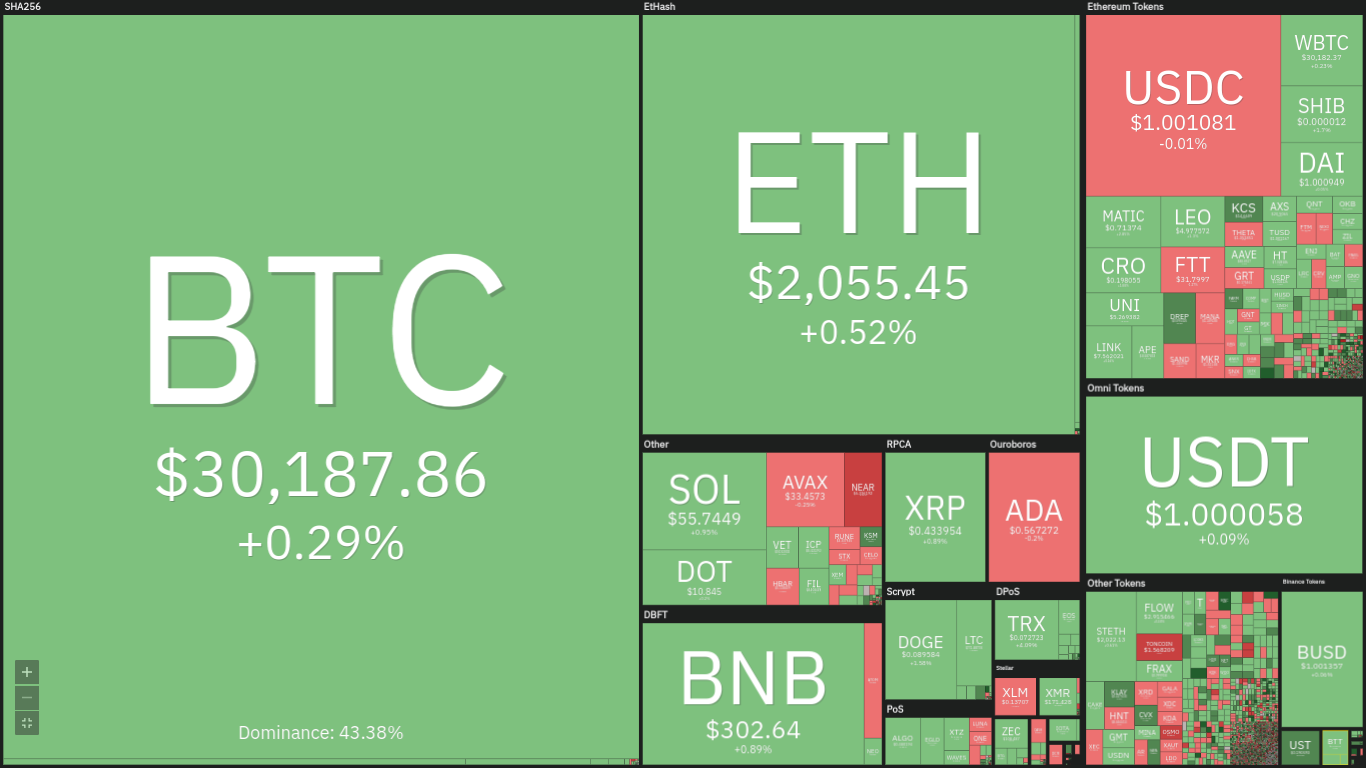

The chart beneath further expresses the state of the sector under consideration throughout last week. One of the good news from the depiction is that Bitcoin is regaining its market dominance as it increased from 40% to 43%.

Nonetheless, UST is down by more than 80% over the last seven days, which is unlikely for a stablecoin. The runner up is Fantom as it loses 54%. The top gainer is MKR as it has gained 12% during this period. Many may wonder why there are massive selloffs across the market.

80,000 Bitcoin Were Sold

The Luna Foundation guards in a bid to save the declining UST, sold all of its bitcoin reserves. 80,000 units were sold off and the effect of the trade resonated throughout the market. Unfortunately, the quest to halt the retracing stablecoin failed.

The consequences of this failure affected the governing coin of the blockchain, LUNA. As a result, it dipped for almost $100 to exchange at a few cents. Billions of dollars in market cap was lost and investors REKT.

The crypto market is gradually taking shape. The chart below affirms that the recovery is a gradual process and may take more time. Cryptocurrencies like KSM and KAVA are already seeing significant increases.

Source: Coin360

With a brief overview of the sector, here are the top four cryptocurrencies to watch this week

Top Four Cryptocurrencies to Watch This Week

1. Bitcoin (BTC)

Bitcoin lost more than 10% of its value last week. It was something that many never expected but it happened and the incurred losses are yet to be recovered. Monday began the spell of the downtrend.

