The past week has presented its challenges and triumphs for most cryptocurrencies. One of the beneficiaries of the positive sentiment that permeates the market during the period under consideration is the LUNA.

The coin seems to be making a comeback as it gained more than 120% over the last seven days. At the time of writing, it is worth $4.60. Closing behind this asset is RVN as it saw increases of more than 60%.

The global cryptocurrency market cap also saw notable increases as it slowly climbed above $1 trillion from $950 billion at the start of the week. It peaked at $1.05T and closed a little higher which signifies a 10% positive change in valuation.

With regards to fundamentals, the market seems to be riding on the upcoming Ethereum merge. There was also a video in circulation where Prince Charles, UK’s latest monarch, said Bitcoin was a good development.

It is safe to say there were more positivities than the opposite. Will it continue this week?

Top Five Cryptocurrencies to Watch

1. Bitcoin (BTC)

The past week marked the continuation of an uptrend that started two weeks ago. The bulls built on the lead they had and saw the apex coin gain more than 9% of its worth per unit. Bitcoin saw an increased amount of demand concentration at various levels which resulted in this feat.

During the first day of the week, we observed that the top coin failed to meet up with expectations as it recorded low trading volumes. There was low volatility and it failed to record any notable price change.

The market got heated up the next day as BTC faced strong rejections after an attempt above $20k. The intense selling pressure resulted in a dip to $18,669 and the largest cryptocurrency by market cap lost more than 5%.

Wednesday marked the start of another bullish round as bitcoin showed signs of recovery. The uptrend lasted till the end of the week. Nonetheless, the biggest move happened on Friday.

The apex coin opened at $19,300 and peaked at $21,600. It closed at above $21k and recorded a positive change of more than 10%. Several indicators hinted at more uptrends. One such is the Pivot Point Standard.

Bitcoin closed above its pivot point. The Relative Strength Index also peaked at 60 with MACD’s 12-day EMA surging. The previous intraday session fostered this claim as the largest cryptocurrency recorded gains of almost 3%.

Unfortunately, the current seven-day period is not starting off well as the previous. As of the time of writing, the largest coin by market cap is down by more than 8%. Although there seems to be little selling congestion at $20k, there are possibilities it may give way.

If this happens, the $18k support may see more pressure. However, we may expect more price movement between $19k and $20,000 before the retest. On the bullish side, bitcoin may struggle to reclaim key levels like $21k.

2. Ethereum (ETH)

The largest alt by market cap was more like the star of the crypto industry during the previous week as its biggest upgrade was slowly approaching. It enjoyed similar movements to BTC as it marked the second seven-day period of consecutive gains.

Ether had a good start to the previous week as it saw gains exceeding 2%. However, it lost momentum on Tuesday as it retraced from $1,687 to a low of $1,553. As a result, the coin lost almost 4%.

It saw recovery after a dip to the seven-day period low. It broke the $1,500 support and dipped and rebounded at $1,487. We may conclude the asset was bullish all the way from that point until the end.

Like the preceding cryptocurrency, ether saw its biggest increase on Friday. It climbed above its pivot point and maintained the edge throughout the period under consideration. However, it exhibited signs of correction on Sunday.

The same sentiment is present during the new week. The market seems not to be in favor of anyone as Ethereum is also facing severe selling pressure. Currently, it struggling to hold $1,580.

The current intraday session marks the second consecutive loss. Nonetheless, there are indications of more price movements ahead. One such is the Moving Average Convergence Divergence.

We observed that the most recent pressure has hastened the bearish convergence. This may spell more downtrend for the largest altcoin as the convergence is soon to be followed by divergence.

Considering the previous week’s low, we may conclude that ether may retest the $1,400 support. Based on the most recent state of the market, it is hard to tell if ETH will experience a rapid recovery. Nonetheless, if such happens, we may expect to see the altcoin reclaim $1,500.

3. Ravencoin (RVN)

RVN was the second biggest gainer during the previous week. The coin saw notable hikes that saw it achieve attaining levels it hasn’t in more than three weeks. it makes the list of cryptocurrencies to watch as indicators are hinting at a retest of another key level.

RVN had a similar performance as the previously highlighted coins. A good on Monday saw it surge by almost 12% as it opened at $0.034 and peaked at $0.039. The second day of the week came with a notable downtrend.

The correction started after the token saw strong rejections at $0.42. The bulls failed to defend the mark and the asset dipped as low as $0.037, signifying a more than 4% drop from its opening price of $0.038.

The next two days were marked with dojis, indicating the inability to record any notable losses or gains. This changed on Friday. A closer look at the chart reveals a longer candle than any seen in more than 60 days.

The token surged from $0.036 to a peak at $0.062. However, it met rejection and retraced to $0.056 which signifies a more than 50% increase from the opening price. A small candle the next and a red one on Sunday.

The previous intraday session reaffirmed that RVN may see more uptrend. Current trading action indicates that it may close the day with notable losses. A closer look at the indicators tells one reason for the downtrend.

We observed that the asset was overbought. Based on RSI rules a cryptocurrency that experiences that phenomenon is due for a correction. It is hard to say how long the price decrease will last, nonetheless, MACD and PPS are still bullish.

