Bitcoin saw notable buying pressure at the start of the day, surging to a high of $102,201. However, it trades slightly lower than the mark at the time of writing.

The apex coin is at risk of further declines as the bulls struggle to sustain the momentum. Indicators on the 2-hour chart reveal a significant spike in selling volume. The coin prints its first red candle of the day as it faces rejections at the peak. RSI is declining in response to the latest trend. Other metrics have since halted their uptrend and may flip bearish if the trend continues.

The largest cryptocurrency may continue its downtrend after several failed attempts to halt it. It had one of its biggest declines on Sunday, plummeting from $103k to $98k. The asset broke below the $100k support for the first time in almost two months.

Investors fear that the asset may return below the highlighted mark following the latest rejection. Data from Glassnode suggests that the cryptocurrency will likely experience more selloffs amid the over 10% increase in trading volume it is currently witnessing.

The platform noted that newer investors are facing increased pressure to sell their investments. BTC always rebounded above the short-term holders’ realized price following all dips since April. The trend is shifting, and a declining STH-MVRV indicates that this may lead to a decline, with the cryptocurrency potentially slipping below the highlighted metric, placing pressure on investors to take profit.

Lookonchain reveals that Bitcoin OGs are under the same pressure. The platform announced that a wallet transferred 61 BTC from its bag with 600 units of the coin. This is the first move after a twelve-year period of dormancy. Many speculated that the transfer was made in an attempt to take profit.

Bitcoin Needs the $98k Support.

Lookonchain noted that another big market player is in huge profit after shorting Bitcoin. The bearish rhetoric across the market may see the apex coin dip lower. However, it needs to hold one critical level to guarantee a rebound.

Reports from Glassnodes indicate that the $98k support remains the most important for BTC after it lost $100k. The platform presented a chart that highlights an area with a notable supply cluster. This means that demand is at its lowest around this level. The image points to $95.5k-$97k as such levels, indicating that a drop in this region will result in further declines.

The readings from the metrics suggest an increased likelihood of a possible slip below $95k if the apex coin loses $98k.

The 1-day chart suggests that this outcome is likely. Previous price movement shows that the apex coin always retests $96k after losing the highlighted mark. One such event occurred on Nov. 25, when it retraced to a low of $92k after losing the mark. The most recent one happened in February when it retraced to $94k.

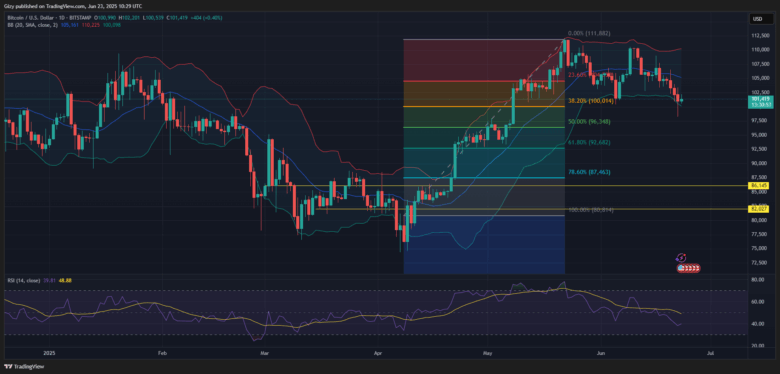

The fibonacci retracement supports this speculation as it indicates no notable levels with demand concentration after $100k. Based on this metric, Bitcoin may retrace to the 50% fib level at $96,300 before rebounding.

It is worth noting that other metrics, like the moving average convergence divergence and average directional index, remain negative.

Find Cryptocurrencies to Watch and Read Crypto News on the Go Follow CryptosToWatch on X (Twitter) Now