Following a four-day dip, the bulls were expecting a surge as the new intraweek session began. However, after a small increase to $34,224 ($200 higher than its opening price), it met rejection and the coin retraced to $30,000, losing more than 11%.

Tuesday brought relief but not was significant as the buyers failed to sustain a surge to $32,650, leading to corrections. Nonetheless, the asset closed with a 3% increase. The next day, bitcoin lost twice its accumulated gains.

It dipped to $27,757 but ended the day losing more than 6%. BTC dipped to it lowest for the week Thursday as it retraced to a low of $25,401 (the lowest in almost a year). The concluding three sessions were marked by small increases.

The seven-day period closed with significant improvements in indicators. For example, the Relative Strength Index (RSI) has improved significantly as the once oversold asset is seeing moderate buying pressure. It shows as the said metric ended the period at 35,

This may spell goodwill for bitcoin, as the RSI rules state that an oversold cryptocurrency is bound for a rebound. We may be correlating surge to the stated rule. Additionally, the Moving Average Convergence Divergence (MACD) is also experiencing a bullish convergence.

It is also important to bear in mind the previous weekly trends of corrections on Wednesday and Thursday. This may deter further efforts above $31,000.

2. Zcash (ZEC)

Like most cryptocurrencies, Zcash experience increased bearish dominance on Monday. The selling pressure saw the 41st coin by market cap lose more than 18% as it retraced from $114 to $92.

The next day saw the bulls attempt a recovery but failed due to reduced demand concentration above $100. Opening at $92, the asset peaked at $104 but faced rejection and was sent down to its initial price.

Wednesday saw the continuation of the bullish struggle as the altcoin hit a high of $96 but lost momentum, leading the bears to capitalize. It retraced to a low $75 but recovered and closed at $83, losing 10%.

ZEC revisited a level not seen in months on Thursday but rebounded at $68 and received a significant boost to end the session with an almost 4% increase. The next three days were bullish as the asset gained almost 30%, erasing the incurred losses.

Due to a massive retracement on Wednesday, zcash became oversold but recovered as the week progressed. RSI is making progress towards 50 which may mean further uptrend for the token. MACD also indicates that the asset had a bullish divergence and is showing no signs of further decrease.

3. Maker (MKR)

Maker is one of the few tokens in the top 100 to see more upward trajectory throughout the previous week. While most cryptocurrencies saw at least three days of constant retracements, MKR experienced only two with reduced effects.

The asset under consideration experienced a more than 11% drop on Monday as it dipped from $1,1194 to $1,052. Tuesday brought comfort as the incurred losses were recovered. The token opened at $1,050 and peaked at $1,257.

It ended the session at $1,222 which indicates a more than 16% increase. MKR saw it biggest push the next day as it hit a high of $2,284 but lost the level and was sent as low as $1,074. Little improvement was seen and close at $1,130 was seen, suggesting a 7% decrease.

The next four days were marked by immense uptrends. For example, on Thursday, maker saw a 18% increase after a dip below $1,000. Subsequent sessions saw a 15% surge.

Due to a massive retracement on Monday, MKR was oversold but recovered as the week progressed. RSI has gained stability above 50 which may mean further uptrends for the token. MACD also indicated that the asset had a bullish divergence and is showing no signs of further decrease.

4. Kava (KAVA)

Like most cryptocurrencies, KAVA experienced increased bearish dominance on Monday. The selling pressure saw it lose more than 22% as it retraced from $3.4 to $2.6.

The next day saw the bulls attempt a recovery but failed due to reduced demand concentration above $3. Opening at $2.6, the asset peaked at $3 but faced rejection and was sent down to its initial price.

Wednesday saw the continuation of the bullish struggle as the altcoin hit a high of $2.7 but lost momentum, leading the bears to capitalize. It retraced to a low $1.7 but recovered and closed at $1.9, losing 30%.

The asset under consideration revisited a level not seen in months on Thursday but rebounded at $1.3 and but could not recover as it ended the session with a 14% decrease. The next three days were bullish as the asset gained almost 52%, erasing more than half the incurred losses.

Due to a massive retracement on Wednesday, Kava was oversold but recovered as the week progressed. RSI is making progress towards 50 which may mean further uptrends for the token.

The Moving Average Convergence Divergence (MACD) bears more good news as it indicates an ongoing bullish convergence. A divergence may result in the asset under consideration experiencing more price increases.

Conclusion

This article highlighted five cryptocurrencies to watch this week. The above predictions coming true largely depend on market conditions remaining relatively stable for most parts of the next seven days, which of course is not guaranteed. The volatile nature of the crypto space means investors and traders must do their own research and always keep an eye on the charts

Find Cryptocurrencies to Watch and Read Crypto News on the Go Follow CryptosToWatch on X (Twitter) Now