However, it is certain that traders should gear up for massive volatility. With price increases in view, we expect more attempts at key resistance. One such is $0.75. Several attempts at the mark have failed in recent times. It remains to be seen if the upcoming test will be successful

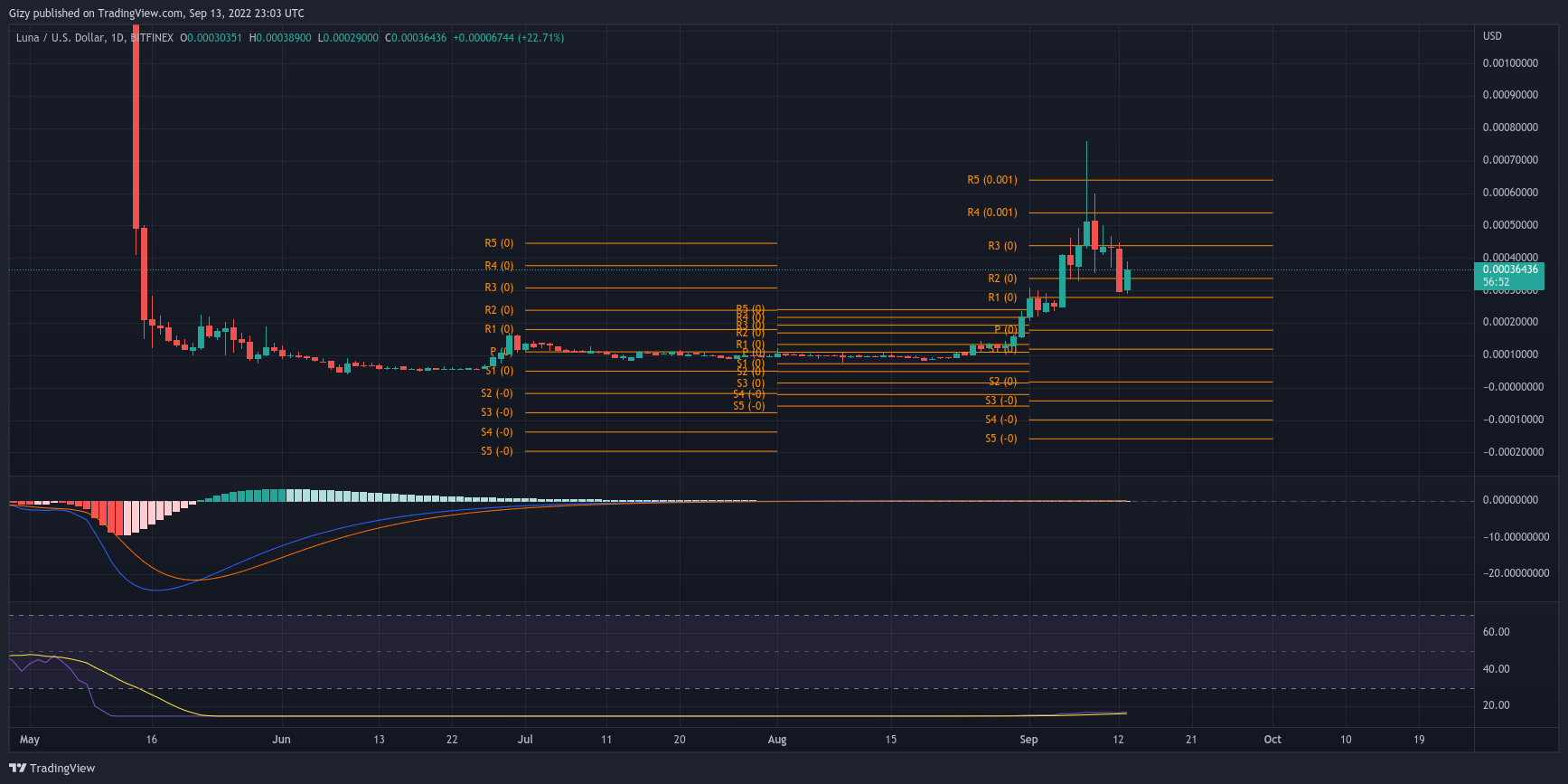

4. Terra (LUNA)

LUNA seems to be making a comeback from the previous near-closure experience it had. The last seven day was one of its best performances as it surged by more than 100%. There are worries that this surge may not last.

Nonetheless, price action over the last seven days may allay these fears. LUNA had a good start to the previous week. The coin opened at $0.00025 and closed at $0.00040, gaining more than 60% in the process.

The sudden spike in prices triggered a more fierce struggle for dominance between both trading factions. Terra peaked at $0.00046 but met strong rejection and retraced as low as $0.00033. The bulls fought back and rallied it to a close at $0.00038.

Massive volatility continued to unfold as the coin dipped to $0.00032. It bounced off the support and surged to a high of $0.00049. The rejection sent the asset to a close at $0.00043 which indicates a more than 14% increase.

LUNA saw its biggest hike on Thursday. It spiked to a level it hasn’t since May. A massive selling pressure sent the crypto under consideration as high as $0.00076. Like in recent times, the surge was met with fierce rejection.

As a result, terra closed as low as $0.00051. Nonetheless, it recorded gains of more than 14%. Such massive increases in seven days may lead many to wonder if the uptrend will continue.

It is important to note that the results from the past week may be an indication that traders are finally waking up to reinvest in the coin. If that is the case, the bulls may continue to rally the asset in the coming days

5. Mina (MINA)

Mina also had a good run during the previous week. Although it had a bad start, it picked up momentum as the seven-day period progressed. The first two days were marked with consistent downtrends.

The token lost more than 7% during those 48 hours. Mina picked up momentum on Wednesday with a 5% increase, recovering from the previous day’s loss. Little increases happened often throughout the week but failed to have any impact as the asset recorded no notable gains.

It is hard to predict price movement over the next six days. Nonetheless, there are strong indications that it will be filled with volatility. One key level to watch is the $0.62 support.

Find Cryptocurrencies to Watch and Read Crypto News on the Go Follow CryptosToWatch on X (Twitter) Now